What does Tuesday’s RBA meeting hold?

The RBA meets next week on Tuesday, June 6, at 05:30 UK time. At the last RBA rate meeting, the RBA surprised markets with a 25bps interest rate hike that was not expected. In that meeting, the RBA stated that it is aware of the risk that expectations of persistently high inflation may lead to larger price and wage increases. It also recognizes that further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe.

How is inflation doing in Australia?

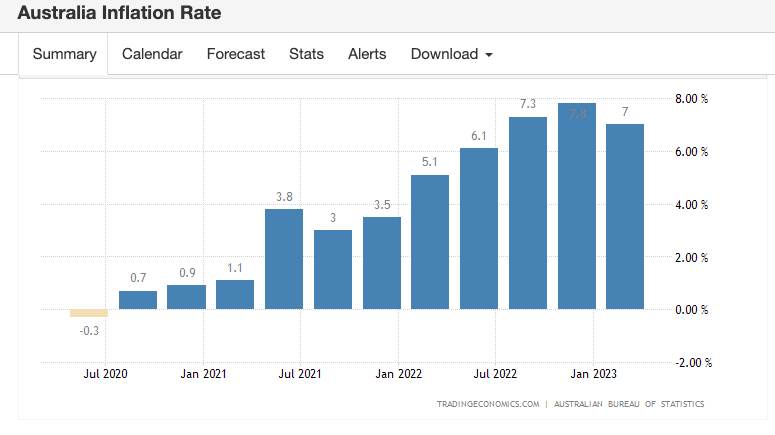

The headline inflation level is at 7% y/y, and way above the 2% target.

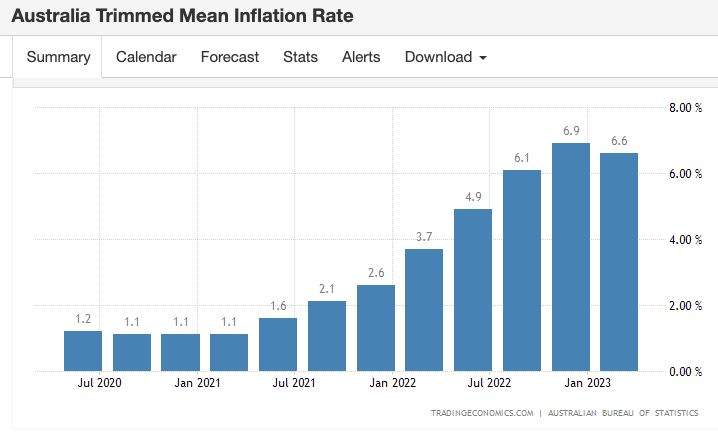

The core inflation level is at 6% y/y, and that is not sending any comforting signs too.

Additionally, the monthly CPI indicator in Australia increased in April 2023 to 6.8% y/y. This was the first increase in annual inflation since last December for this metric.

So, this means the RBA could easily decide to surprise markets with another 25bps hike.

What’s the outlook for the AUD/NZD?

If the RBA surprises markets with a 25 bps hike, some sudden gains in the AUDNZD pair would make sense.

If the RBA doesn’t hike rates and also signals that it has reached a natural “pause point,” then that will contradict interest rate markets which still see a terminal rate of over 4%. In that instance, watch for potential AUDNZD selling out of the meeting.

If the RBA does neither of the above, the outlook is less certain and will come down to finer points within the statement.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.