Why I called for SPY upswing

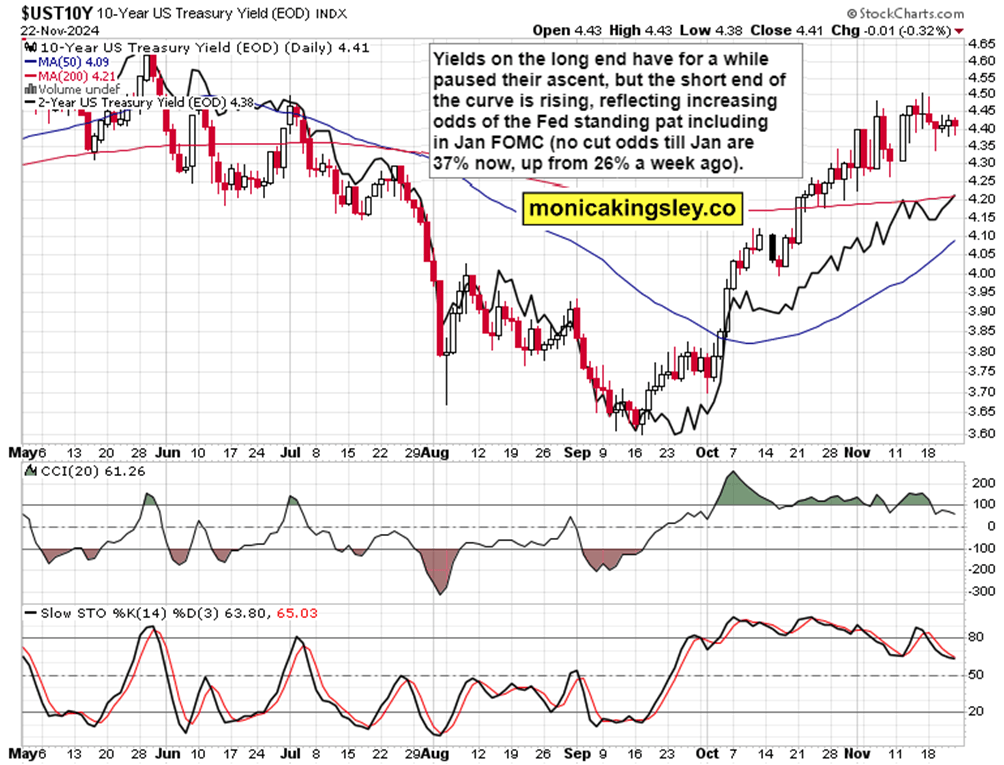

S&P 500 continued making higher lows, and my low 5,940s support wasn‘t jeopardized in the least. Understatement, as my bullish calls kept delivering for all clients. Yields on the short end continued rising, reflecting very decent incoming data – manufacturing and services PMI both confirmed the talked about index of economic surprises being positive last couple of months, which is also what helps propel USD to new highs compared to anemic eurozone growth.

Russell 2000 bout of outperformance called, with both XLI and XLY firing are good signs going into Monday. Bitcoin kept pushing towards $100K as MSTR did its best erasing Thursday‘s decline (looking uncinvincing to me for now, but BTC can and will ignore its key play‘s gyrations that actually resemble arbitrage). Precious metals upswing is smartly unfolding too – and the good incoming data qualifier I had in place for silver, meant the white metal participated in the rally.

As usual, let‘s keep pulse on the markets via annotated charts, with way more details following in the premium section. Today, I‘m also bringing you an important hint as regards oil.

Crude Oil

Crude oil showed it was ready to break above $70 – it took manufacturing and services PMI to do so. The cornerstone of a run > $75 is in place now as demand is not being destroyed in the least – the hunger for black gold worldwide goes on – rising by well over 2 million barrels per day in recent years, having surpassed the 100M bbd/d milestone last Dec already.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.