Why the selling into good PPI

S&P 500 almost instantly gave up the tame PPI driven upswing, Nasdaq didn‘t shine as brightly as into FOMC, and consumer discretionaries weren‘t enthused either. I take it as a sell the news reaction following sharp weekly gains in both indices – it would be too early to fear deflation or job market coming apart at the seams as this tweet sums up. In reading the economic tea leaves of when the Fed would actually cut and how many times this year (once or twice, the FOMC members are almost evenly split), Treasuries are being bought regardless.

It was the 30y Treasury auction (4.63% prior, but 4.40% achieved yesterday) that calmed down markets, providing for a decent retracement, apart from Russell 2000 of course. The Fed is simply in no hurry to cut (thankfully not about to raise), but I think Sep is the month they actually would.

Just like I revealed yesterday the CPI and FOMC expectations, I‘ll today quote yesterday‘s premium PPI predictions with the rationale plus market reaction takeaways.

(…) The PPI prediction … finished … with „The inflation on the back burner theme would be reinforced by tomorrow‘s PPI interpretation, sending stocks and precious metals higher.“

CPI really came on the low end, and when for now corporate earnings don‘t disappoint, profit margins are good, but revenue is struggling, that means that input costs aren‘t rising too steeply. If you look though at latest hourly earnings, these are up, above expectations, so that results in more of a PPI opportunity to surprise on the downside today, which would be greeted with Nasdaq led upswing continuation applying to S&P 500 as well.

Today‘s wildcard has been BoJ announcing Jul plans to start reducing bond purchases, which only served to push Treasuries even higher, precious metals catching some more bid following the pre-Treasury auction slide yesterday, and yen to weaken before it returned to its starting position of weakness.

Given the significant developments in precious metals technically, today‘s free analysis features a lot of silver coverage.

Much Telegram and Twitter live commentary follows as always.

Gold, Silver and Miners

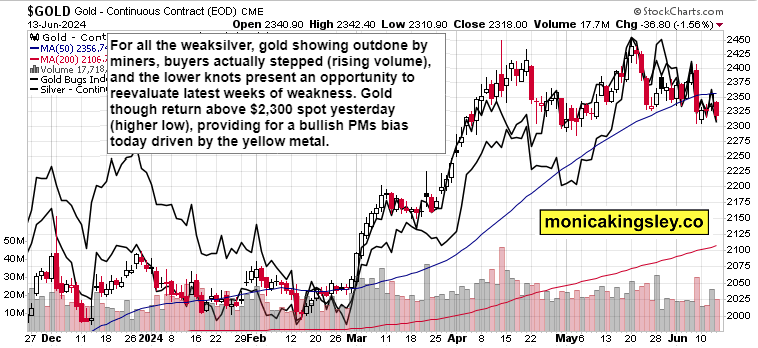

This chart warrants at least a daily pause in selling, but I‘m not looking for any silver or miners outperformance. It‘s rather wait and see than bottom is in situation, as is apparent from the following two silver charts showing one support line holding, the other being backtested from below (both posted earlier today in the premium Trading Signals channel).

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.

-638539673998931009.png&w=1536&q=95)

-638539674557512381.png&w=1536&q=95)