Why equities ignore rising yields

S&P 500 tanked on distinctly hotter than expected CPI, yet failed to break through 6,015. Market breadth and sectoral view had been pretty dismal, yet in a zigzagged line the S&P 500 led by Nasdaq continued on a volatile mend (in intraday terms of this path).

Crucial resistance had been though respected overnight, and the sequence of headlines touching on geopolitics – and how they had been perceived in Europe, on European stock exchanges I mean - was what prevented equities from declining – and today‘s extensive video dives into the clues covered in great detail for swing trading and intraday clients, with Ellin‘s ES gains as a cherry on the cake (there are great advantages in combining the daily analytics with quick intraday calls). Important message as regards supports intraday, too.

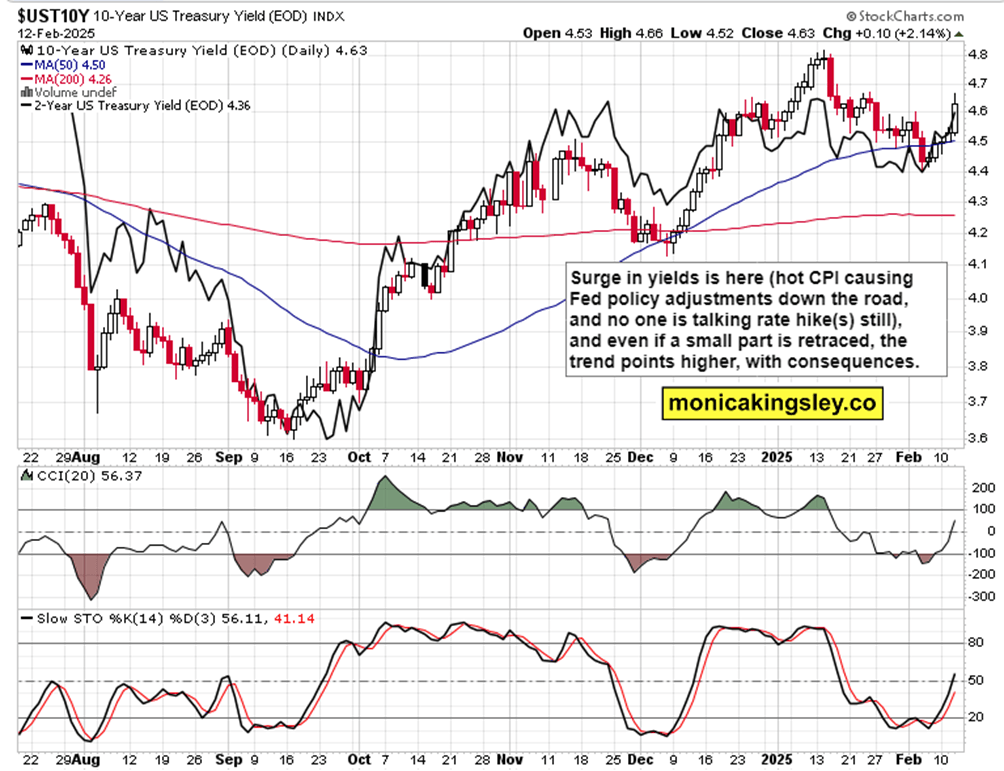

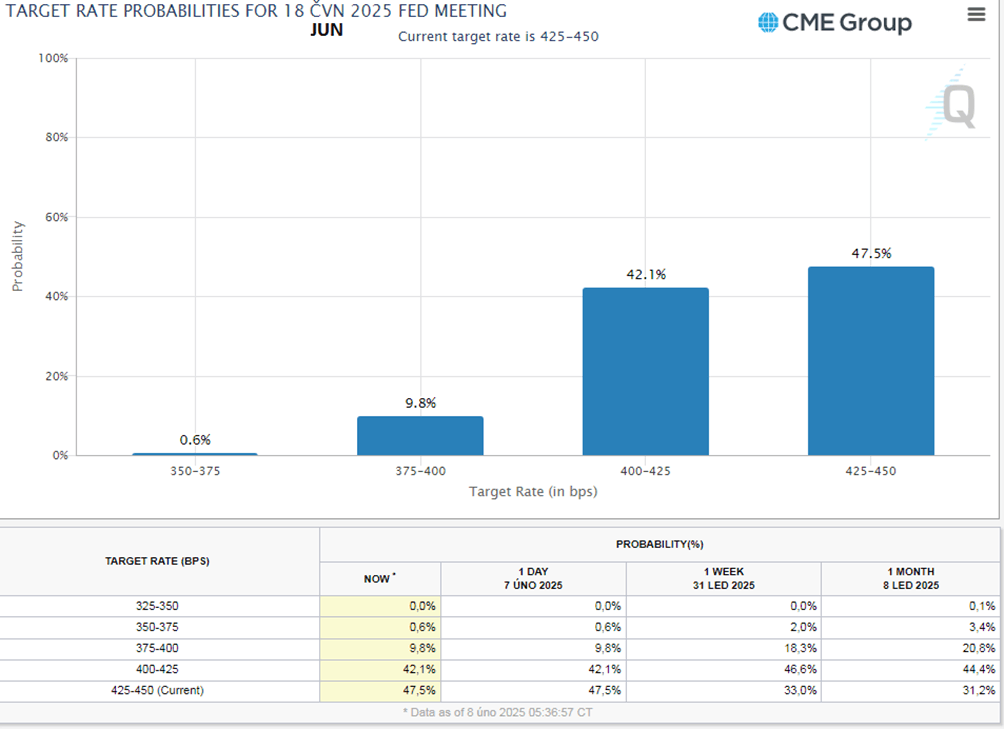

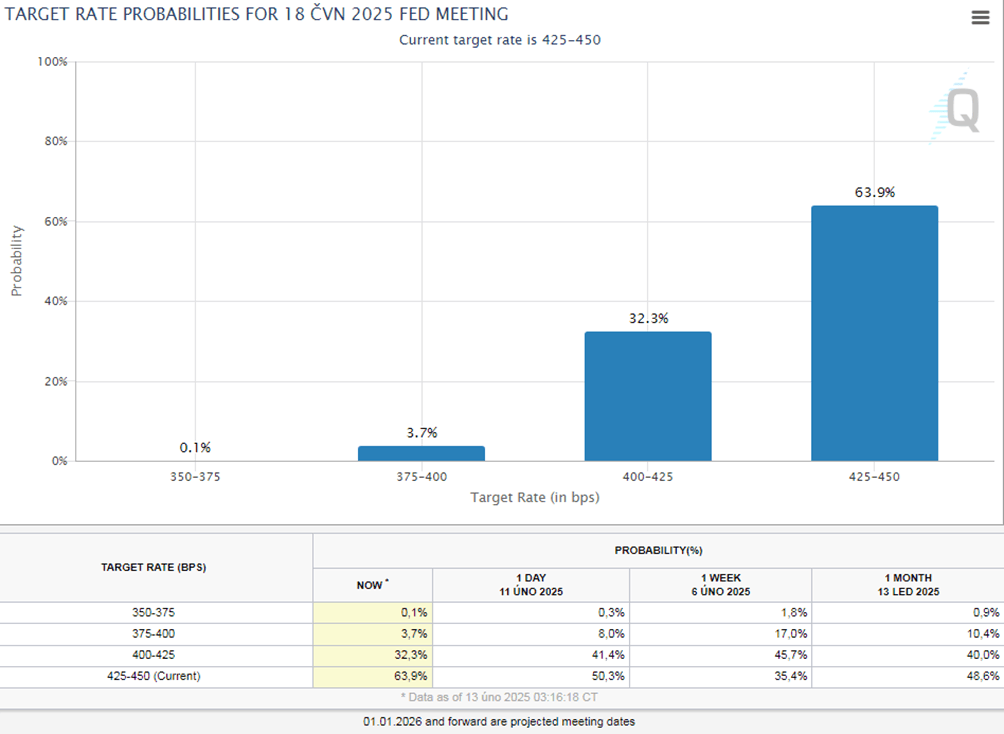

Better adjust fast and keep constant finger on the pulse of market moving data and events – that‘s why I am (and we‘re) here for, to bring you the very best – check against the yields path as leading higher called on the weekend (for the reprieve in yields to end). See the difference in Fed watch tool Saturday and now – the retreat in rate cutting odds.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.