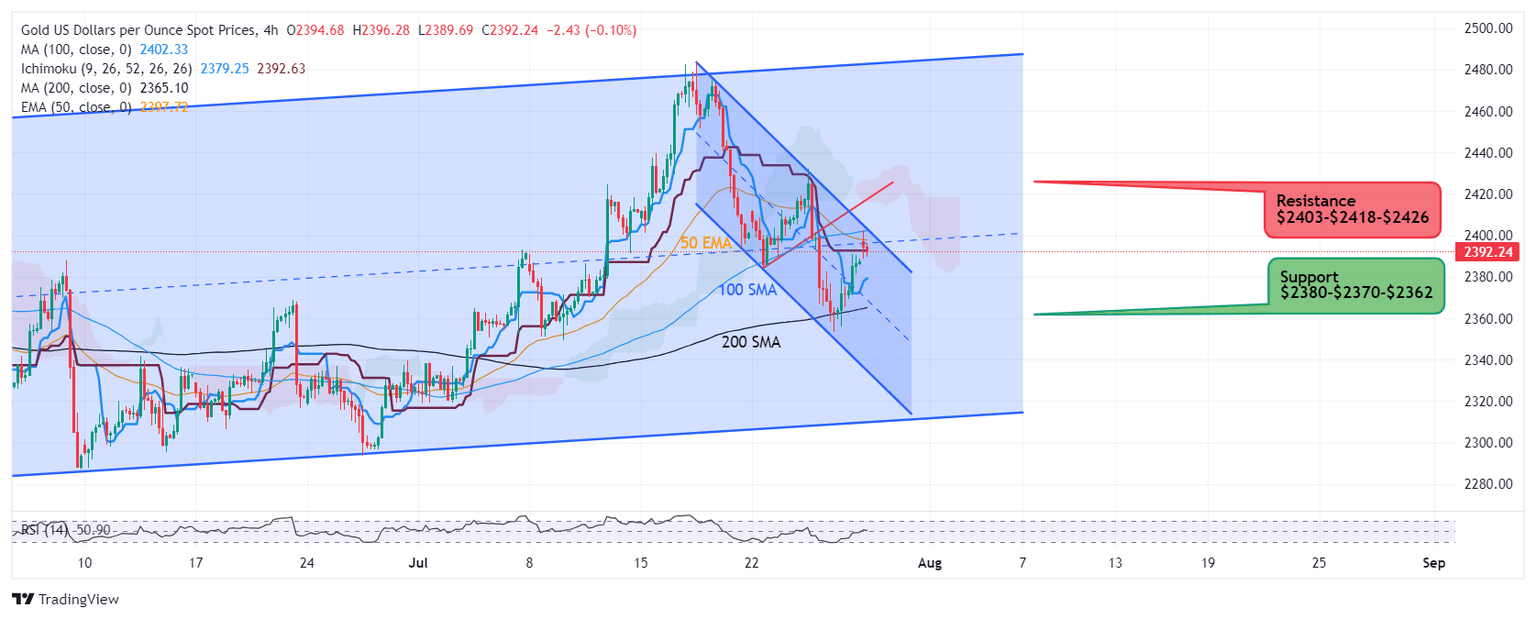

Will Gold sustain above $2,400 with increasing bets on September rate cut?

Gold briefly reclaimed $2400 psychological zone but lacks required stability.

Markets increase bets on Septeber rate cut.

Bullish advance needs strong break above $2400-$2405.

Support sits at $2380-$2365.

Todays asian opening trades witnessed bulish move that tested $2402 only to begin retracement towards $2387 while immediate support is seen located at $2379 where buyers may resurface in anticipation of upward move and continuation of bullish advance requires a convincing break above 4 hourly 50 EMA $2398 followed by 4 hourly 100 SMA $2302 which will aim next hurdle $2400-$2405 followed by awaited clearance through $2412

Next key resistance would come at $2426-$2433 which is another supply zone and may act as turning point for next upleg that may accelerate bullish rally towards $2460-$2468

If $2426-$2433 zone is not breached, bears may make renewed attack eyeing downward correction that may push the metal towards $2380 below which 4 hourly 200 SMA $2365 may be visited.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.