What can we expect from ISM business PMIs next week?

-

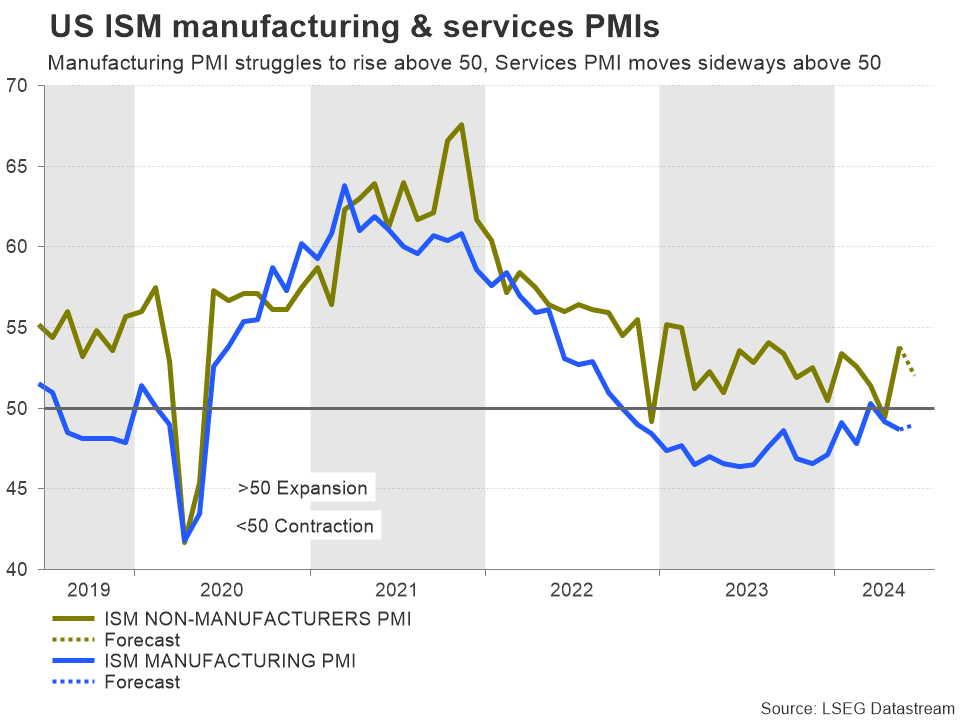

ISM manufacturing PMI to tick higher; services PMI to lose some pace.

-

Business outlook could stay unchanged; rate cut forecasts will remain inflation-driven.

-

EURUSD stays neutral after core PCE inflation; needs a strong rebound above 1.0885.

What happened previously?

Dollar traders will pay close attention to the US ISM manufacturing and non-manufacturing PMI readings for June due on Monday and Wednesday respectively at 14:00 GMT.

While Friday's US nonfarm payrolls report will be the big event next week, business surveys could showcase early signs of hiring trends and changes in inflationary pressures, and therefore influence investors’ thoughts on rate cut timing.

May’s ISM PMI release came below expectations, displaying a faster moderation in manufacturing activity for the second consecutive month in the contraction area below 50. The overall reaction in the US dollar was negative as the price paid and new orders sub-indices eased significantly, but the response could have been worse if the employment index would not have returned to the expansion area.

Encouragingly, the non-manufacturing PMI survey came to overshadow the weakness in the manufacturing sector two days later, boosting the composite index back to the growth territory. The report showed services activities rising to the highest in nine-months led by real estate and health care businesses, while the details revealed progress in employment and softer increases in prices paid, although challenges regarding high interest rates and increased wages remained. Still, the US dollar could not sustain its bullish action until a stronger-than-expected nonfarm payrolls came to its aid in fully healing its wounds.

What will June's ISM business PMIs show?

The truth is that the first quarter was not fruitful for the US economy, with GDP growth falling by half to 1.4% from 3.4% in Q4 - the lowest in almost two years. Nevertheless, the first-quarter GDP data, aside from some pandemic-related distortions, tends to be relatively lackluster following the holiday season.

Economic statistics in the second quarter haven’t been impressive so far either, but they came out better than expected, pushing rate cut projections towards the September-December 2024 period, when the US general election will also take place.

Perhaps an upbeat PMI report could raise doubts about whether a rate cut is necessary in September. Forecasts point to a slightly higher ISM manufacturing PMI of 49.0 compared to 48.7 in May and a softer services PMI of 52 from 53.8 previously, which, if correct, wouldn’t drastically change the outlook for the US economy overall.

The focus will remain on inflation

The S&P Global business PMIs could be more encouraging next week, with analysts predicting a rebound both in the manufacturing and services indices. Nevertheless, inflationary pressures may continue to play a significant role in determining monetary easing decisions. Moreover, with the manufacturing sector experiencing one of its longest periods within the contraction region and the services sector struggling to resume a positive trajectory, rate cut projections may linger.

The Fed’s favorite inflation measure, the core PCE index, met forecasts for a slowdown to 2.6% from 2.8% previously – the lowest level reached since the measure spiked from 1.9% to 3.1% in April 2021. The data increased the odds for a September rate cut above 60% despite an upside surprise in personal income.

Comments from the San Francisco Fed president, who indicated that the central bank is still uncertain about when to slash interest rates, also helped. Perhaps the Fed might wisely take its time during the summer to monitor changes in inflation ahead of the Jackson Hall symposium in August and before making any serious policy decision in September.

EUR/USD levels to watch

In any case, the core PCE inflation index did not cause strong volatility in EURUSD today, leaving the pair below the nearby resistance of 1.0725. For the bulls to stay in the driver’s seat in the coming sessions, the pair must claim its simple moving averages (SMAs) within the 1.0770-1.0788 region in order to advance towards the 1.0850 barrier, which blocked buyers on June 12. Even higher, a sustainable rally above 1.0885 could shift the focus back to April’s upleg.

On the downside, sellers could take control below the 1.0660 support area, likely pressing the price towards the 1.0600 round level. If that floor cracks, the decline could worsen towards the 1.0515 area.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.