What to expect from the BoJ monetary policy decision

The Bank of Japan (BOJ) is scheduled to meet this week on January 17th and 18th, with some market experts betting on more policy changes based on recent economic data and pressure from investors on the bank’s yield curve policy.

While other central banks have been hiking interest rates aggressively to combat inflation, the BOJ has been doing the opposite for decades in a bid to spur price increases in the world's third-largest economy. Now economists believe that after the BOJ wraps up its two-day meeting, it may decide to cease its strategy of controlling the yield curve altogether.

Inflation reaching unacceptable highs

Although CPI inflation still sits enviably lower in Japan compared to other major economies, data released on Monday indicated that factory gate inflation had increased more than predicted in December. It now remains at its highest level in 42 years as domestic manufacturers battle rising import prices and a depreciating yen.

According to figures released by the BOJ, Japan's producer pricing index (PPI) increased by 10.2% on an annualized basis in December 2022, which was higher than both the consensus forecast of 9.5% expansion and the prior month's reading of 9.7%. Inflation as measured by the PPI increased by 0.5% in December, which was higher than the 0.3% increase economists had predicted but lower than November's 0.8% increase. However, the previous month of November was revised upwards, from 0.6% to 0.8%.

In 2022, the index reached an all-time high; its greatest point since 1981, with the primary driver said to be increased volatility in global commodity prices, which rose in December on hopes of a demand revival in key importer China.

Also, according to a report released on the 9th January, core consumer prices in Japan's capital, a leading indication of national trends, surged 4.0% in December from a year earlier, above the central bank's 2% inflation goal for the seventh consecutive month, indicating a widening of inflationary pressure.

Yield Curve Control – What is it, and how does it factor into Japan’s Monetary Policy?

The yield curve is a line that charts the connection between the interest rates (yields) on bonds of comparable quality and various maturities at different points in time. The slope of the yield curve is a useful indicator of future changes in interest rates as well as current and future economic activity.

The normal yield curve, also known as an upward sloping curve, the inverted yield curve, also known as a downward sloping curve, and the flat yield curve are the three most prevalent varieties of yield curves. Curves that slope upwards, also known as normal curves, usually represent economic growth, while curves that slope downwards, also known as inverted curves, represent economic contraction.

The phrase "yield curve control" (YCC) refers to the process through which a central bank aims to achieve a certain longer-term interest rate objective and then buys or sells as many bonds as are required to achieve that rate target. The conventional method that the Federal Reserve employs for regulating economic development and inflation in the United States is to establish a key short-term interest rate known as the federal funds rate. A very different strategy to YCC.

After a lengthy period of economic stagnation and exceptionally low inflation, the BOJ adopted its yield curve management mechanism in September 2016 with the objective of boosting inflation towards its 2% target. To do this, they established a 0% objective for 10-year bond rates in addition to the -0.1% aim for the overnight rate. The goal was to manage the yield curve such that short and medium term rates would be lowered without significantly affecting returns for pension funds and life insurance.

Since inflation is now at a 41 year high, the tables have turned, and to protect its yield ceiling, the BOJ has increased its purchasing, including via promises to acquire limitless sums of bonds. Analysts have criticized this move, saying it distorts market pricing and contributes to an undesirable drop in the value of the yen, which drives up the price of imported raw materials.

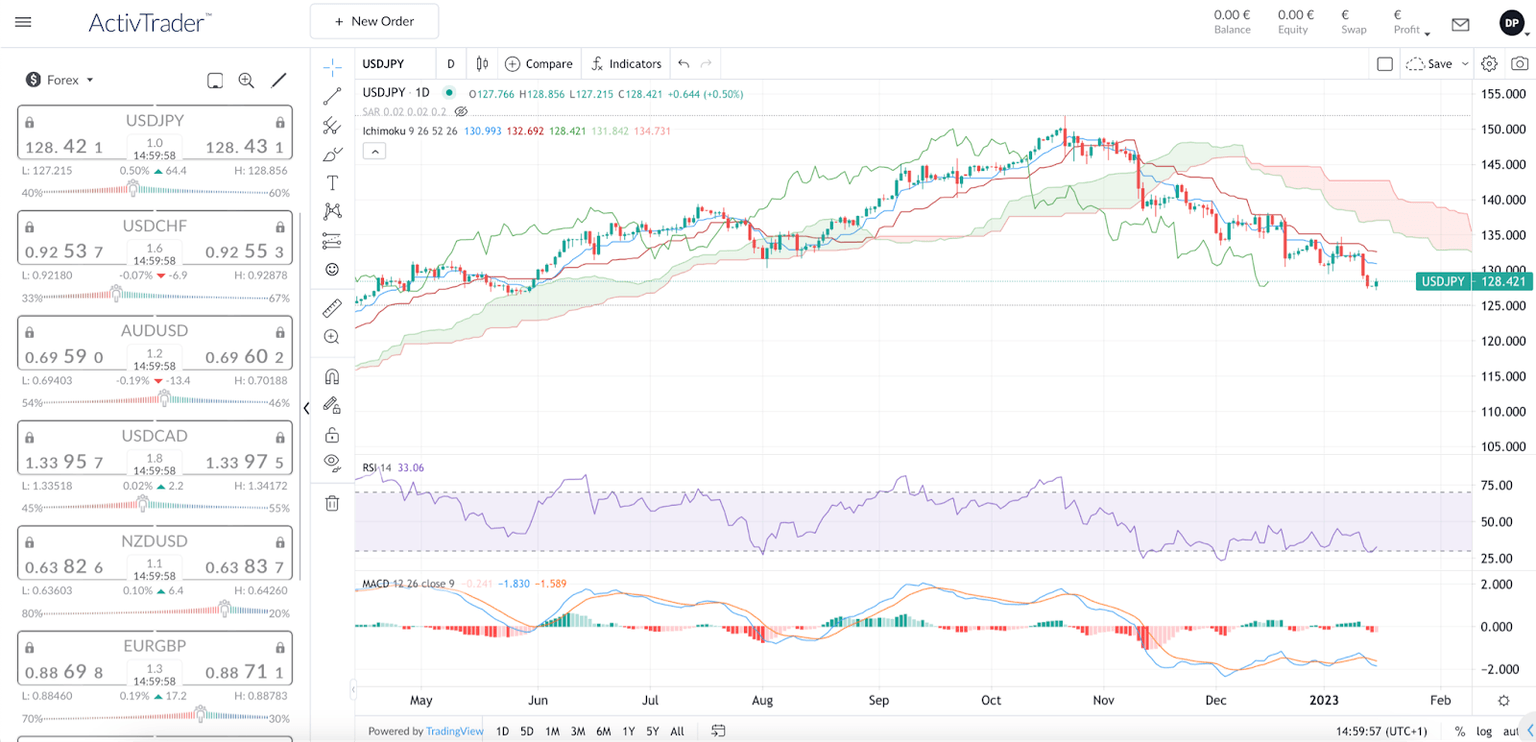

Daily Chart USD/JPY - Source: ActivTrades Online Platform

Less than a month ago, the BOJ shocked markets by increasing the range around its 10-year yield target to 0.5% from the previous 0.25%, causing a repricing of market rate increase expectations.

The BoJ had to take action last Friday when the benchmark 10-year bond yield cap was broken (it rose over the ceiling of 0.50%), amid rising suspicions of more policy changes.

Will the BOJ finally increase overnight rates?

As the Bank of Japan's officials cling to the expectation that a tight labor market would ultimately stimulate consumer demand, strong wage and consumption growth is likely to be the catalyst that forces the bank to move away from its ultralow interest rates. Since.

As labor shortages worsen and living expenses rise, an increasing number of large corporations, like Fast Retailing, the parent company of Uniqlo, have committed to raising wages. This is a departure from their long-standing practice of maintaining cheap pricing of their products and low salaries.

In order to determine whether pay increases have expanded enough to be maintained in the next year and beyond, the BOJ would likely examine different statistics, including the government's monthly salary data and union umbrella surveys, released later this year.

The BOJ may conclude that its stimulus plan was successful if it can gather enough evidence that wage increases are spreading and if it gets to that point, then the bank may use increasing earnings as evidence to support changes to its policy framework.

Stay up to date with what's moving and shaking on the world's markets and never miss another important headline again! Check ActivTrades daily news and analyses here.

Author

Carolane de Palmas

ActivTrades

Carolane graduated with a Masters in Corporate Finance & Financial Markets and got the AMF Certification (Financial Markets Regulator in France). Afterward, she became an independent trader, investing mostly in European and American stocks/indices.