Will the ECB be forced to follow the Fed?

Central banks seem to have got things round the wrong way. The Eurozone economy is faltering, as today’s PMI data for September highlights, yet it’s the Fed that’s cutting interest rates by 50bps, while the ECB remains on a more cautious rate-cutting path. However, the September PMI data could add some urgency to ECB rate cuts for the rest of this year.

Germany: A recession is a near certainty for Q3

PMI data for France and Germany was weak across the board, with surprise declines in the service sector, on top of more weakness in manufacturing sentiment. In Germany, the average composite PMI for the last three months is 48.3, which is below the average for April – June of 51.1. This significantly increases the chance of a recession in Germany. Growth in Q3 for Europe’s largest economy is now likely to be worse than the -0.1% decline in GDP recorded for Q2. The German yield curve dis-inverted, as 2-year yields fell faster than 10-year yields, in a sign that the investors are concerned about the outlook for the European economy. It is also a sign that the market believes that the ECB will have to cut interest rates at a faster pace than initially thought.

On Friday there was a 25% chance of an October rate cut from the ECB, this has risen to 40% today, on the back of the weak PMI data. We continue to think that the market is underpricing the risk of more rate cuts from the ECB this year and next. There are currently 43bps of cuts priced in by the market for the rest of this year, and the ECB is expected to cut rates 6 times in the next 12 months. The risk is that these cuts get front-loaded to protect the European economy from a harsh downturn, that appears to be getting worse.

French bond yields show signs of strain

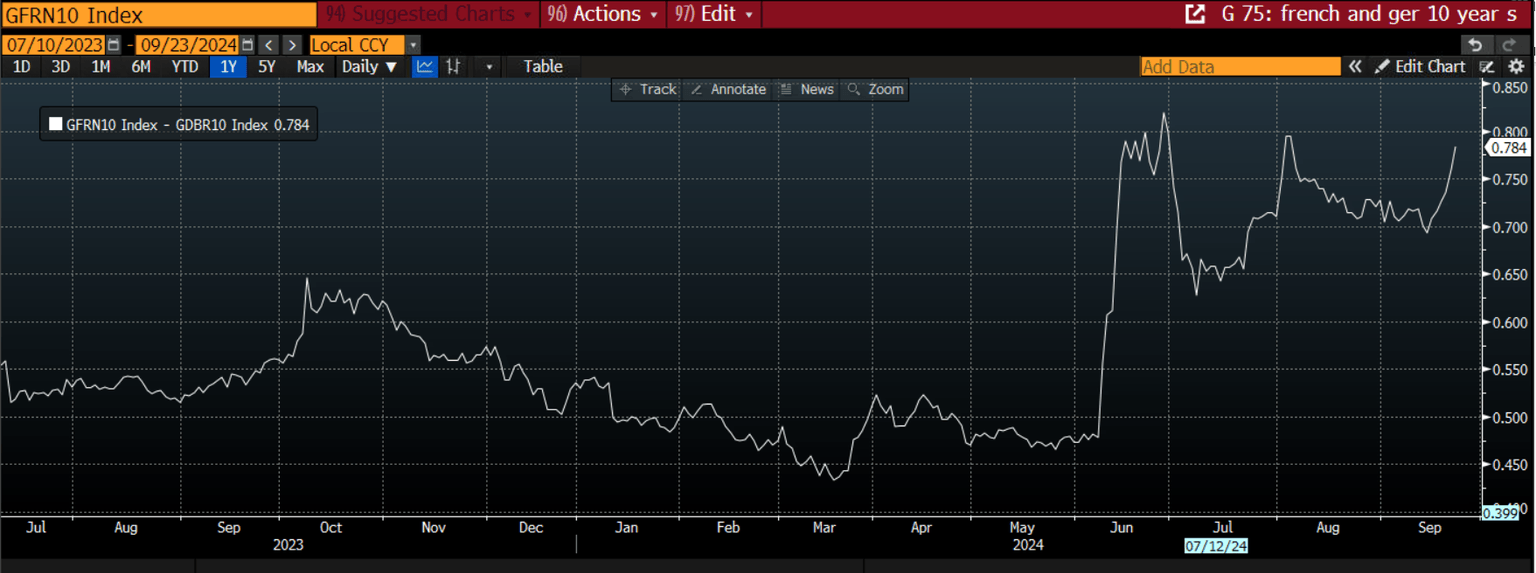

There could be more pressure on the ECB since the French sovereign bond yield spread is also widening vs. Germany at the start of the new week. The market seems to be unconvinced that the new French government will be able to push through a tough budget in an attempt to reign in public debt levels. This spread is now back at the highs from early August when global volatility surged, and they are nearly back at the highs from June, after the snap French government elections weighed heavily on French sovereign bond prices.

French – German 10-year bond yield spread

Source: XTB and Bloomberg

The woes for the Eurozone are impacting the euro. It is the second worst performing currency in the G10 FX space today, although it has managed to climb back above $1.11 vs the USD. EUR/JPY and EUR/GBP could be at greater risk of downside pressure compared to EUR/USD going forward, as the interest rate differential could widen between Europe and Japan and the UK compared to the US. EUR/GBP has plunged to its lowest level since 2022, and a break below £0.8350 may encourage a deeper decline back to £0.8300, the lows from Q1 2022.

It is also worth noting that the stock market impact is less severe than the euro, since most European indices are more closely linked to the global economic cycle rather than the domestic European economy

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.