Will the Fed cut interest rates again and why is the dot plot important

The Federal Reserve (Fed) is expected to cut interest rates on Wednesday for the third consecutive meeting. Every time the Fed decides on rates, it is a crucial event as it directly affects families and businesses in the United States. Moreover, the Fed’s last meeting of the year will also be important because it will provide the outlook for what it expects to do in 2025.

The interest is the price to pay when borrowing money: personal loans, business loans, student loans, credit cards, mortgages,... the amount of interest in all these ultimately depends on the level of the federal funds rate that is set by the Fed.

The Fed decides the level of interest rates independently, meaning that its decisions aren’t subject to approval by the US federal government. Setting interest rates is one of the Fed’s most powerful tools as it directly affects the economy: high interest rates can make borrowing money more expensive for households and businesses, while lower rates can make it cheaper and easier to get a loan approved.

What does a rate cut mean and why is it important?

A cut in interest rates means that the Fed reduces borrowing costs. This would be the third time in a row the US central bank opts to cut rates this year, after trimming them in September and November.

In late summer, the Fed signaled the end of the rate-hiking cycle and the beginning of a new phase, where interest rates could consistently go down.

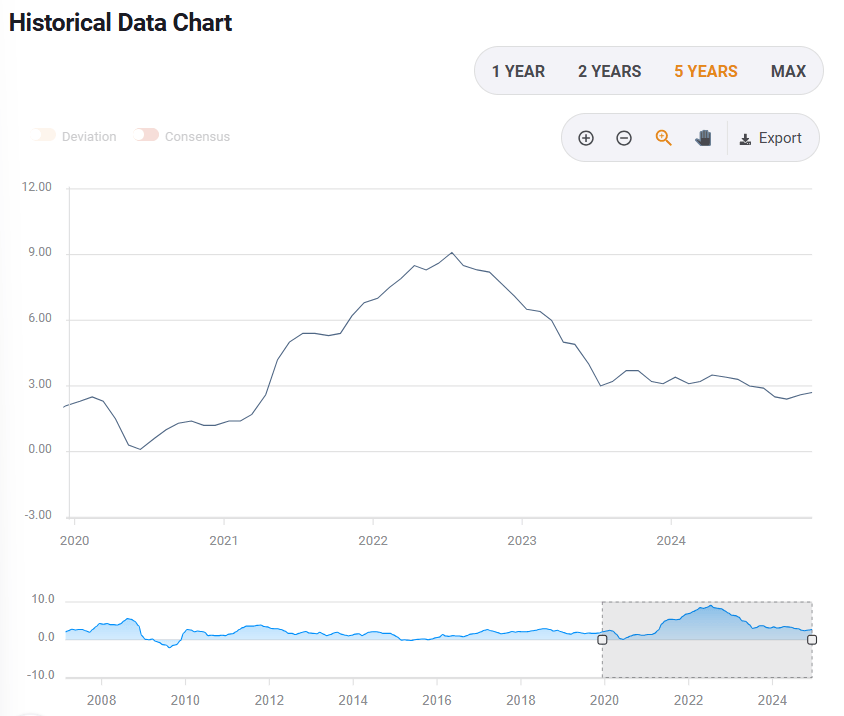

Evolution of interest rates in the United States in the last five years. Source: FXStreet.

But why is this important?

As the rate level set by the Fed basically influences the amount of interest in any loan, lower rates mean consumers and firms will be able to take loans at a cheaper price than before.

So, good news for your pocket.

Now, think big. Lower rates can encourage thousands of people to take a loan to buy big-ticket items and pay less interest for it (and thus be able to spend this money somewhere else). The same applies to businesses, which can get cheaper funds to invest in expansion. This is why lower rates tend to help the economy grow.

Will the Fed cut interest rates again on Wednesday?

Yes, it will. Economists and analysts who closely follow the Fed consider that another interest-rate cut is almost a done deal.

As of December 16, investors price in a 97% probability that the Fed will cut rates on Wednesday, according to data from the CME FedWatch Tool. Only 3% expect the US central bank to hold interest rates steady.

Market pricing of Fed target rate probabilities for November. Source: CME Group FedWatch Tool.

Several members of the Federal Open Market Committee (FOMC) – the group of people in charge of deciding on interest rates – have said they see another rate cut as appropriate.

However, the picture becomes more blurry heading into 2025 as more and more Fed officials’ comments highlight increasing doubts about continued rate cuts (we will talk about this later). Of course, the Fed could opt to leave interest rates unchanged already on Wednesday, but that would be a huge surprise, and US central bankers don’t usually like to rattle markets with such unexpected decisions.

Why does the Fed cut rates?

As the US central bank, the Fed has a dual mandate: to promote maximum employment and stable prices.

Since 2022, the inflation rout seen in the US, or the quick rise in prices, led the Fed to act swiftly because one of its mandates – price stability – was at risk. With prices rising sharply, the central bank decided to quickly lift interest rates with the aim to cool down the economy and keep price rises at bay.

Prices rose at a peak of 9.1% in June 2022, according to the Consumer Price Index (CPI). Since then, the inflation rate has gradually declined and stood at 2.4% in September 2024, very close to the 2% target set by the Fed. Since then, however, inflation has rebounded slightly to 2.7% in November.

Evolution of annual inflation in the United States since 2020, measured by the CPI. Source: FXStreet.

With price increases in the US more controlled, the Fed’s worries about inflation are broadly fading. By itself, this reason would already be enough to reduce interest rates.

However, lately, some concerns have emerged regarding the Fed’s other mandate: promoting maximum employment.

The US labor market has been red-hot since the reopening from the pandemic, with employers consistently hiring new workers to meet strong demand for goods and services. The US unemployment rate – which measures the number of unemployed people as a percentage of the overall labor force – fell to 3.4% in January 2023, the lowest level in more than five decades.

But labor market conditions are slightly different now. The US economy continues to add jobs every month but at a slower pace than before. The unemployment rate stands at 4.2%, which is still low by historical standards but has increased significantly in the last few months. The data suggests that the US labor market is losing momentum.

By how much the Fed is expected to cut rates?

By 25 basis points (bps), or a quarter-percentage-point, to a range of 4.25%-4.50%. The other option, although very improbable, is to keep rates at their current levels.

"The Federal Reserve is expected to cut rates by a further 25bp on December 18 as it continues to move policy from restrictive territory to somewhere closer to neutral," said James Knightley, Chief International Economist at ING, in a recent note.

In normal cycles, the Fed tends to change rates by a quarter-percentage point, as is broadly expected for Wednesday. Still, larger moves are possible if the central bank believes it needs to act more quickly, as it did in September when the central bank lowered rates by 50 basis points.

Similarly, the Fed raised rates very aggressively several times in the past few years in an effort to quell inflation.

Will the Fed continue to cut rates?

This is a key question for this week’s meeting whose answer will likely move markets more than the decision itself. Fed officials repeatedly say that the central bank is “data-dependent”, meaning that any action in the future will depend on data collected about the state of the US economy.

Usually, the Fed keeps an eye on data related to both inflation and the labor market. There is increasing evidence that inflation persists, not at the levels seen in previous years but still above what the Fed would like to. This could mean that the Fed could suggest that it will become more cautious about lowering interest rates next year.

So, while Wednesday’s interest-rate cut appears to be a done deal, things get complicated when looking further away.

Adding to the uncertainty are President-elect Donald Trump’s policies regarding immigration controls, tariffs and personal and corporate tax cuts. Most analysts see these measures as inflationist, and their implementation would likely mean that the Fed would think twice before further cutting interest rates.

Everyone will be able to see how these nuances are interpreted by the Fed on Wednesday. Every three months – December included – the US central bank publishes a Summary of Economic Projections (SEP), popularly known as the dot plot.

This document includes a chart plotting the projections of various Fed members, each represented by a dot – hence the name: dot plot. The central bank also adds a handy table summarizing the range of forecasts and, most importantly, the median. By looking at that table, one can clearly see where Fed officials see interest rates heading.

Fed’s latest Summary of Economic Projections, from September. Source: Federal Reserve.

The latest dot plot showed that, on average, Fed officials saw rates hovering around 3.4% at the end of 2025. Any change to this number will be key to seeing how sentiment among policymakers has changed after Trump’s victory and the recent inflation uptick.

Most analysts expect the bank’s projection to rise from the current 3.4%, and this would mean less interest-rate cuts than previously anticipated for next year.

"We expect the Fed meeting to include signals from policymakers that the pace of rate cuts will be slower going in the year ahead," economists at Wells Fargo said.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

FXStreet Team

FXStreet