What Europe stands to lose from Trump’s latest threatened tariffs

If Donald Trump goes ahead with his threat of more tariffs against the EU next week, we calculate that could knock 0.33% off GDP growth in the short term. Although that sounds marginal, it would be a real blow to more exposed economies desperate to reverse stagnating trends. And over time, that figure could soar.

Anxiety levels are rising in Europe

When the US is your most important trading partner and it's threatening still more tariffs on you, the European Union can be forgiven for feeling anxious. Donald Trump is expected to announce more trade-war charges on many countries on 2 April; he's called it a 'liberating day' for America. We reckon a 25% US tariff on Europe could reduce the EU's GDP by 0.33% in the short term, considering the direct impact on exports. While that might sound marginal, when your economies have been stagnating for months, if not years, the cost will be considerable. And could rise even more over time.

It all depends on the level of exposure. Tariffs increase the price of a product, and the extent to which demand decreases as a result of this price increase helps determine the direct impact on GDP.

Short-term impact (1-2 years):

-

American consumers may struggle to find alternatives or new trade routes may not yet be established.

-

An additional 25% tariff on EU exports to the US is estimated to decrease exports by 19%.

-

Considering the GDP contained in this export decline (1.93% for the EU), this results in a 0.33% decrease in GDP.

-

Indirect effects, such as loss of confidence and negative consequences for financial markets, can further exacerbate the negative impact on GDP.

Long-term impact:

-

Over time, American consumers and producers may find substitutes for the affected imports.

-

The direct impact on EU GDP can rise to 0.87% at a 25% tariff.

-

The negative shock of American tariffs can escalate with multiplier effects, such as:

-

Loss of production leads to job losses, negatively affecting consumption.

-

Decreased investments.

-

-

These combined factors reinforce the direct long-term effect on GDP, with US tariffs having a substantially negative impact on the European economy.

The US is the EU's most important trade partner

In terms of goods exports, the US is the EU's most important trade partner, with exports totalling 504 billion euros in 2023, representing 20% of all extra-EU exports. Of these, 158 billion euros, or 31%, come from Germany, making it the country with the largest exposure to the US market by a significant margin.

However, due to Germany's strong overall export orientation, US trade flows account for only 22% of its extra-EU trade, which aligns with Italy and the EU average. Countries such as France (16.3%), the Netherlands (15.5%), and Spain (13.1%) fall below this average, making them relatively less exposed to the US market.

In contrast, Ireland sends 46% of its extra-EU trade to the US. This high exposure is partly due to the favourable tax treatment of US multinationals and the establishment of US pharmaceutical production in Ireland. Besides pharmaceutical products, EU-US trade mainly consists of cars, machinery and equipment, and chemicals.

US exports represent 20% of extra-EU goods trade

The big complication of comparing export values to GDP

Total exports provide a good initial indication of economic exposure to international trade, but comparing export values with GDP is complicated by two factors. Firstly, GDP measures domestic added value, while exports combine both domestic and foreign value. Secondly, exposure to the US can also occur indirectly through exports from other countries. This can be illustrated by the production process of car parts. For example, if a European Union country imports aluminium sheets, processes them into car parts, and then exports them to the US, the recorded export value of these parts includes both the cost of the aluminium sheets (foreign added value) and the domestic added value created during processing.

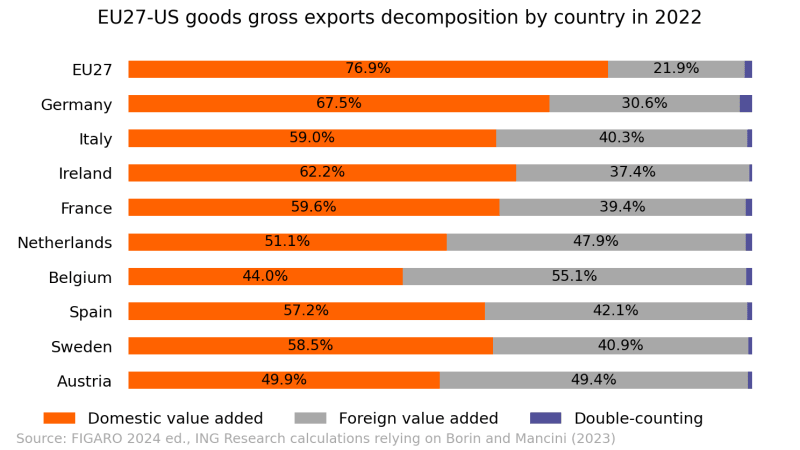

This dynamic applies not only to car parts. On average, EU exports to the US consist of approximately 77% domestic-added value and 22% foreign-added value. For about 1% of the export value, the origin is unclear. Important differences between countries can also be observed. Relatively smaller countries, like Belgium and Austria, or countries with significant seaports, like the Netherlands and Belgium, generate less domestic added value compared to larger counterparts such as Germany.

Domestic value-added in gross exports to the US by country

Country-level exposure to the American market

Domestic added value provides a clearer insight into the share of GDP directly exposed to trade relations with the US. Consequently, it can be calculated that the added value—or GDP exposure—of the total direct exports from the EU to the US amounts to 1.9%. However, this is just the beginning. The domestic value-added content of exports from individual EU countries is significantly lower than that of the entire EU due to the extensive supply chains within the EU internal market. For example, if car parts are produced in one EU country and then exported to Germany for assembly into complete cars before being shipped to the US, the domestic added value contained in those car parts is indirectly exposed to the American market.

For Belgium, for instance, these indirect exports to the US through other EU countries increase its GDP exposure from about 0.9% to 1.54%. This is the relevant exposure to evaluate the potential impact of American tariffs. Compared to the overall EU’s exposure at 1.9% of its GDP, countries like Spain and France are markedly less exposed, at 1.1% of their GDP. Germany and Italy, on the other hand, are significantly exposed at 2.1% and 2% of their GDP, respectively. These exposures are largely driven by direct exposure—both at 1.7%—resulting from their substantial exports to the US and relatively high domestic value-added content in US exports. Ireland stands to lose the most from US tariffs, with an exposure equivalent to 9.7% of its GDP.

Additionally, the indirect exposure to the US market via other countries affected by US tariffs, such as China, Canada, and Mexico, is rather limited. Therefore, the direct impact of tariffs on EU GDP vis-à-vis these countries is expected to be limited.

EU value-added exposure to US market via different trade channels

With the US threatening more tariffs, the EU faces significant economic angst. A 25% US tariff could slash the EU's GDP by 0.33% in the short term, with long-term impacts potentially soaring to 0.87%. That figure, however, is extremely difficult to be certain of given the unpredictability of the geopolitical situation. One thing's for sure, though: the stakes couldn't be higher. We should find out more on 2 April when Donald Trump reveals his latest plans.

Read the original analysis: What Europe stands to lose from Trump’s latest threatened tariffs

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.