EURUSD: With a continuation of its previous week weakness seen the past week, further downside pressure is envisaged in the new week. Support lies at the 1.3100 level where a break will expose the 1.3050 level. Below here will pave the way for a move lower towards the 1.3000 level. If this continues, expect further downside to occur towards the 1.2950 level. On the upside, resistance lies at the 1.3200 level where a break will aim at the 1.3250 level, its psycho level followed by the 1.3300 level. Further out, resistance comes in at the 1.3350 level. All in all, EUR remains biased to the downside in the medium term.

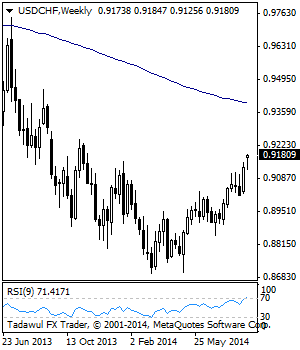

USDCHF: Faces Corrective Pullback Risk

USDCHF: With USDCHF unable to follow through higher on the back of its previous week, it faces the risk of a pullback in the new week. On the upside, resistance resides at the 0.9200 level where a break will aim at the 0.9250 level. Further out, resistance resides at the 0.9300 level. A breather may occur here and turn the pair lower. On the downside, support lies at the 0.9150 level with a break targeting the 0.9100 level and then the 0.9050 level. Further down, support comes in at the 0.9000 level. A cut through here will target the 0.8950 level. All in all, the pair remains biased to the upside in the medium term though facing corrective risk.

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.