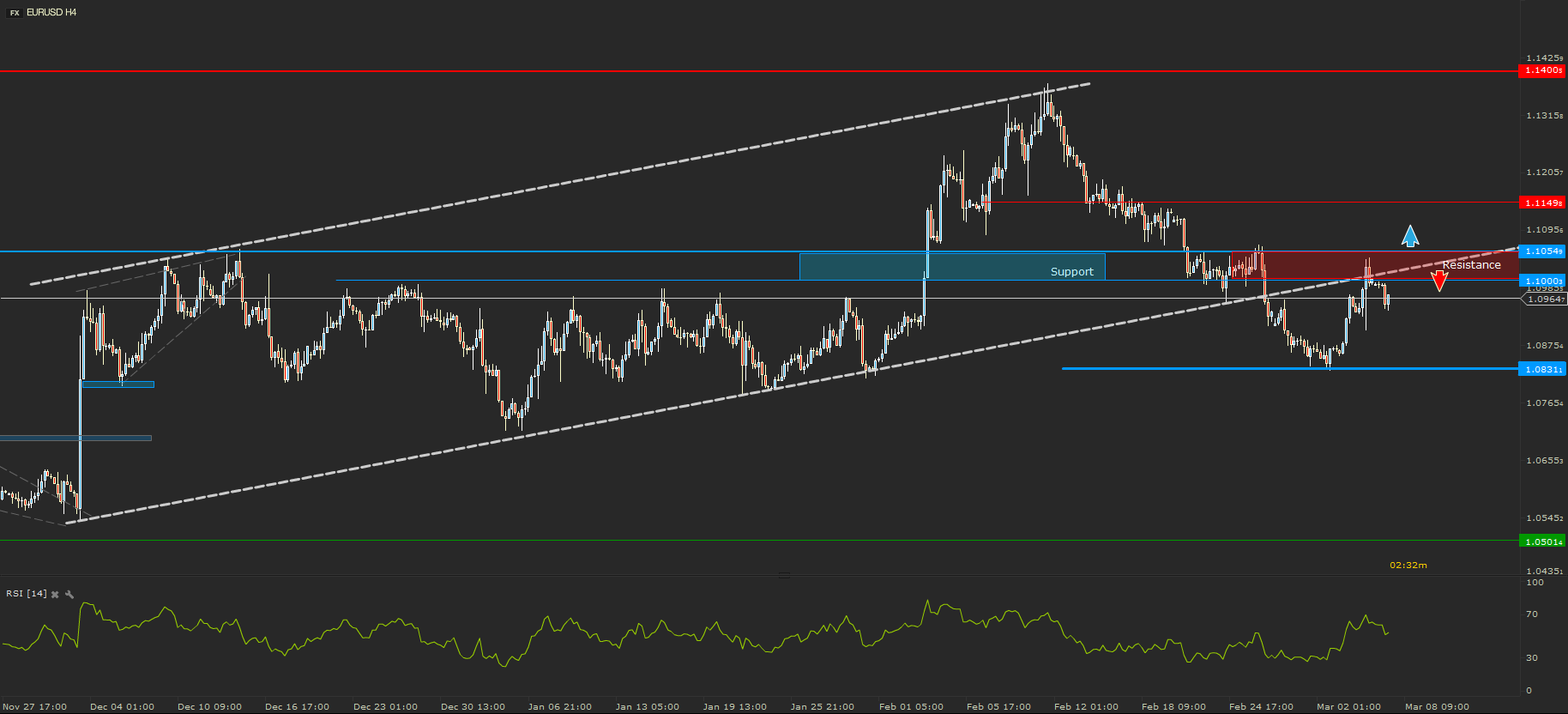

EURUSD – Trying to comeback

The EURUSD managed to break the support area from 1.1000 and dropped below the main trend line of the uptrend. The fall has stopped at 1.0830, where it found a local support. The bounce brought the price back above 1.1000, but it was not enough to continue the rally. Currently bulls are trying to push against the resistance area.

A break above 1.1055 would be a strong buying signal because this would signal a comeback of the price in the main uptrend channel. A fail to break above the latest high and 1.1055, could signal another drop back to the previous lows from 1.0830.

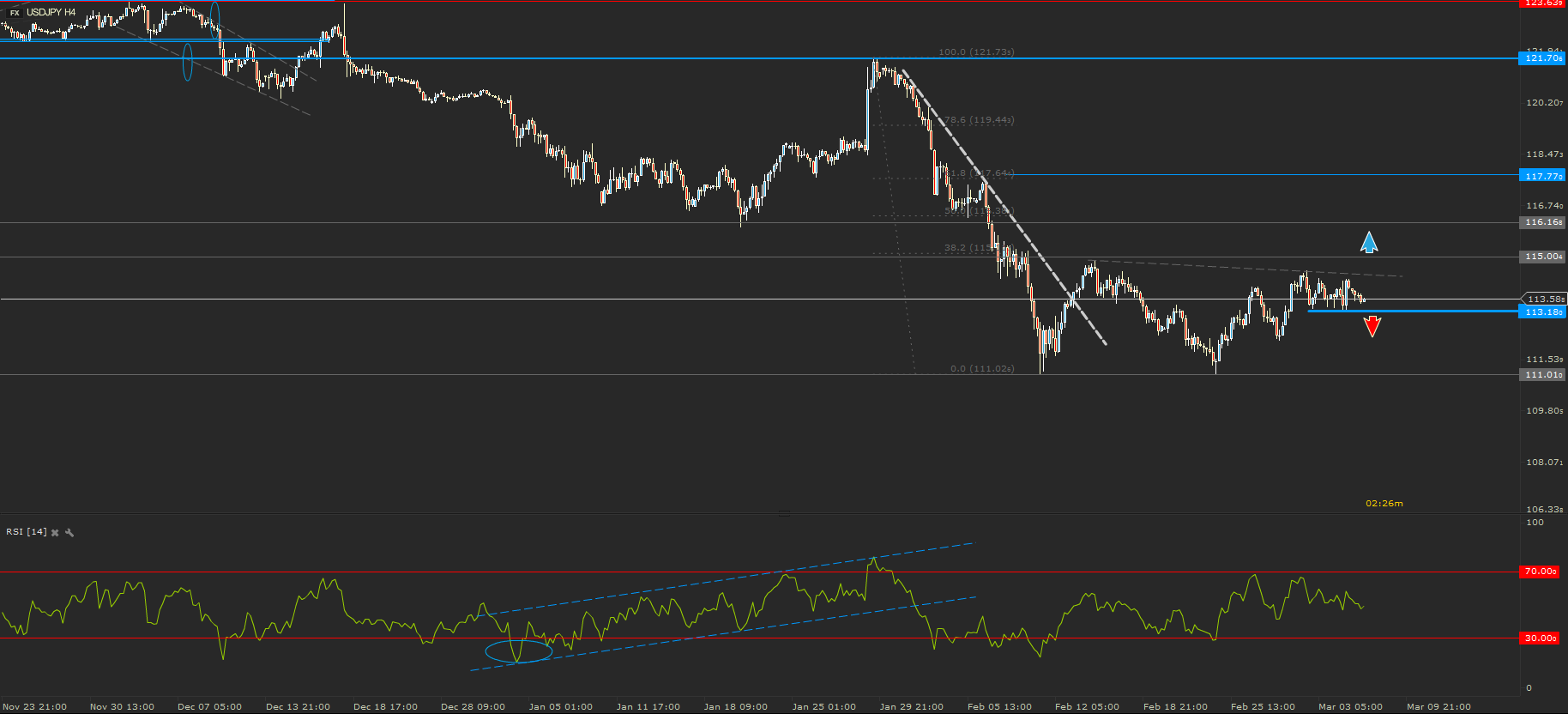

USDJPY – In a sideways move

Two weeks ago I was expecting the price of USDJPY to move sideways without proper fundamental incentives. Which actually happened. After another bounce from 111.00, the price moved towards 115.00 which did not reach until today.

A break below the local support from 113.18 would signal a drop back towards the main support from 111.00. On the other hand, a break above 115.00 resistance, would signal a possible rally towards 116.00, or even higher towards 117.00.

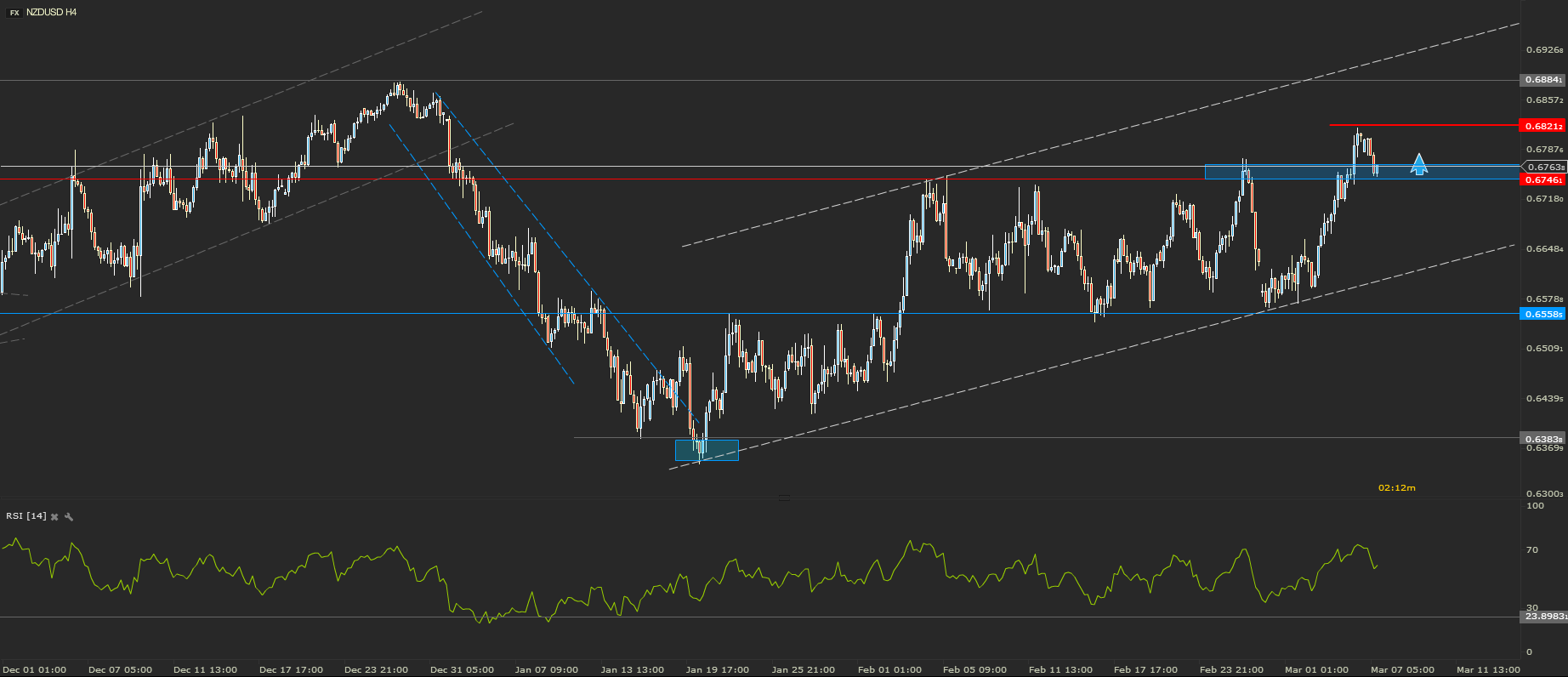

NZDUSD – On its way to 0.6900.

The price of kiwi dollar has broken twice the resistance from 0.6746. First time was a false break, which was followed by a plunge back to the key level support from 0.6558, while the second one was a strong break which triggered a rally stopped only at 0.6820.

Currently the price retested 0.6746 as support. I am expected a bounce to start and trigger another rally which, this time, would get the price above 0.6850, targeting 0.6900. A strong break below 0.6700 would infirm my current theory.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.