Why the Fed is set to cut interest rates again after Trump nears US presidential win

The Federal Reserve (Fed) is expected to cut interest rates on Thursday for the second consecutive meeting. This is a crucial event as it will happen right after the US presidential election and it directly affects families and businesses in the United States.

The interest is the price to pay when borrowing money: personal loans, business loans, student loans, credit cards, mortgages,... the amount of interest in all these ultimately depends on the level of the federal funds rate that is set by the Fed.

The Fed decides the level of interest rates independently, meaning that its decisions aren’t subject to approval by the US federal government. Setting interest rates is one of the Fed’s most powerful tools as it directly affects the economy: high interest rates can make borrowing money more expensive for households and businesses, while lower rates can make it cheaper and easier to get a loan approved.

What does a rate cut mean and why is it important?

A cut in interest rates means that the Fed reduces borrowing costs. This would be the second time the US central bank opts to cut rates this year, after trimming them in September for the first time in more than four years.

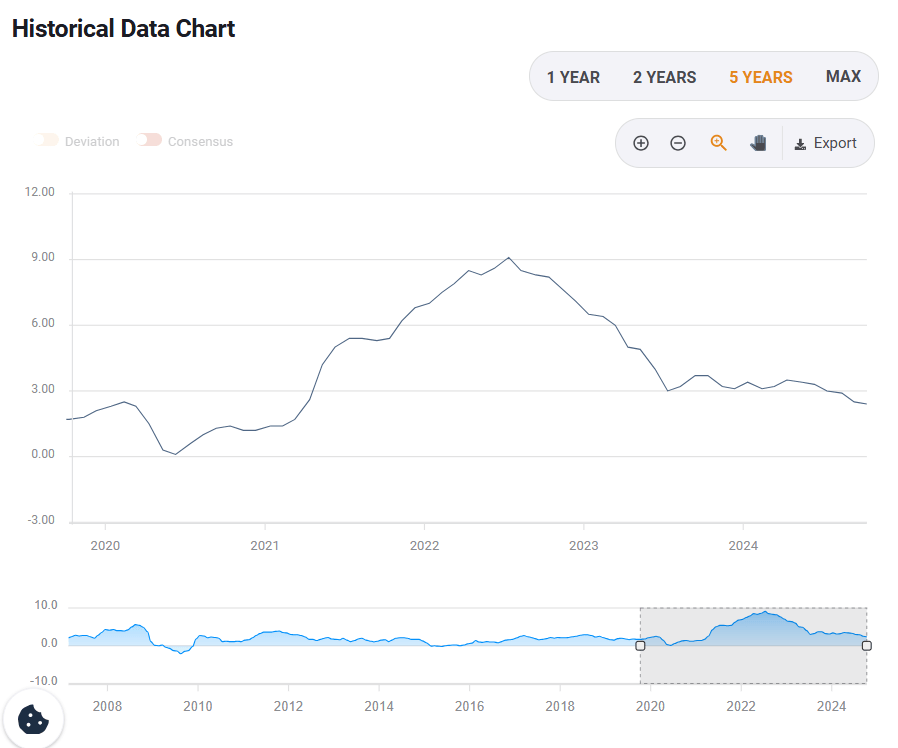

If the Fed indeed decides to cut rates, it would become the first back-to-back cut after a series of sharp increases during 2022 and 2023. We will go into this later, but the Fed has signaled the end of the rate-hiking cycle and the beginning of a new phase, where interest rates could consistently go down.

Evolution of interest rates in the United States in the last five years. Source: FXStreet.

But why is this important?

As the rate level set by the Fed basically influences the amount of interest in any loan, lower rates mean consumers and firms will be able to take loans at a cheaper price than before.

So, good news for your pocket.

Now, think big. Lower rates can encourage thousands of people to take a loan to buy big-ticket items and pay less interest for it (and thus be able to spend this money somewhere else). The same applies to businesses, which can get cheaper funds to invest in expansion. This is why lower rates tend to help the economy grow.

Will the Fed cut interest rates again on Thursday?

Yes, it will. Economists and analysts who closely follow the Fed consider that another interest-rate cut is a done deal.

Moreover, several members of the Federal Open Market Committee (FOMC) – the group of people in charge of deciding on interest rates – have also explicitly said they see another rate cut as appropriate.

The Federal Reserve Chairman, Jerome Powell, said in August that “the time has come for policy to adjust.” In plain words, Powell meant that he and his colleagues at the FOMC share the view that it is the right moment to cut interest rates.

Why does the Fed cut rates?

As the US central bank, the Fed has a dual mandate: to promote maximum employment and stable prices.

Since 2022, the inflation rout seen in the US, or the quick rise in prices, led the Fed to act swiftly because one of its mandates – price stability – was at risk. With prices rising sharply, the central bank decided to quickly lift interest rates with the aim to cool down the economy and keep price rises at bay.

Prices rose at a peak of 9.1% in June 2022, according to the Consumer Price Index (CPI). Since then, the inflation rate has gradually declined and stood at 2.4% in September 2024, very close to the 2% target set by the Fed.

Evolution of annual inflation in the United States since 2020, measured by the CPI. Source: FXStreet.

With price increases in the US more controlled, the Fed’s worries about inflation are fading. By itself, this reason would already be enough to reduce interest rates.

However, lately, some concerns have emerged regarding the Fed’s other mandate: promoting maximum employment.

The US labor market has been red-hot since the reopening from the pandemic, with employers consistently hiring new workers to meet strong demand for goods and services. The US unemployment rate – which measures the number of unemployed people as a percentage of the overall labor force – fell to 3.4% in January 2023, the lowest level in more than five decades.

But labor market conditions are slightly different now. The US economy continues to add jobs every month but at a slower pace than before. The unemployment rate stands at 4.1%, which is still low by historical standards but has increased significantly in the last few months.

Moreover, the latest employment report showed that the US economy added a mere 12,000 jobs in October, the weakest growth since December 2020. Even though the numbers were distorted by temporary events such as the recent hurricanes or strikes, the data suggests that the US labor market is clearly losing momentum.

By how much the Fed is expected to cut rates?

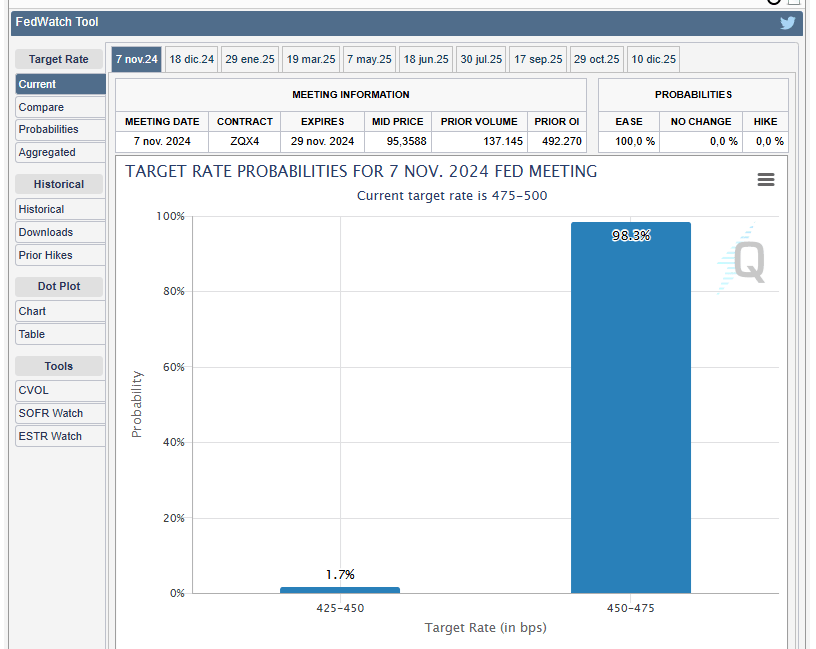

By 25 basis points (bps), or a quarter-percentage-point, to a range of 4.50%-4.75%. The other options are a 50 bps cut, as in September, or keeping rates at their current levels.

“We should almost certainly see a 25bps cut from the Fed (...) This potential cut is likely to be unanimous,” said Jim Reid, Deutsche Bank's global head of economics and thematic research, in a recent note.

In normal cycles, the Fed tends to change rates by a quarter-percentage point, as is expected on Thursday. Still, larger moves are possible if the central bank believes it needs to act more quickly, as it did in September when the central bank lowered rates by 50 basis points.

Similarly, the Fed raised rates very aggressively several times in the past few years in an effort to quell inflation.

The US presidential election result could also influence the Fed’s actions this time. “Fed Chair Jerome Powell and his colleagues would also want to be seen as not taking sides in politics. By following through on expectations, they would show their independence,” says Yohay Elam, senior analyst at FXStreet.

Market pricing of Fed target rate probabilities for November. Source: CME Group FedWatch Tool.

Will the Fed continue to cut rates?

Fed officials repeatedly say that the central bank is “data-dependent”, meaning that any action in the future will depend on data collected about the state of the US economy.

Usually, the Fed keeps an eye on data related to both inflation and the labor market. However, in the current context, the latter is gaining more importance as price growth appears to be under control and there are increasing signs that labor market conditions could be deteriorating.

Investors expect the Fed to further cut interest rates at its final meeting of the year, to be held in mid-December.

However, while Thursday’s interest-rate cut appears to be a done deal, things get complicated when looking further away. The unanimous decision expected for this week could be certain in December amid increasing uncertainty driven by the US presidential election outcome.

“The data dependency will mean it might be tough to garner too much from the (Fed) meeting, especially if the election outcome and with it future fiscal and trade policies are unknown,” says Reid from Deutsche Bank.

“Even if the election outcome is known the full extent of policy change could take months to become apparent, especially on trade if (former President Donald) Trump wins,” he adds.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Thu Nov 07, 2024 19:00

Frequency: Irregular

Consensus: 4.75%

Previous: 5%

Source: Federal Reserve

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

FXStreet Team

FXStreet