What to expect from the upcoming BoE meeting?

The last BoE meeting in March saw a ‘dovish hike’. The split was 8-1 on hiking rates by 25 bps with one dissenter. The dissenter was BoE’s Cunliffe. Why did Cunliffe dissent? It was because consumer confidence has fallen due to the squeeze on disposable income for UK households.

Rising taxes, higher energy prices, and increasing food prices are all adding extra burdens to UK households. Some of the poorer households are struggling to cope with the range of price rises across the board. Council tax, gas, electricity, food, communications, fuel, and many more basic items have increased costs.

This is what worries the Bank of England. They do not want to be the cause of slowing growth.

Inflation fears remain

Headline inflation is at 7% and that will concern the BoE. They don’t want to see inflation entering strongly into wages. Once it does, then inflation becomes systemic and generates its own force. If the BoE can prevent that they will. The balancing act is that they will need to do that without slowing growth. Higher rates increase cost burdens on households.

What to expect

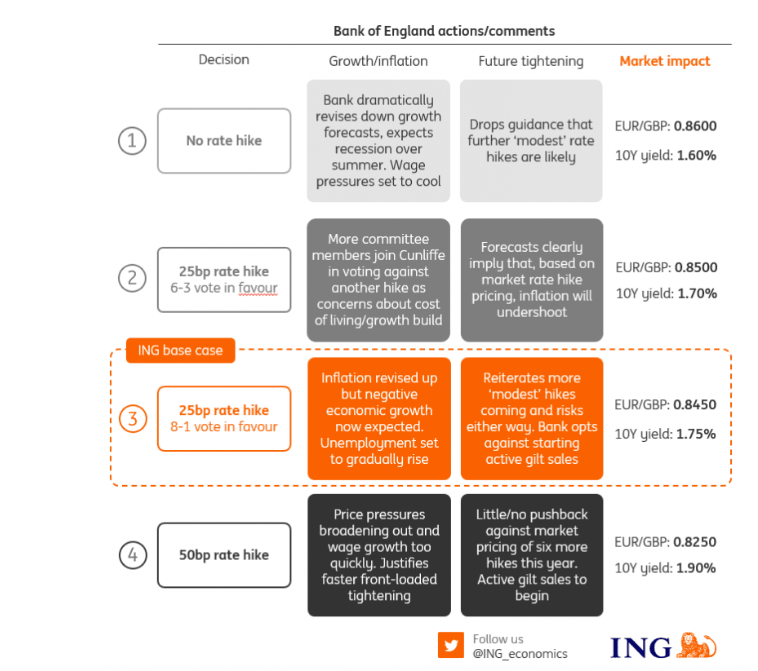

ING’s base case below is persuasive. Namely that the BoE will hike on Thursday, but it will be a more dovish hike as the BoE push back against STIR market’s aggressive interest rate rise pricing. STIR markets have interest rates above 2% this year for the BoE!

Key voting members

The BoE has nine voting members and the current breakdown is that, along with Cunliffe, Catherine Mann, Silvana Tenryro, and Haskel are dovish members. Catherine Mann said at the end of April that If we are seeing higher energy prices and slowing sales then we already are in a stagflation environment. However, she did say that it is a little premature to use that term. Will she change her mind after the latest energy news from Russia restricting supply to only those who will pay in Rubles? We could see Mann change her view, but she has also re-iterated the need to seep inflation anchored and kept open the chances of a more than 25 bps rate hike.

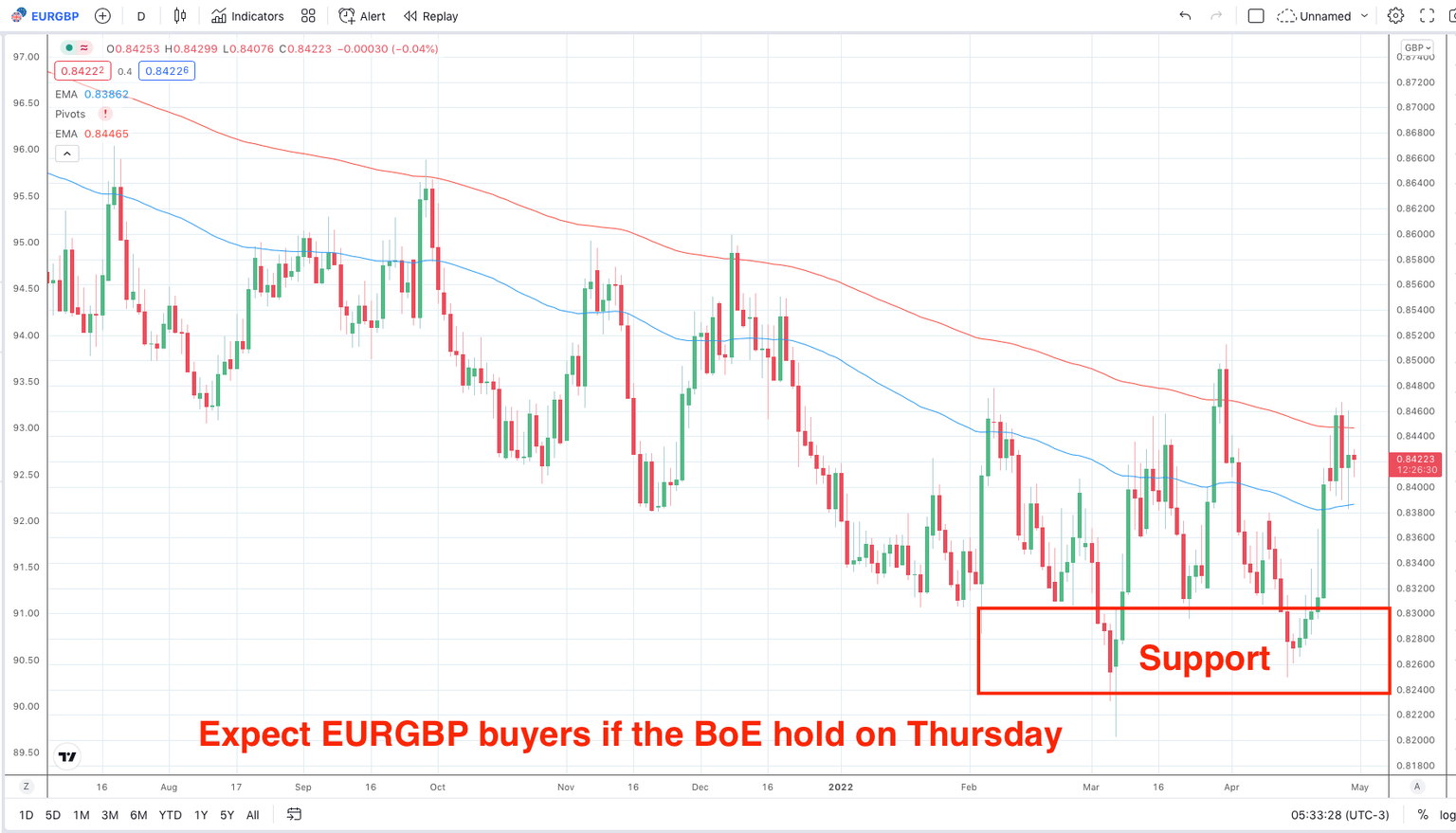

If we see the BoE stay on hold then expect EURGBP upside immediately post the meeting and buyers on dips.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.