Week's top three trades: Wheat

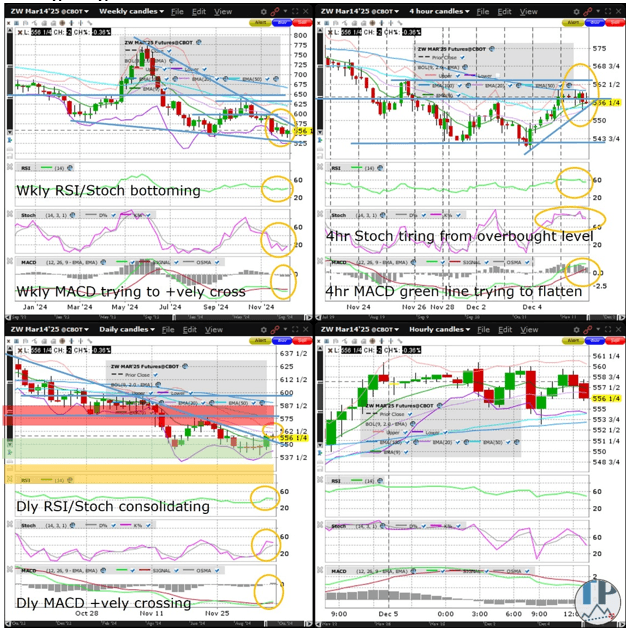

Wheat (ZW) formed a daily Doji Friday (on the March contract) just above the daily chart downtrend resistance. Nevertheless, ZW remains vulnerable to perhaps one final extension lower to the weekly chart descending wedge support following Tuesday’s highly anticipated WASDE. Regardless of whatever post-WASDE downside, ZW’s weekly chart descending wedge is nearing completion, offsetting some bearishness from last week’s fresh 2024 low (on the continuous monthly chart on tradingview.com) and lower December low versus the November low.

For now, ZW’s rallies will likely remain bear rallies until it can reclaim on a weekly basis, the October high. Until then, ZW is at moderate risk by Q1 sometime of sliding further to the 2019 low and even 2016 lows (as hinted by the still downsloping MACD on the continuous 3 month chart on tradingview.com). The weekly and daily RSI, Stochastics and MACD are bottomish, rallying or consolidating recent gains. I am looking to go long in the green zone (of the daily chart), targeting the red zone for Friday. The amber/yellow zone is where I might place a stop if I was a swing trader (although in my personal account with which I seldom hold overnight I sometimes set my stops tighter).

Author

Darren Chu, CFA

Tradable Patterns

Darren Chu, CFA, ex-Intercontinental Exchange | NYSE Liffe, TMX Group, CMC Markets, is the founder of Tradable Patterns – a publisher of futures/FX technical analysis on Bloomberg, LSEG (Refinitiv) and Factset.