Where next for EUR/JPY? [Video]

![Where next for EUR/JPY? [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Crosses/EURJPY/computer-keyboard-with-currency-pair-eur-jpy-button-49017434_XtraLarge.jpg)

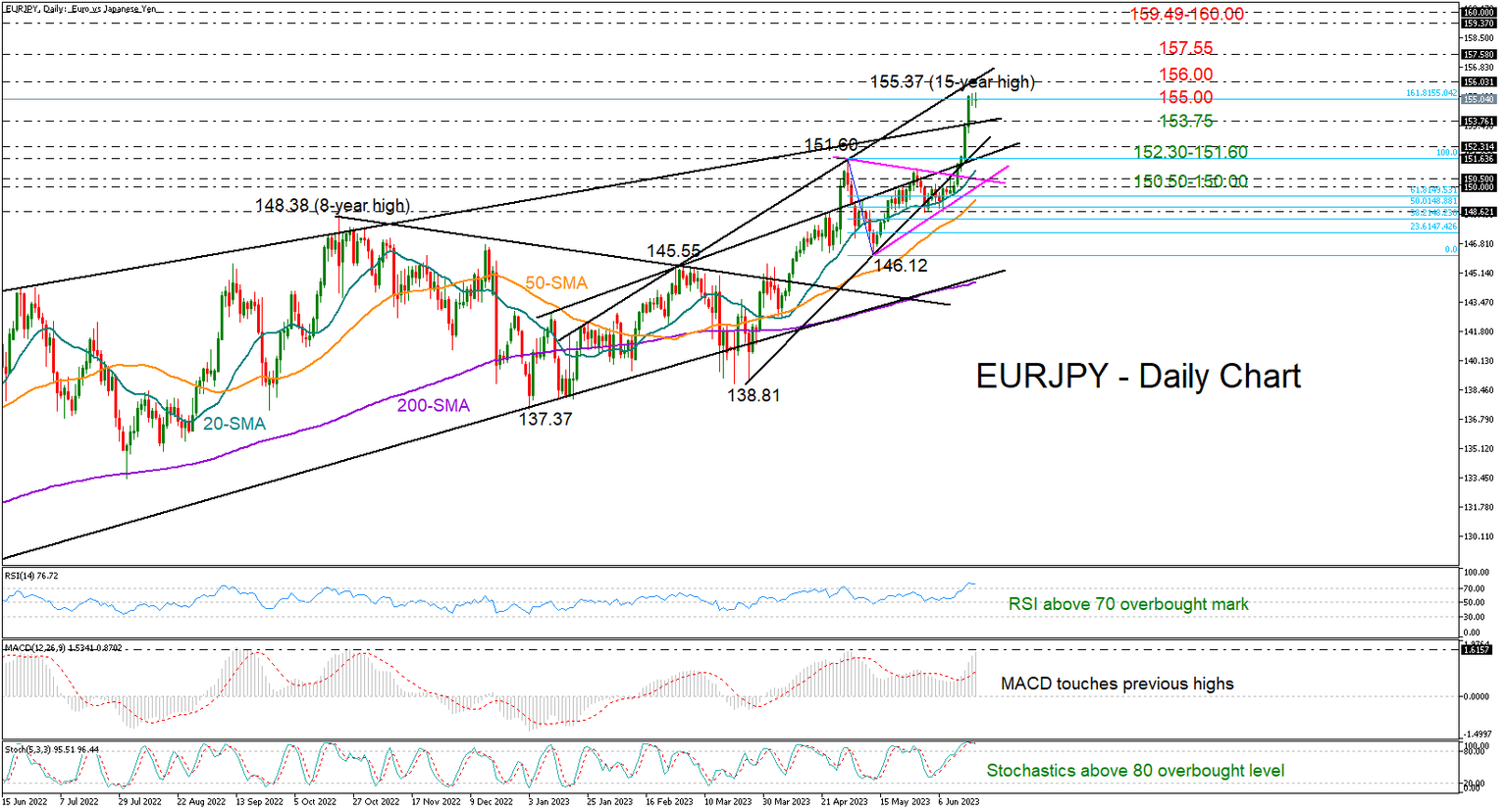

EURJPY experienced a huge week after a bullish triangle breakout, appreciating by more than 3.0% to an almost 15-year high of 155.37 in what was the fastest rally in more than a decade.

The bulls are trying to revive their positive momentum near their recent highs as the RSI and the stochastic oscillator are flagging overbought conditions. Note that the MACD is currently testing a former peak area, raising some caution too.

The nearest obstacle could be around 156.00, where the resistance trendline which connects all the highs from January 18 is positioned. A significant extension higher could lift the price up to the 2007-2008 constraining zone of 159.40-160.00, unless the 157.55 barrier cools upside pressures beforehand.

In the case the price stalls around the 161.8% Fibonacci extension of the 151.60-146.12 downfall at 155.00, the focus will turn to the broken long-term ascending line from August 2020 at 153.75. Failure to pivot there might provoke a quick downfall into the 152.30-151.60 area, where April's ascent topped. The 20-day simple moving average (SMA) is converging to the same region, while slightly lower, the pair may look for support within the 150.50- 150.00 territory before the 50-day SMA comes under examination.

All in all, the latest spike in EURJPY could motivate some profit-taking, especially if the pair proves unable to claim the 155.00-156.00 zone.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.