Will GBP/JPY rebound again? [Video]

-

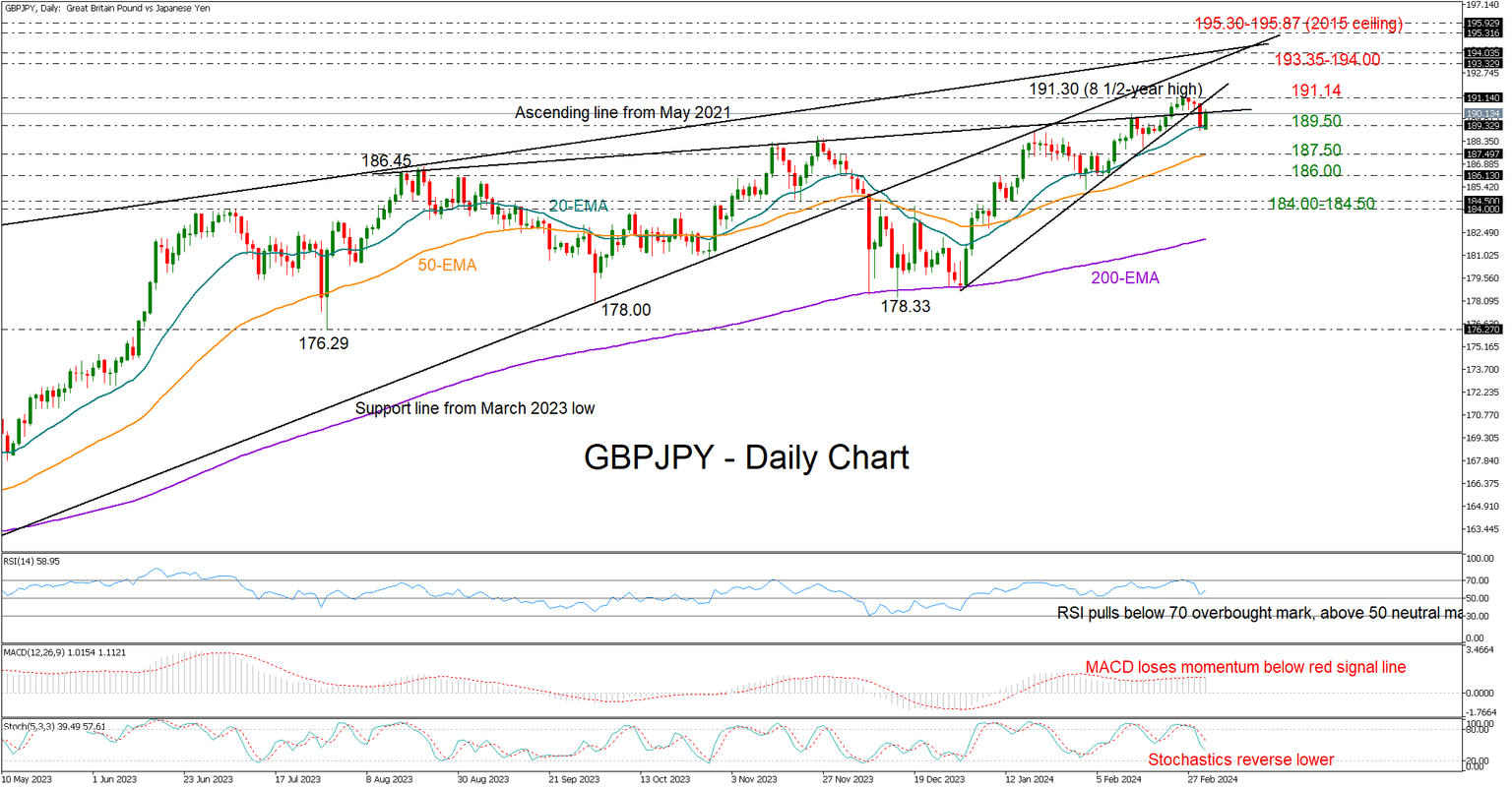

GBPJPY breaks below key support area after new high.

-

Technical signs weaken, but 20-day EMA comes to the rescue again.

![Will GBP/JPY rebound again? [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Crosses/GBPJPY/iStock-1151541926_XtraLarge.jpg)

GBPJPY extended its pullback from an eight-and-a-half-year high of 191.30 for the third consecutive day on Thursday to find support around the 20-day exponential moving average (EMA) at 189.50. The line had protected the market at the end of January, though with the pair having crossed below a short-term ascending trendline, the odds for a continuation lower might be larger despite the current bullish action in the price.

The negative reversal in the momentum indicators is a sign that buying interest is fizzling out. A bounce back above the 190.20-191.14 is now required to improve sentiment and trigger an advance towards the 193.32-194.00 zone, where the broken support trendline from March 2023 and the resistance line from May 2021 are positioned. Breaking above that wall, the uptrend could stretch towards the 2015 ceiling of 195.30-195.87.

Otherwise, a step below the 20-day EMA at 189.50 could squeeze the price towards the 50-day EMA at 187.50. Additional losses from there could initially retest the 186.00 base and then the 184.00-184.50 region.

All in all, GBPJPY could experience more downside movements, unless the current recovery mode in the market drives the price successfully back above the 191.14 level.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.