Where next after our great fireworks

S&P 500 performed great on both retail sales and unemployment claims coming in solidly better than expected – all clients were ready and reaping benefits, both swing and intraday. What was the factor that further enhanced my macro reading on the economy (and it not dipping into recession, forget those yield curve or Japan fears, it‘s been over and the sentiment readings I featured last week, only boosted those odds) – it was the bond market featured premium.

Here is once again the data release aftermath prediction featured Wednesday before the closing bell in our channel.

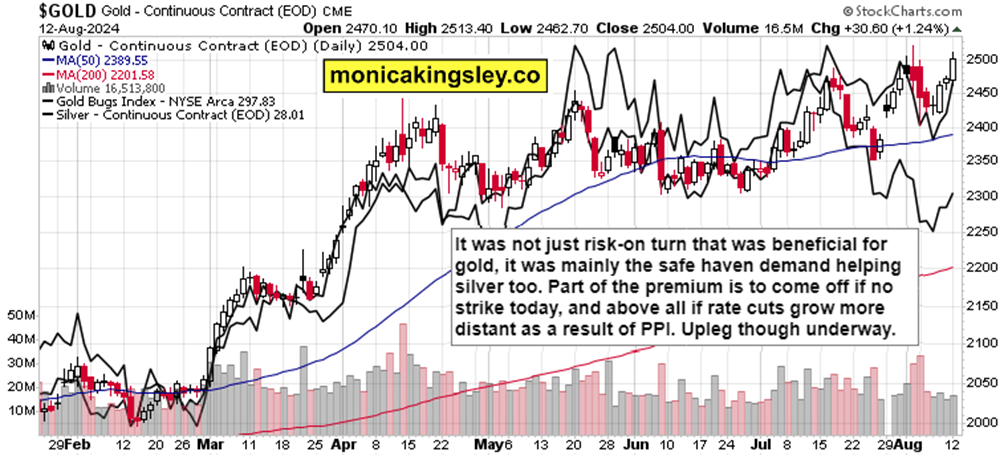

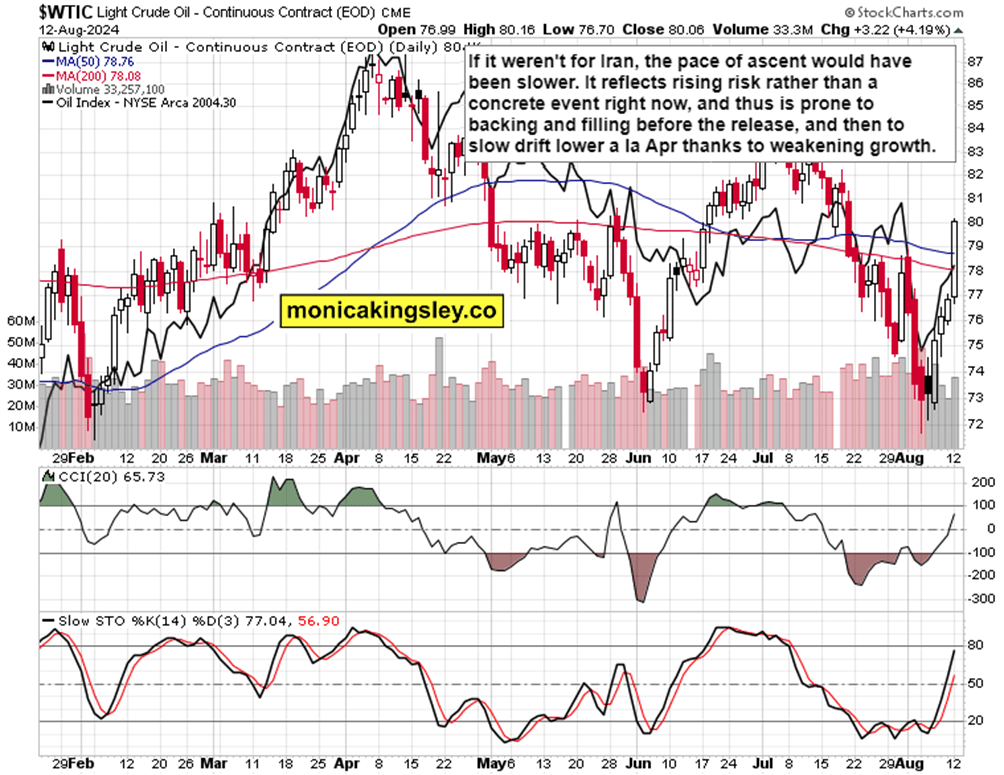

Most certainly, S&P 500 rally broadening followed, and Nasdaq didn‘t disappoint in the least, and the same can be said regarding precious metals (upswing underway call) and crude oil (not retaining its high ground and turning south) as you can see from both premium charts featured for clients Tuesday morning (premium coverage daily).

Today‘s consumer confidence and housing data won‘t move the markets nearly as dramatically – it‘s going to be about digestion of yesterday‘s sharp gains and forget not it‘s opex with VIX having calmed all the way to 15,23.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.