What to expect in monetary policy this week

The week ahead promises to be yet another interesting one, as the US gears up for another round of employment data ahead of the Fed’s final meeting of the year in a couple of weeks. Additionally, a couple of major Monetary Policy Meetings are due to take place in Australia and Canada which may also prove worth watching.

In this article, we take a look at what to expect from the upcoming meetings of the RBA and BoC. Their final meetings of 2023 will either send the consumer public off to the holidays with a sigh of relief or, like last year, tug at their finances yet again going into the new year.

Reserve Bank of Australia

Monetary policy meeting, Tuesday 5th December, decision statement released at 3:30 AM GMT

The Reserve Bank of Australia will have its last rate meeting of the year this week, breaking over the summer until it convenes again in February next year. It raised its cash rate to a 12-year high of 4.35% last month, and many believe it should be done for now.

After reaching a five-month high of 5.6% in September, the Australian Consumer Price Index (CPI) index slowed to 4.9% in the year ending in October, falling under expectations of 5.2%. Softer increases in transport costs and housing prices, with new dwelling prices growing the least since August 2021, largely caused the inflation decrease and the weakest rate since July this year.

On the employment front, in October, there was a reasonable rise of 55,000 new jobs created in Australia. However, in the same month, the unemployment rate, after adjusting for seasonal factors, increased slightly to 3.7%. The current figure represents a small rise from the previous three-month low of 3.6% recorded in September, which aligned with market forecasts, but is still historically on the low side.

Australia's Gross Domestic Product (GDP), also remains in reasonable shape, having grown by 2.10% in the second quarter of 2023 compared to the same quarter of the previous year. The newest figures are due to be released the day following the RBA’s meeting, however forecasts are for growth of around 1.7% for the third quarter.

At the end of November, the Organisation for Economic Cooperation and Development (OECD), which is an institution that represents affluent countries, revised its prediction for the global economy. According to their report, the RBA has most likely completed the process of increasing interest rates for the time being. The study also suggested that inflation will fall to the target range by the end of 2025.

Additionally, the research forecasts that there will be a reduction of 75 basis points in interest rates between the third quarter of 2024 and the end of 2025. Up to around that time, the cash rate will continue to be maintained at its present restrictive level.

Daily charts of the AUD/USD and S&P/ASX 200 - Source: Online trading platform ActivTrader

Bank of Canada

Monetary policy meeting, Wednesday 6th December, decision statement released at 3:00 PM GMT

The Bank of Canada maintained borrowing prices at a 22-year high of 5% at its October meeting, in line with market expectations. Furthermore, the bank indicated that it will use the latest economic indicators as a basis for future rate decisions. The decision to extend the tightening pause for a second time was preceded by a warning from the Governing Council against overtightening, after earlier interest rate hikes that limited economic activity and price increases.

In October, Canada's annual inflation rate decreased to 3.1% from 3.8% in the previous month, marginally undershooting the 3.2% market forecasts. The outcome, which was released on the 21st of November, supported market speculation that the BoC is unlikely to raise interest rates again since it was lower than its prediction that inflation would likely stay at about 3.5% through the middle of next year.

Softening Employment data, which was released on the 1st of December, will also be a likely influence on the outcome of this week's decision. Following an increase of 17.5K in October and above predictions of 15,000, employment in Canada increased by 24.9K in November. This was still a reasonable figure but was down from the average of 39K per month this year. Also in November, the unemployment rate increased to 5.8% from 5.7% the previous month, as predicted by the market. It's fair to say that the labour market seems to be following a cooling trend since earlier this year, as it should be expected to.

In a recent speech, Bank of Canada Governor Tiff Macklem suggested that interest rates may now be sufficiently restrictive to return inflation to target. Given the dip in surplus demand and the anticipated continuation of poor economic growth, many now believe that the central bank will be finished with raising interest rates in this cycle.

Economists surveyed by Reuters predict that the BoC will begin reducing interest rates in the second quarter of next year, in response to the deceleration of inflation and economic growth. They further anticipate that the benchmark borrowing rates will decrease by a minimum of one percentage point by the close of 2024.

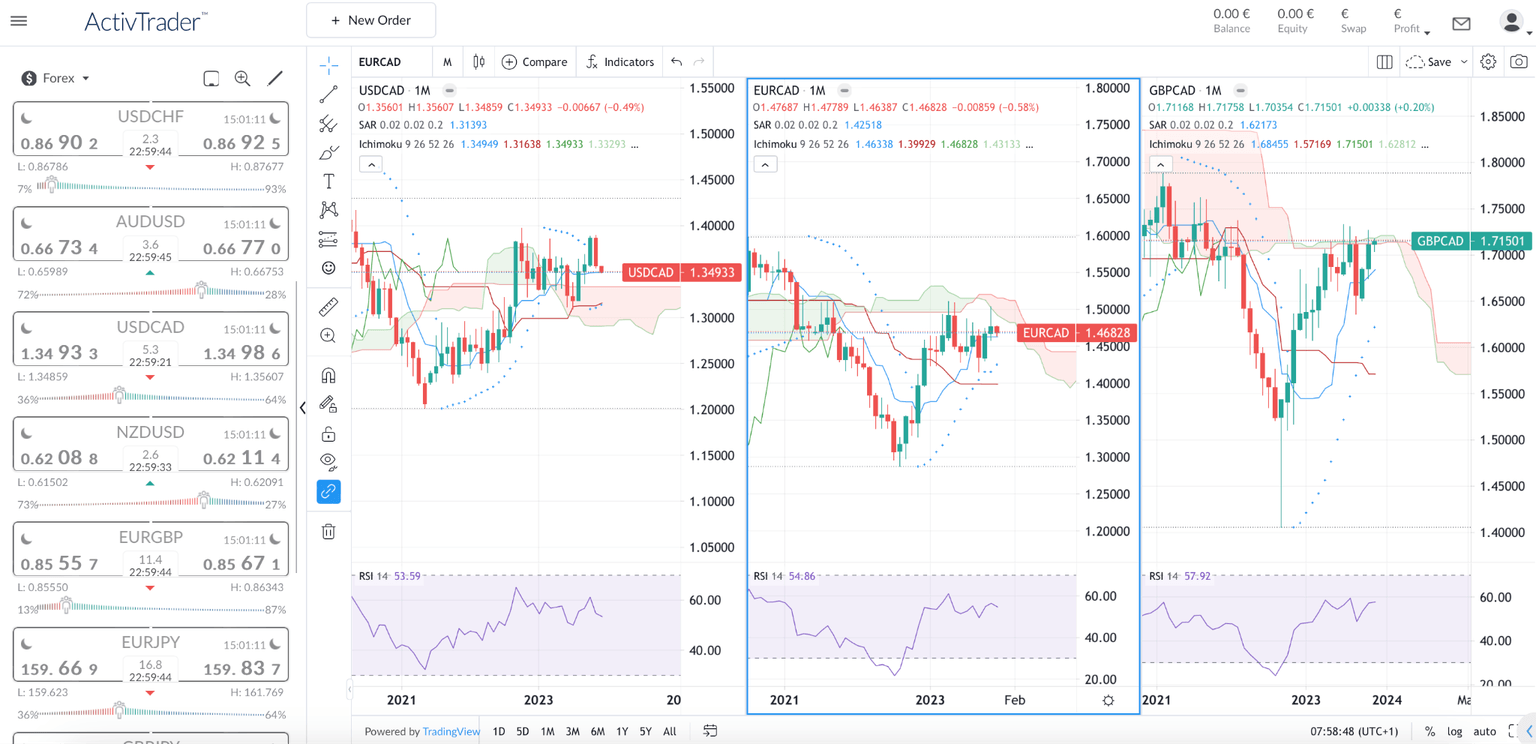

Monthly charts of the USD/CAD, EUR/CAD and GBP/CAD - Source: Online trading platform ActivTrader

Stay up to date with what's moving and shaking on the world's markets and never miss another important headline again! Check ActivTrades daily news and analyses here.

Author

Carolane de Palmas

ActivTrades

Carolane graduated with a Masters in Corporate Finance & Financial Markets and got the AMF Certification (Financial Markets Regulator in France). Afterward, she became an independent trader, investing mostly in European and American stocks/indices.