When the facts change, I shake it off

What if we’re all getting it wrong on central banks again? What might cause interest rates to stay higher than just about everyone is now expecting? James Smith is channelling Taylor Swift this week. Brace yourself; we knew he was trouble

When the facts change, I’ll shake it off

Keynes supposedly once said, “When the facts change, I mumble something about Taylor Swift, blame the weather, list a load of temporary factors I couldn’t have possibly foreseen, then I change my mind”. It was something like that, anyway. My economic history is a bit hazy these days…

And speaking of Taylor, imagine my delight when I discover she’s back performing in London for a second time this weekend. We UK economists have already blamed her twice for our dodgy inflation predictions in this cruel summer. Even Bank of England Governor Bailey said recently that Swift is “interesting” but “not the big story”. Something tells me he won’t be in the front row at Wembley this weekend.

Anyway, about those Taylor-made excuses: what if we’re all getting it wrong on the central banks – again?

The downside risks are clear. Last week, I mused how there’s a real possibility that central banks have left it too late to start cutting rates. We all seem to agree that rate cuts are needed. How quickly those cuts need to happen is still up for discussion.

Markets are becoming less convinced about the need for rapid easing. The panic about an impending US recession has subsided. And the central banks, still reeling from that big inflation surprise of the past few years, are still undeniably cautious about the risk of cutting rates prematurely.

So, what might they be worried about? The US Presidential Election is an obvious candidate. Check out our team’s new scenarios explaining how November’s vote could have big implications for the Fed’s easing cycle and generate dramatically different outcomes for financial markets. In short, a victory for Donald Trump could see higher growth and inflation and fewer Fed rate cuts.

Over in Europe, policymakers are acutely aware that the downward impact on inflation from food, energy and good prices is starting to fade away. We saw that here in the UK this week. And that's exposing the fact that services inflation is still uncomfortably high across the continent.

In Germany, Carsten points out that despite rising unemployment, there are no signs that unions are scaling back their demands for above-inflation pay rises. The risk is that wage growth will stay high for much of the next year rather than come down as the European Central Bank currently hopes and expects. We’ll get fresh data next week, which, alongside the ECB’s new September projections, will be the most crucial things that will make up the ECB's minds, according to Mr B.

It’s not just services. Shipping prices have been rising consistently this summer, helped by the ongoing disruption in the Red Sea. Higher inventories and lower retail demand have so far contained the impact on consumer prices. But chatting with my colleague Bert, he warns that this could change if the European consumer starts splashing cash on goods again now that purchasing power is steadily improving.

A lot of this, it should be said, isn’t necessarily the base case. But it serves as a reminder that the risks facing central banks aren’t all pointing in the same direction right now.

It's an uncertain story, so to say that Jerome Powell’s speech at the Fed’s Jackson Hole conference next week will be pivotal would be a major understatement. James Knightley reckons we’ll get further confirmation that a September rate cut is all but baked in. But could that be a 50-basis point cut? We think it might, but Powell pushed back on this when he was asked back in July. Let’s see if he’s changed his mind.

Whatever he tells us next week, the reality is that most roads lead back to the US jobs market. It’s that, and less so inflation, which holds the key to the size of that first cut in September. A move lower in the jobless rate in a few weeks would, James Knightley reckons, tilt the balance back in favour of a smaller move. But keep an eye out for benchmark revisions to the payrolls figures next week. Read what James K says below on how they could signal that the recent jobs data has been less rosy than first thought.

Because when the facts change, well, you know what to do.

Chart of the week: Shipping costs have risen sharply this year

Source: Macrobond

THINK ahead in developed markets

United States

Jackson Hole Symposium (Thu): This is likely to be used as a platform to confirm that the Federal Reserve now thinks monetary policy is too restrictive and that they can start to lower interest rates. Inflation is looking better behaved, and this is allowing them to put more emphasis on the jobs market, which is showing signs of cooling quite quickly. After the market volatility of ten days ago, financial markets are currently favouring the Fed delivering a 25bp interest rate cut on September 18 following better retail sales numbers and signs of resilience in jobless claims. Nonetheless, there are still important events and data releases that mean a 50bp cut can’t be excluded as a possibility.

Provisional annual benchmark revisions of non-farm payrolls (Wed): Based on tax return data, it could be that the BLS has overstated US employment by perhaps 500,000 in the year to March 2024. This would suggest that the models that the BLS use to compute the change in non-farm payrolls each month, which supplement the survey data they compile, have continued to be too optimistic. Significant revisions and a weak jobs report on September 6 would certainly make the market more aware of the risk of a 50bp Fed rate cut.

Eurozone

Purchasing Managers' Index (Thu): The eurozone PMIs will be even more relevant than usual as a snapshot of activity as the economy has shown unexpected signs of weakness in recent months. The first half of the year finally showed positive GDP growth again, but recent survey data has cast doubt on the pace of recovery. Another weak reading would confirm our view that growth is decelerating again, which would solidify a September rate cut.

Wages (Tue): On Tuesday, the ECB will release their negotiated wage data for the eurozone, which will be vital for the ECBs September rate cut decision. Q1 data surprised to the upside, ticking up instead of falling as the ECB had hoped for. With unions still trying to recoup lost purchasing power, it doesn’t look like a material decline from the current high of 4.7% can be expected in H2.

Sweden

Riksbank meeting (Tue): Sweden’s Riksbank is poised to cut rates for a second time when it meets this month. The central bank is grappling with disappointing economic growth and core inflation that’s proving increasingly benign. We expect a 25 basis point cut, taking the policy rate to 3.50%. Read our full preview

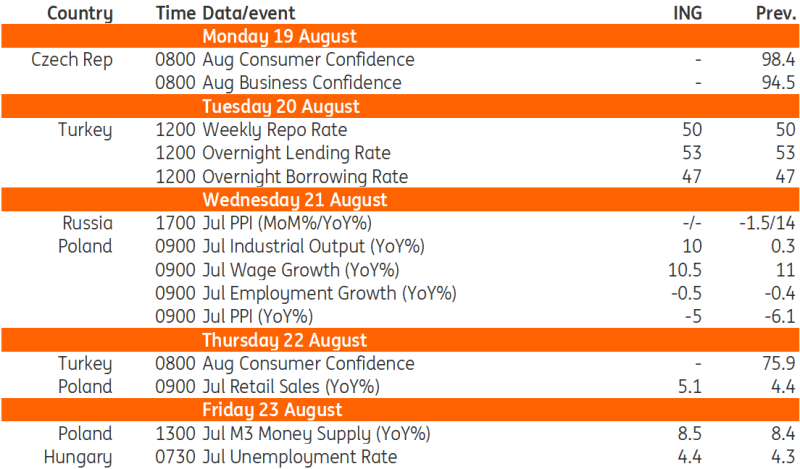

THINK ahead for Central and Eastern Europe

Poland

Industry (Wed): External headwinds remain strong, especially from a weak German automotive industry, but Polish manufacturing is gradually recovering. The July industrial output reading will be boosted by strong calendar effects. Two more working days relative to last year should push industrial production growth into double-digit territory. We forecast July industrial output growth at 10.0%YoY vs. 0.3% in June. These positive year-on-yer growth rates follow five consecutive quarters of declines.

Labour market (Wed): Wage growth eased slightly but continues at a double-digit pace. Average corporate sector wage growth was likely 10.5%YoY in July, from 11% a month earlier. At the same time, employment remains relatively stable, albeit lower than last year. We project a 0.5%YoY decline in the number of jobs in July.

Retail (Thu): Consumption remains the backbone of the current economic recovery, as buoyant growth in real disposable incomes provides solid foundations for higher consumer spending. Households are not keen on opening their wallets and the marginal savings rate remains elevated, but a consumption-led recovery has continued regardless. We forecast a 5.1%YoY increase in retail sales in July. Consumer confidence weakened recently as households expect higher energy bills in 2H24, but it shouldn't be a game changer or a huge obstacle for further growth in private consumption for the remainder of the year.

Construction (Thu): Construction is one of the weakest spots in the Polish economy currently and is the main reason why fixed investments are declining (construction accounts for nearly 50% of total fixed investment). Yet, the pace of declines is easing. In July we project construction output decline at 2.4%YoY after a drop of 8.9%YoY in June. The decline is broad-based across infrastructure construction, dwellings and buildings.

Hungary

Unemployment rate (Fri): The only significant data release in Hungary next week is the unemployment rate. We expect the recent strong momentum to continue, although the headline figure may see a slight uptick that won’t undermine the underlying strength of the labour market. Companies are still in a wait-and-see mode, continuing to hoard labour in a rather unimpressive economic environment.

Turkey

Interest rates (Tue): We expect the CBT to keep the policy rate on hold at the August rate meeting. There are continued challenges with the disinflation process, given administered price and tax hikes and sticky services inflation. We think an improvement in monthly inflation trends, inflation expectations, and a more visible slowdown in economic activity may lead to the start of rate cuts from November. The currency outlook, alongside the evolution of reserves, will also be key in shaping monetary policy.

Key events in developed markets next week

Source: Refinitiv, ING

Key events in EMEA next week

Source: Refinitiv, ING

Read the original analysis: When the facts change, I shake it off

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.