Where next for the Dax?

The Dax has rallied 30% from its low of 8257 reached 19th March. It remains 20% off levels traded at the end of February. Whilst, the Germany economy is reopening as restrictive lockdown measures are eased fears of a second wave of covid-19 infections and growing US – Sino trade tensions could limit gains in the Dax as it approaches a key trendline dating back from 2011.

Easing lockdown measures

Germany is ahead of the game as far as easing lockdown measures go. The country has already opened shops, large and small, restaurants, bars and gyms. Germany is pressing ahead with easing lockdown measures despite the transmission rate, R, remaining over the critical threshold of 1 for a third straight day. If accurate it means that the number of infections are growing rather than falling, raising concerns of a second wave of infections. This could mean at worst a return to lockdown.

US – Sino trade war

The Germany, the exporter nation has China and the US as its principal trading partner. As we saw in the first chapter of the US – Sino trade war Germany was particularly affected as global trade slowed.

Reports from China indicate that advisors in Beijing are pressing Xi Jinping to abandon the signed Phase 1 trade deal. This comes following Trump's comments he could implement further trade tariffs as he attempts to pin blame for covid-19 on China.

A second chapter to the trade war would be even more damaging to the Germany economy than the first, given the weaker position that the economy would facing the challenges from.

The Dax is rising as tensions ease. However, more substantiated evidence of increased trade tensions could drag the Dax significantly lower.

Global recession

As an exported nation, Germany is particularly sensitive to the global outlook. Signs that the global recession could be worse than initially anticipated could drag on the index and vice versa.

Dax Levels to watch

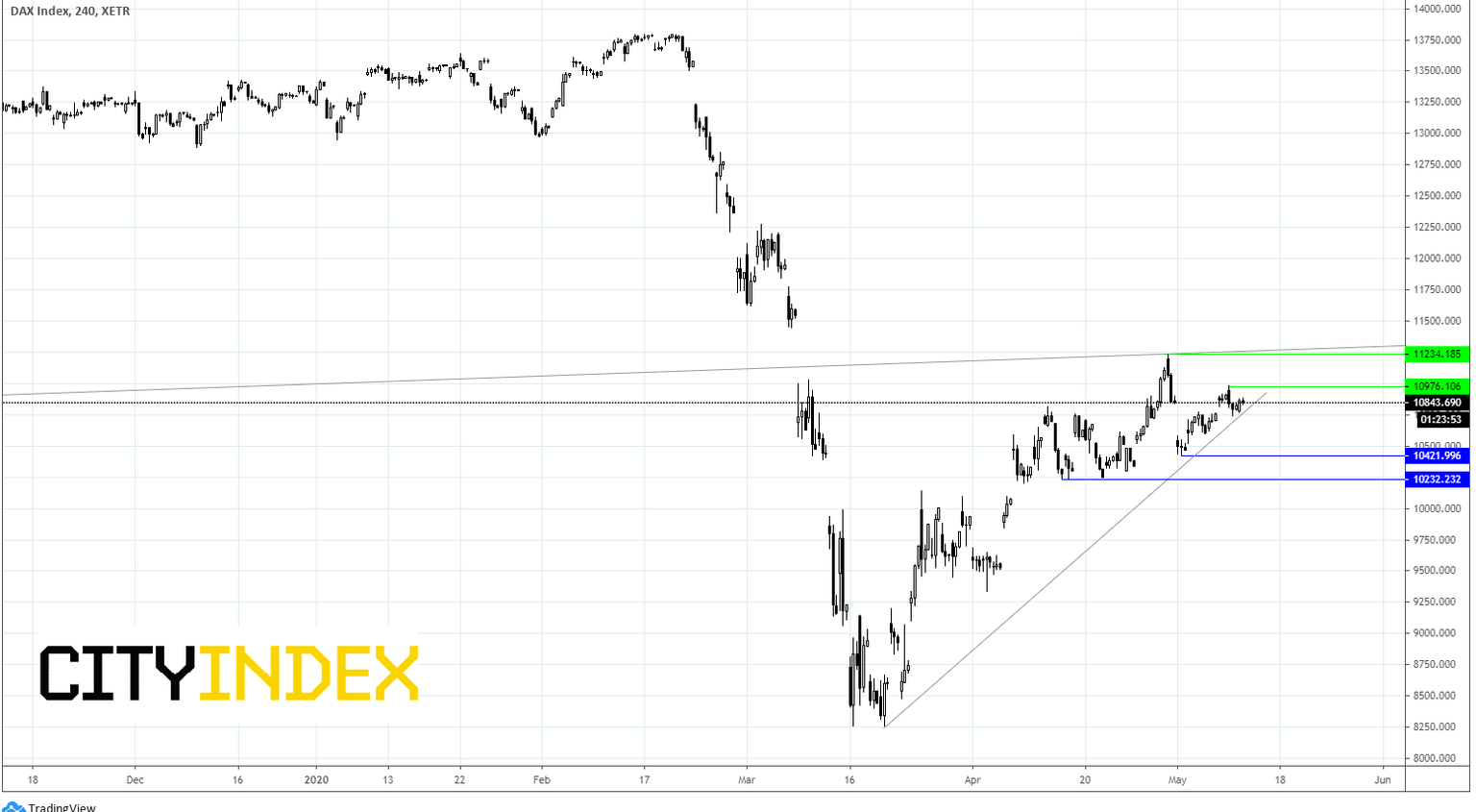

The DAX is trading 0.4% higher and remains above the ascending trendline from March low, a bullish chart. The Dax is also approaching a key trend line running from 2011 a breakthrough resistance of this trendline 11300 would be a strongly bullish signal.

Immediate resistance can be seen at 10976 (high 8th May) prior to the key psychological level of 10,000 prior to 11234 (high 30th April) and 11300. A move above this level could see a significant push higher.

On the flip side support can be seen at 10770 (trend line support) prior to 10421 (low 4th May) and 10230/10200 (15th April). A breakthrough at this level would tell us whether weakness is a pullback ahead of another drive higher or something more sincere and a move lower back towards the March lows is on the cards.

Author

Fiona Cincotta

CityIndex