What now for the Democrats?

Like many, I applaud Biden’s decision. I would have preferred that he’d made it sooner, but there’s still plenty of time for the Democrats to run a successful campaign. In fact, I wish something on the order of a two-month campaign – as opposed to a two-year campaign – were the norm and not the exception. The length of time – and money – currently spent on presidential campaigns is unconscionable. This issue is difficult in that, given our commitment to free speech, I don’t really see a way to preclude individuals or PACs from mounting campaigns for office at any time of their choosing. I just wish that, in the best interests of our country, the two parties would mutually agree that they wouldn’t sanction fundraising and spending much before, say, a quarter prior to an upcoming election.

For those who were reluctant to see Biden take himself out of the race for fear that the Democrats would self-destruct in an all-out melee with prospective replacement candidates tearing each other down, that fear seems to have largely been unfounded given the broad swath of endorsements coming to Kamala Harris. And for those who argue for an open convention rather than a “coronation,” that just may happen. The lineup of endorsements for Harris doesn’t prevent the delegates from making judgments in opposition to these endorsements. Maybe they will; maybe they won’t. Regardless, the Democrats will ultimately unify; and, at least at this point, it looks like Harris will be the one.

The longer I sit with the idea of Harris as the nominee, the more I like it. Of course, I’m of the mind that the Biden/Harris administration took positions I favor, particularly in the foreign policy realm, where I think the administration has the greatest autonomy to act and where the contrast between Biden and Trump is stark. I also give the Biden Administration high marks in terms of the posture America has taken with respect to Israel and Gaza. Trump’s bluster about being able to solve this Middle East crisis can’t be taken seriously. By all indications, Trump would likely support Netanyahu uncritically – someone who has increasingly been taking actions antithetical to moving to a peaceful two-state solution. This direction is anything but constructive.

On the domestic front, I align with the Democratic platform much more so than the Republican platform (surprise!); but, sorry to say, much of both of those platforms are performative. Fulfilment of their respective “promises” requires a Congress that will enact required legislation. Particularly in the realm of economics, the Administration, in and of itself, has limited power.

Where the Administration will have a profound effect is on the question of the rule of law; and former prosecutor Kamala Harris is particularly well-suited to represent the case for the Democratic party. The choice is stark. Donald Trump is a convicted felon and sexual predator who has managed to exploit our legal system to avoid any real accountability for his actions in connection with the January 6th assault on the Capitol, the fraudulent elector schemes across the country, and charges relating to his retention and mishandling of government documents and his efforts to resist the return of those documents after they were requested.

In all these cases, due process – in particular, the follow-up to the determination of independent grand juries that probable cause of criminality had been found – has been thwarted either because of the efforts of Trump and his lawyers to delay adjudication or because of highly suspect rulings by Trump-appointed jurists that broadly immunized Trump from criminal prosecution and threw out the documents case altogether, despite the merits of the accusations.

We’re at a critical juncture. Upholding the rule of law without fear or favor has been a critical distinguishing feature of America, and it’s under threat. The phrase, “no man is above the law,” which currently seems suspect, will definitively be relegated to the pre-Trump history of America if Trump were to be re-elected. We have a chance to save it under Democratic leadership. Kamala Harris is probably the best positioned potential candidate to make this case; and with her at the helm prioritizing this issue, it should be a landslide.

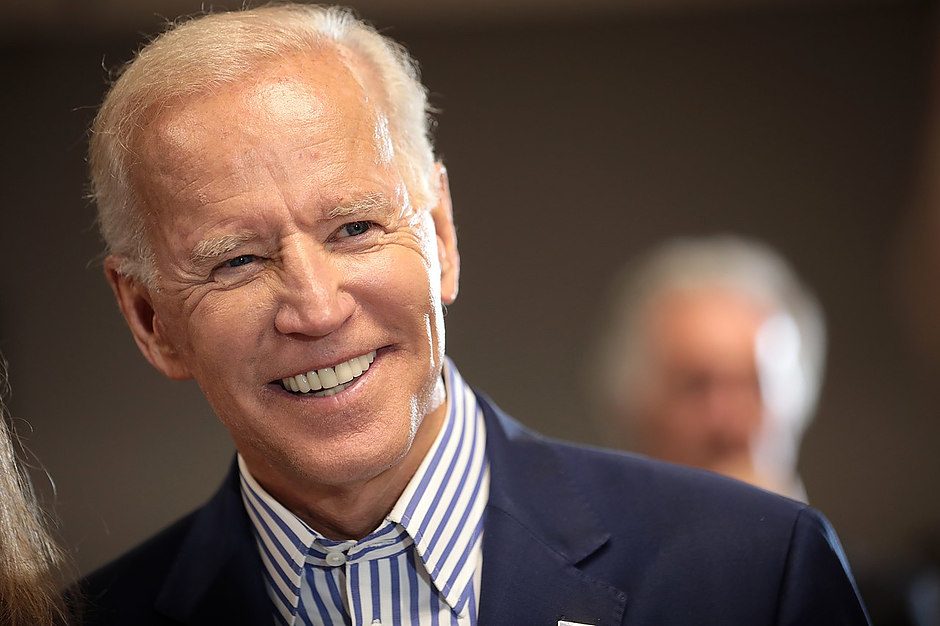

Author

_XtraSmall.jpg)

Ira Kawaller

Derivatives Litigation Services, LLC

Ira Kawaller is the principal and founder of Derivatives Litigation Services.