-

Dollar rallies on bets of slower Fed rate cuts.

-

December Fed decision corroborates the notion.

-

But Powell says that they are not on a preset course.

-

Dollar expected to stay strong, but downside risks exist.

Hawkish Fed fuel’s Dollar’s engines

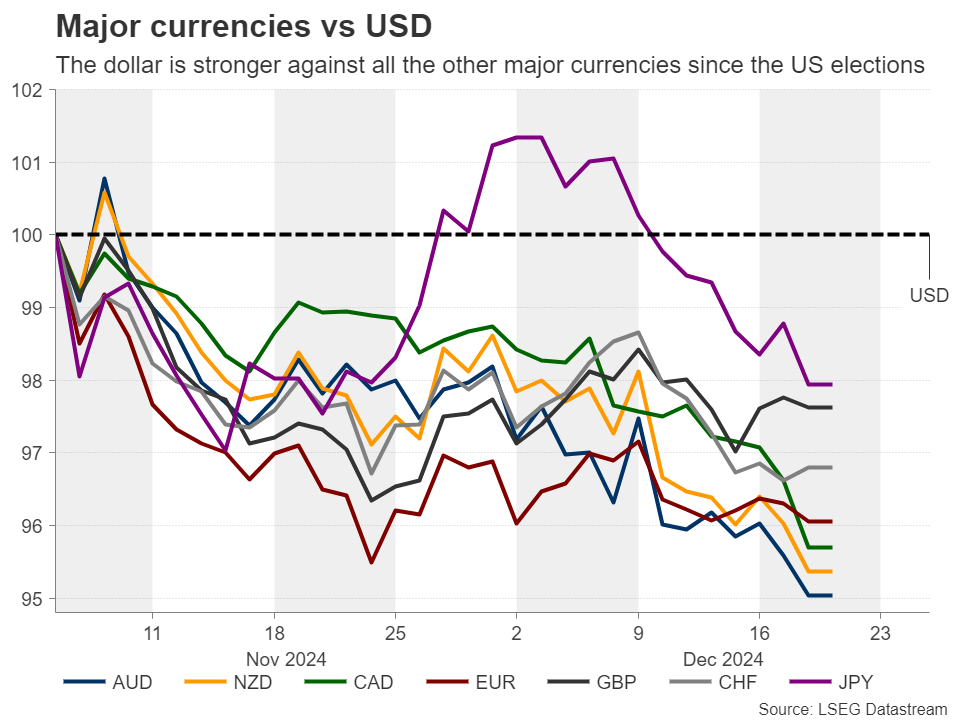

Recently, the US dollar has asserted its dominance in the FX kingdom, stepping to the throne on expectations that the Fed may need to adopt a more cautious approach to rate reductions, in light of persistent inflationary pressures and the robust performance of the US economy. Concerns about the potential inflationary impact of president-elect Trump's tariff and tax cut policies have further bolstered the dollar.

The December FOMC decision has validated investors’ concerns regarding the likelihood of inflation getting out of control again, and that’s why traders gave another strong shot in the greenback’s arm.

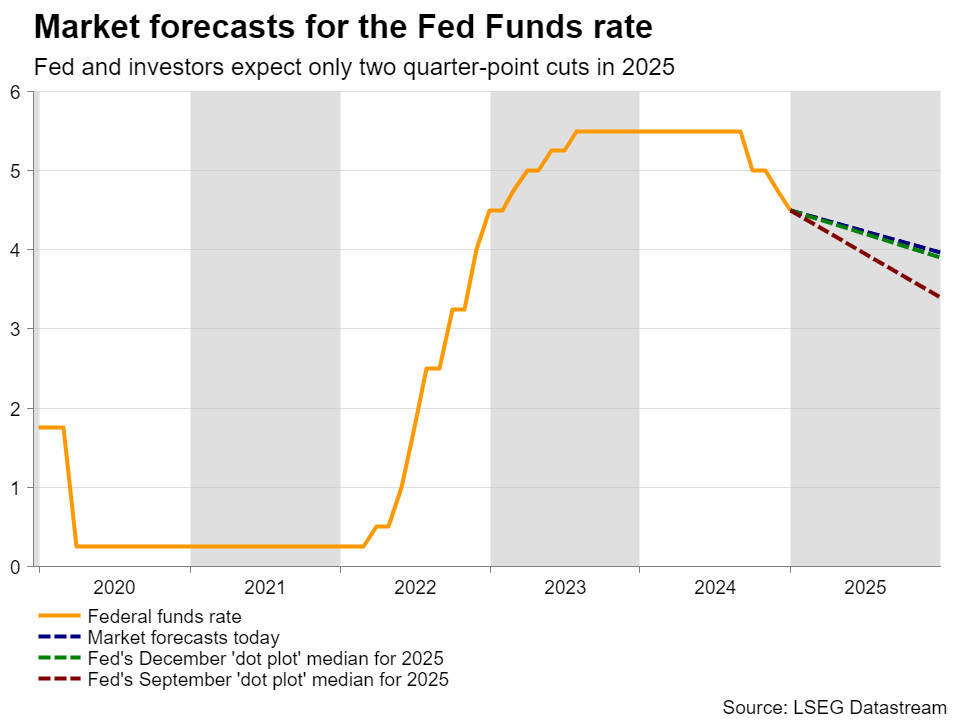

Although Fed officials decided to cut interest rates by another 25bps at Wednesday’s gathering, bringing the total reduction to 100bps from the September peak, the statement accompanying the decision, the new macroeconomic projections and Fed Powell’s press conference were painted with hawkish colors.

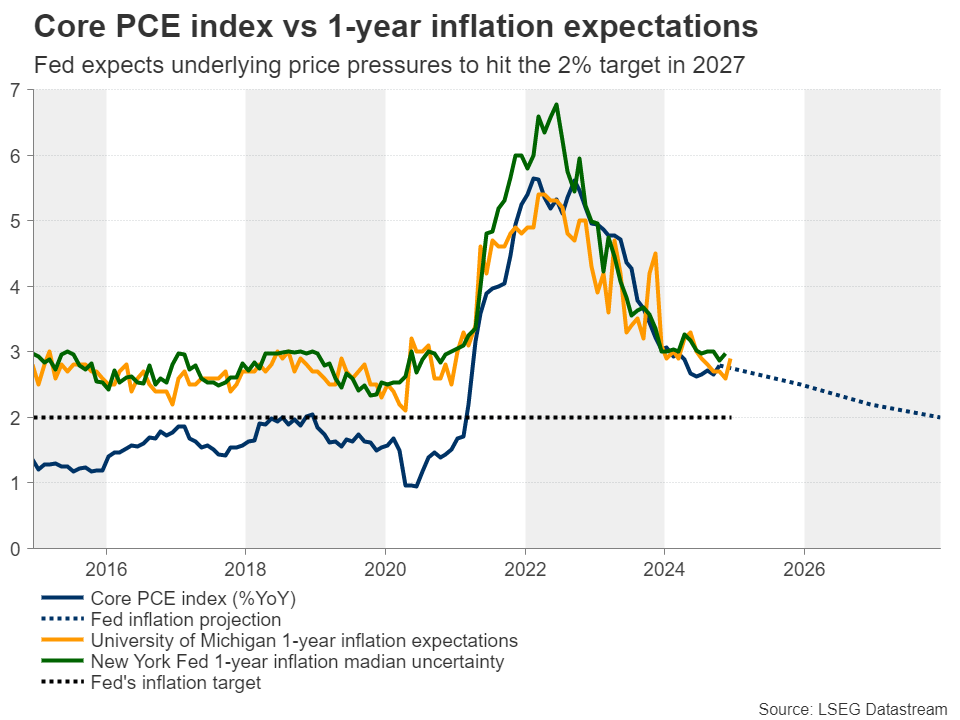

In the statement, it was noted that although inflation has made progress, it remained “somewhat elevated”, while at the press conference, Fed Chair Powell said that if inflation proves stronger, they can dial back policy even more slowly. More importantly, policymakers revised up their inflation projections to show that they expect the core PCE price index, their favorite inflation metric, to hit the 2% target only in 2027, while the new ‘dot plot’ was revised up to show only two quarter-point reductions in 2025. In September, officials saw four cuts for next year.

Is the rally poised to continue?

So, what implications does the decision hold for the future trajectory of the dollar? And what potential risks could precipitate a correction in the current rally?

The upward revisions suggest that Fed policymakers may have begun to incorporate the inflationary risk associated with Trump’s policies in their projections. And this is more evident by the fact that from only three back in September, the number of members considering that the risks to the core PCE forecasts are weighted to the upside rose to 15, even after with the forecasts being revised up.

From 2.2% yoy, the median projection of the core PCE inflation for 2025 was revised up to 2.5% yoy, while the 1-year inflation expectations from the University of Michigan and the New York Fed are projecting inflation rates of 3% and 2.9% respectively.

Although Trump doesn’t enter the White House until January 20, Fed Chair Powell confirmed that the Committee is discussing pathways on how tariffs can affect inflation but added that it is very premature to make any kind of conclusion. “We don't know what will be tariffed, from what countries, for how long and what size. We don't know whether there will be retaliatory tariffs," Powell said.

This prompted investors to nearly fully price in a rate-cut pause for the January meeting and should incoming data and Fed speakers corroborate that notion, the dollar is likely to remain supported.

Downside risks exist, but reversal seems unlikely

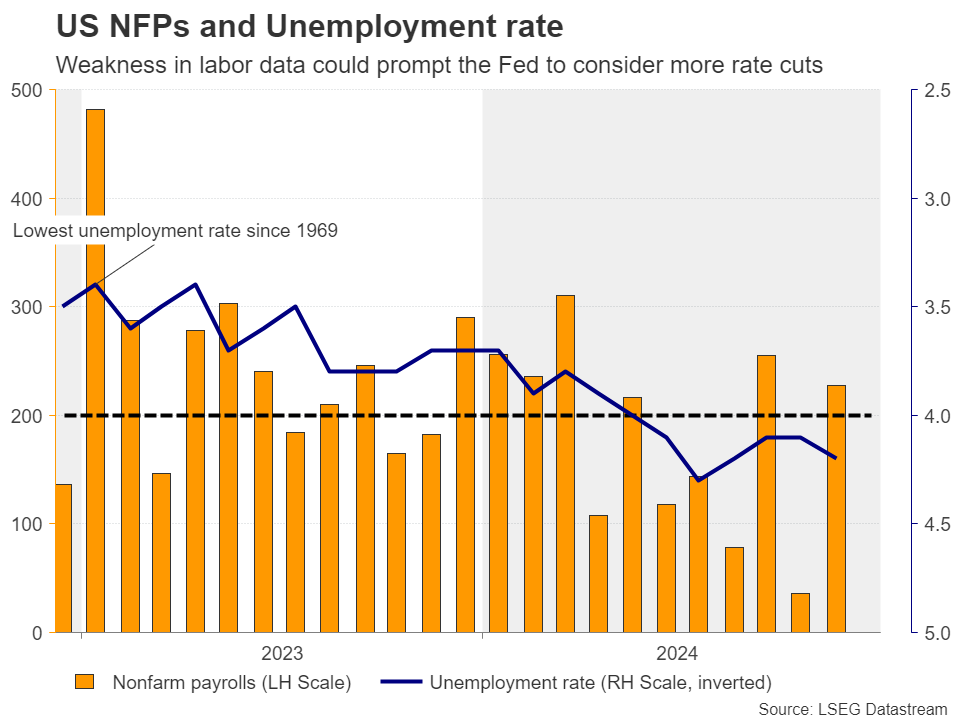

Nonetheless, up until the March decision, when the Fed will publish new projections, there is a lot of data to be released, including three employment reports. And apart from highlighting the upside risks to inflation and the Fed’s cautious stance on interest rates, Powell also said that monetary policy next year will depend on data and not anything that was decided and written down at this meeting, adding that they will be closely looking for further progress in inflation or weakness in jobs.

Therefore, any softness in inflation or labor-market related data could very well disappoint hawkish market expectations, resulting in strong pullbacks in the greenback as market participants start pricing in a few more basis points worth of reductions for 2025. A not-so-aggressive stance by Trump on tariffs could also allow participants to feel more confident about more rate cuts.

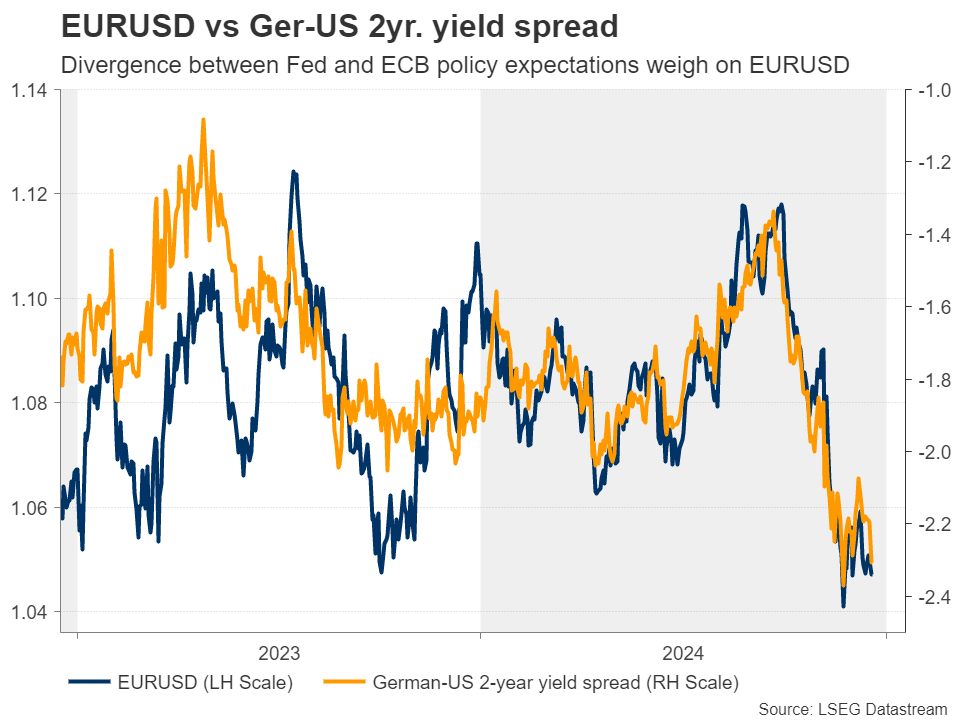

Having said all that though, any declines in the US dollar in case of softer-than-expected US data are unlikely to lead to a major trend reversal, especially against currencies whose central banks are expected to proceed with much more aggressive rate reductions than the Fed in 2025.

One such currency is the euro, with the ECB anticipated to reduce borrowing costs by an additional 110bps by next December. Euro/dollar fell sharply after Wednesday’s decision, but the bears were not strong enough to drive the action below the November 22 low. If that happens in the near future, the downtrend may extend towards the 1.0100 zone, or even towards parity.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD stabilizes near 1.0400 after upbeat US data

EUR/USD consolidates daily recovery gains near 1.0400 following the release of upbeat United States data. Q3 GDP was upwardly revised to 3.1% from 2.8% previously, while weekly unemployment claims improved to 220K in the week ending December 13.

GBP/USD extends slide approaches 1.2500 after BoE rate decision

GBP/USD stays on the back foot and break lower, nearing 1.2500 after the Bank of England (BoE) monetary policy decisions. The BoE maintained the bank rate at 4.75% as expected, but the accompanying statement leaned to dovish, while three out of nine MPC members opted for a cut.

Gold approaches recent lows around $2,580

Gold resumes its decline after the early advance and trades below $2,600 early in the American session. Stronger than anticipated US data and recent central banks' outcomes fuel demand for the US Dollar. XAU/USD nears its weekly low at $2,582.93.

Bitcoin slightly recovers after sharp sell-off following Fed rate cut decision

Bitcoin (BTC) recovers slightly, trading around $102,000 on Thursday after dropping 5.5% the previous day. Whales, corporations, and institutional investors saw an opportunity to take advantage of the recent dips and added more BTC to their holdings.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.