What powers SPY bullish reversal

S&P 500 refused to decline premarket, even before ISM manufacturing PMI and prices, short squeeze days started developing – bears didn‘t stand a chance (not even in the opening hour) to the risk-on move. Importantly, what hasn‘t been the case before – market breadth started improving, looking at both percentages of stocks trading above various moving averages, and actual sectoral composition of the advance.

Genuine turnaround or short squeeze as one of those prior Fridays?

Till New York early afternoon, it could have been very well both, and even if institutional buying towards the close left something to be desired, I do favor the glass being rather half full than half empty – I called early in the day Friday as up.

Is that sustainable? We‘ll see pretty soon Monday, or Turnaround Tuesday (hello services PMI) – I do favor ES moving towards 6,000 Monday, and in the premium section, I‘m introducing to clients the reasoning why, and crucially the clues that would indicate this bullish outlook is being invalidated, if these come around to happen.

Miss not today‘s extensive video talking as well the weekly S&P 500 chart and Q1 prospects (thanks for liking it, subscribing to the channel with notifications on) – and I include gold, silver and miners coverage too (given Bitcoin‘s base building before a fresh push, where is this traditional safe haven asset going?).

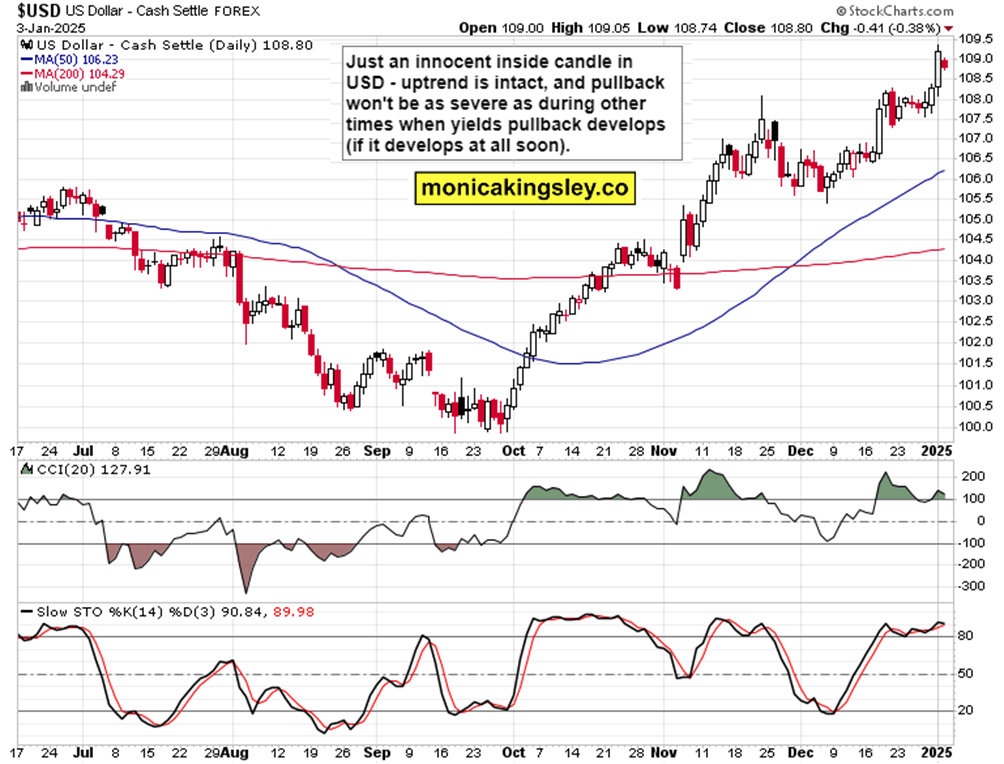

What‘s though clear, is that Friday‘s move was about more than a reaction to economic data beating expectations – the yields view would suggest that at first glance, so let‘s have a look at the dollar as well, all in the context of the Fed shrinking its balance sheet and reverse repo facility being drawn (how much liquidity support is there still available? The takeaway is discussed in today‘s video).

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.