Why SPY fell and where next

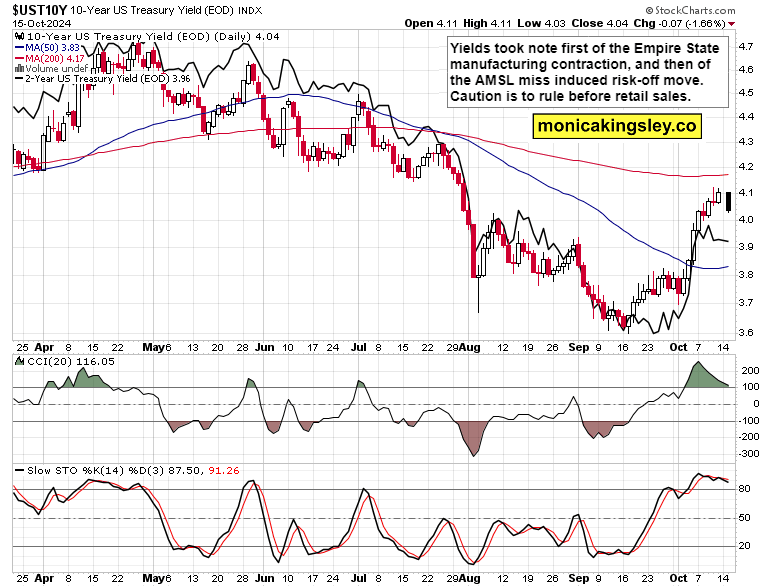

S&P 500 opening push was rejected, and the reasons were related to discretionaries and ASML bookings of course. Their untimely release sent the „AI sector“ down, and there were these pockets of relative strength remaining (and as the below chart shows, more of these were available, premium discussed now). China trades haven‘t found strong footing yet either – such was my prior Wednesday‘s premium call as to where HSI starts getting interesting again.

Summing up, already going into Tuesday without either semis or retail news striking, the S&P 500 chart setup called for protection of latest swing long gains, resulting in +74 ES points gained since Friday‘s PPI. Bitcoin also wobbled in the ASML aftermath, and MSTR stood no chance either in the risk-off rush (check the early stage of breakout above the downward sloping BTC channel) – and the generally bullish expectations going into retail sales tomorrow, got their clock cleaned. And here we are, with premarket stabilization trying to turn into a meek rebound attempt after the opening bell. Attempt, perhaps – here is my commentary from our channel.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.

-638646828451910437.png&w=1536&q=95)