Weekly outlook and review: US Dollar at a crossroads

The surge in US government bond yields underpinned the US dollar last week, with the buck adding three-tenths of a per cent and clocking a four-week high. Recent USD performance weighed on commodities and major US equity benchmarks; the S&P 500 fell -2.3% and snapped a three-week winning streak. The announcement from the US Treasury that it would increase its borrowing over the coming months, i.e., increase bond issuance, and Fitch’s downgrade of US debt, led US yields higher, which was also bolstered by Wednesday’s stronger-than-expected ADP employment release.

Cyclical and safe-haven currencies were underwater; the Aussie dollar erased -1.2% against the dollar, while the Japanese yen and Swiss franc shed -0.4%. Europe’s shared currency wrapped up the week unchanged, and sterling fell -0.8% versus the dollar, touching a low of $1.2620 on Thursday after the Bank of England (BoE) increased the Official Bank Rate by 25bps to 5.25%, as expected.

Friday’s US employment situation report revealed that growth in non-farm jobs slowed more than expected in July, adding 187,000 new payrolls (vs. 200,000 expected and largely falling in line with June’s downwardly revised 185,000 number [May’s release was revised lower to 281,000]). While this exhibits signs that the Fed’s policy tightening is beginning to have an effect, the US unemployment rate dipped to 3.5% (down from 3.6%), and wage growth came in hotter than expected at 4.4% on a YoY basis (MoM saw 0.4% wage growth versus 0.3% expected). So, while the headline number shows signs of slowing, wage growth might concern the Fed, but overall, recent data helps support the case for a soft landing. However, we have one more employment release ahead of the rate decision on 1 September.

Moving into the first full week of August, the dominant theme on the radar is July’s Consumer Price Inflation (CPI) release from the US on Thursday at 12:30 pm GMT. After easing to levels not seen since early 2021, economists estimate that YoY headline inflation will increase to 3.3% in the twelve months to July, up from 3.0% in June, with the core reading—excluding food and energy prices—anticipated to slow by 0.1 percentage point to 4.7% for the same period. On a MoM basis, the headline and core readings are expected to increase by 0.2%. A lower-than-expected number will strengthen the likelihood of the Fed pausing at its next meeting and potentially weigh on the US dollar. At the same time, an upside surprise in this week’s inflation numbers could bolster the dollar and US yields, and pressure stocks lower as investors forecast an increase in the Fed Funds rate.

PPI (Producer Price Index) inflation is also scheduled on Friday at 12:30 pm GMT. YoY headline inflation will increase to 0.7% in the twelve months to July, up from 0.1% in June, according to economists’ forecasts, and the core reading—excluding food and energy prices—is anticipated to slow to 2.3%, down from 2.4% for the same period. Both MoM readings are expected to increase by 0.2%.

Another key release this week will be the UK’s preliminary growth data (first estimate) on Friday at 6:00 am GMT, expected to reveal no growth in Q2 (2023), according to median estimates from economists. As of writing, the event’s forecast range is between 0.2% and -0.1%.

G10 FX (5-day change)

Charts: TradingView

Technical view: Markets to watch for the week ahead

Currencies

US Dollar at a crossroads

The US dollar remains at a technical crossroads, with last week finishing considerably off best levels (+0.3%).

Price action on the monthly chart shook hands with support from 99.67 (complemented by two neighbouring Fibonacci ratios [38.2% and 61.8%] at 98.72 and 98.95, respectively) last month and staged a recovery. Adding to this, the monthly scale reveals that price action has been northbound since bottoming in 2008 at 70.70 if one focusses on the longer-term swings. Q4 (2022), as you can see, printed a noteworthy correction from 114.78 (from channel resistance), which remains active in 2023. Consequently, this timeframe remains USD positive in the longer term (unless we explore space beneath 98.72).

Predictably, due to the fractal nature of the markets, the Q4 (2022) correction on the monthly chart has displayed a visible downtrend on the daily chart, which also remains active. As evident from the daily timeframe last week, the unit whipsawed north of its 50-day simple moving average at 102.38 (as of writing) and crossed swords with an AB=CD bearish pattern from 102.65 (denoted by a 100% projection that’s situated a touch under resistance at 102.92). When using the AB=CD pattern, it’s common to set downside targets based on the 38.2% and 61.8% Fibonacci retracement ratios of legs A-D, which correspond to 99.59 and 102.84. Specifically, these targets are at 101.59 and 100.82, respectively.

It’s important to note that sellers appeared on Friday, suggesting a sell-on-rally approach in line with the current downtrend on the daily chart. Although the monthly timeframe suggests buyers could pursue higher levels in the longer term, the downside support targets derived from the daily chart’s AB=CD formation are still likely to be achieved in the short term this week.

Charts: TradingView

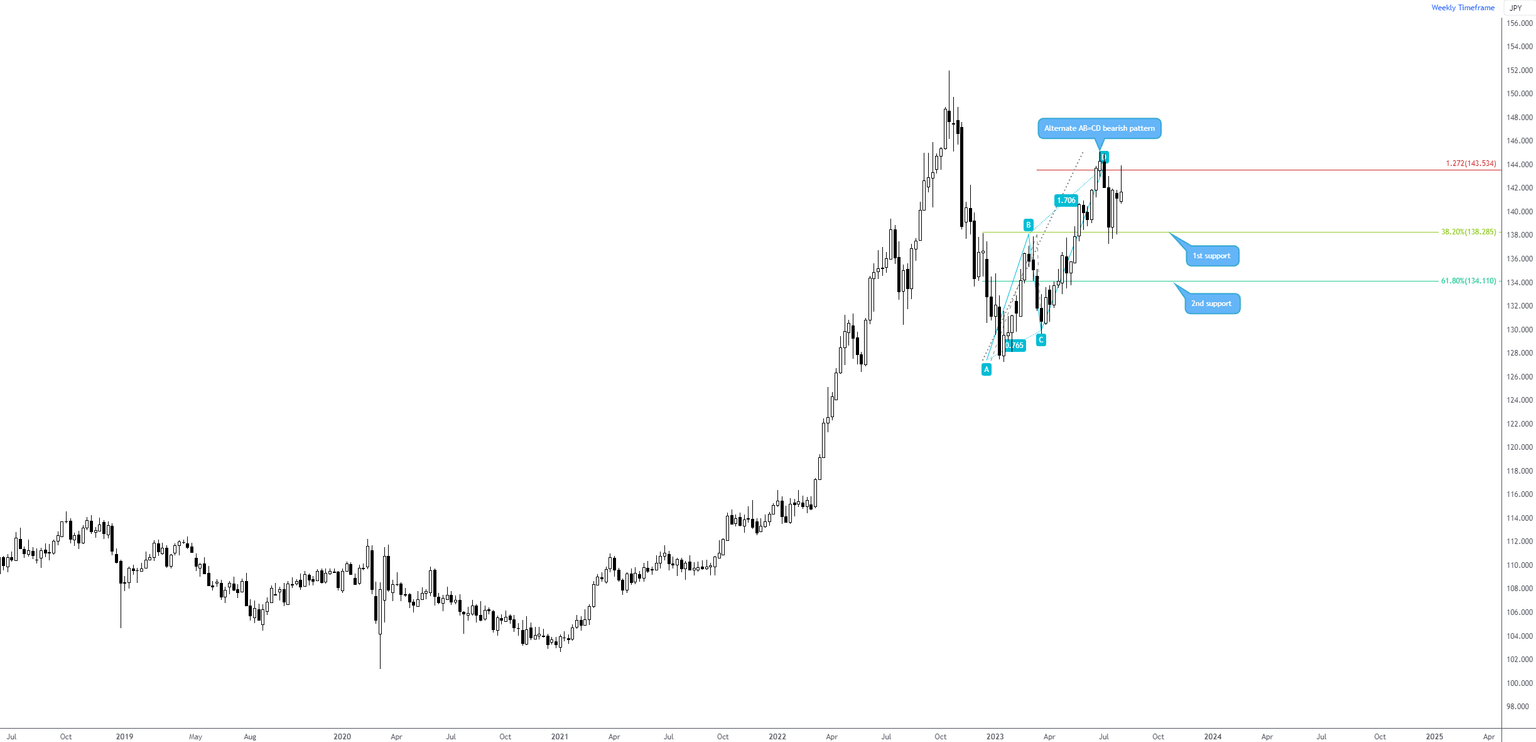

USD/JPY rejecting harmonic resistance

The USD/JPY—up +0.4% last week—is a currency pair the Research Team watched closely in recent days and for good reason. The Team released a post on Thursday, identifying weekly price challenging an ‘alternate’ AB=CD bearish formation at ¥143.53 (1.272% Fibonacci projection ratio) for a second time after testing the first downside support target at ¥138.29 (usually set to the 38.2% Fibonacci retracement ratio derived from legs A-D). Typically, traders are unlikely to be willing to short ¥143.53 again, especially after testing the first downside target. Still, in view of the daily timeframe pencilling in an ‘alternate’ AB=CD bearish formation (1.272% Fibonacci projection ratio) at ¥144.03, complemented by active daily resistance at ¥143.89, there remained a possibility that the market may still hold appeal for potential sellers.

As you can see, price did indeed sell off from the above-noted region in the second half of last week and concluded the week on the doorstep of testing the first downside support target on the daily chart at ¥141.33. Knowing that weekly price responded from its ‘alternate’ AB=CD structure again, breaching the first downside support target on the daily scale could unfold this week, consequently unmasking the second downside support target (usually set to the 61.8% Fibonacci retracement ratio derived from legs A-D) at ¥139.74 and tempting continuation selling.

Weekly chart

Charts: TradingView

Daily chart

Charts: TradingView

Commodities

Active support on XAG/USD following -2.9% fall last week

Daily timeframe

Spot silver in $ terms was a chart of interest in last week’s edition of The Pattern Pulse. The section for XAG/USD noted the following (italics):

XAG/USD stepped below two key levels of support at $23.98 and $24.10 yesterday, both of which are now marked as potential resistances. With the room available for price to target support between $23.09 and $23.31 and the Relative Strength Index (RSI) crossing under its 50.00 centreline (negative momentum), further underperformance could be seen, at least in the short term.

As seen from the daily chart of silver, the precious metal closed out the week bumping heads and recoiling from support between $23.09 and $23.31. In addition to this support structure (not highlighted in The Pattern Pulse) was the nearby ‘alternate’ AB=CD bullish formation at $23.15, depicted by a 1.618% Fibonacci projection ratio.

Based on current technical studies, despite the RSI reflecting negative momentum (< 50.00), there is scope to navigate higher on the daily chart for silver this week (at least in the short term), targeting resistance between $24.10 and $23.98.

Charts: TradingView

WTI Crude Oil testing major resistance; whipsaw eyed

Daily timeframe

Since March of 2022, the price of WTI crude oil has been steadily declining. Whilst not exhibiting a dominant downtrend, there is a discernible downward bias, particularly when assessing the weekly timeframe. However, this week’s attention is on the daily chart, showing that price finished the week testing (marginally breaching) resistance at $82.45, a level withstanding several upside attempts since late 2022.

With the Relative Strength Index (RSI) departing overbought territory (after testing levels not seen since early 2022), this could be another time sellers step in and defend $82.45. The caveat here, however, is that circling just above the noted resistance level is a 1.618% Fibonacci projection ratio at $85.49 (an ‘alternate’ AB=CD bearish pattern) and a 38.2% Fibonacci retracement ratio at $86.56, together with horizontal resistance at $86.36. This area of technical confluence may serve as a magnet to price and flush out a large chunk of sellers at current resistance (a stop-run, if you will) with a test of the $86.40ish region this week/month to potentially propel price back under $82.45, in line with the current downtrend.

Charts: TradingView

Equities

S&P 500: Dip buyers from daily support?

After chalking up a fifth consecutive month in the green (July +3.1%), aided by the Relative Strength Index (RSI) on the monthly timeframe rebounding from support between 40.00 and 50.00 (common in strong uptrends), the S&P 500 is fast approaching the all-time high at 4,818 set at the beginning of 2022.

Price action on the weekly timeframe recently connected with resistance at 4,595 and channel resistance drawn from the high of 4,100 and closed out the week snapping a three-week-bullish phase. Despite ending the week down -2.3% (its largest one-week decline since March), the index is unlikely to print much follow-through selling, given room seen to move higher on the monthly chart and current daily support (see below). Should we break north of the current weekly resistance, resistance calls for attention at 4,743, followed by the all-time high, while extending the recent correction swings the technical pendulum toward support at 4,325.

Across the page on the daily timeframe, support at 4,473 is likely to welcome price action this week, which is set north of the 50-day simple moving average at 4,406 (current). The support level and the monthly timeframe boasting space to move higher could attract dip-buyers into this market, targeting daily resistance from 4,578, closely shadowed by the weekly resistance highlighted above at 4,595. Ultimately, though, medium-term longs in this market will look for the unit to dethrone the weekly resistance and refresh YTD highs.

Charts: TradingView

Cryptocurrencies

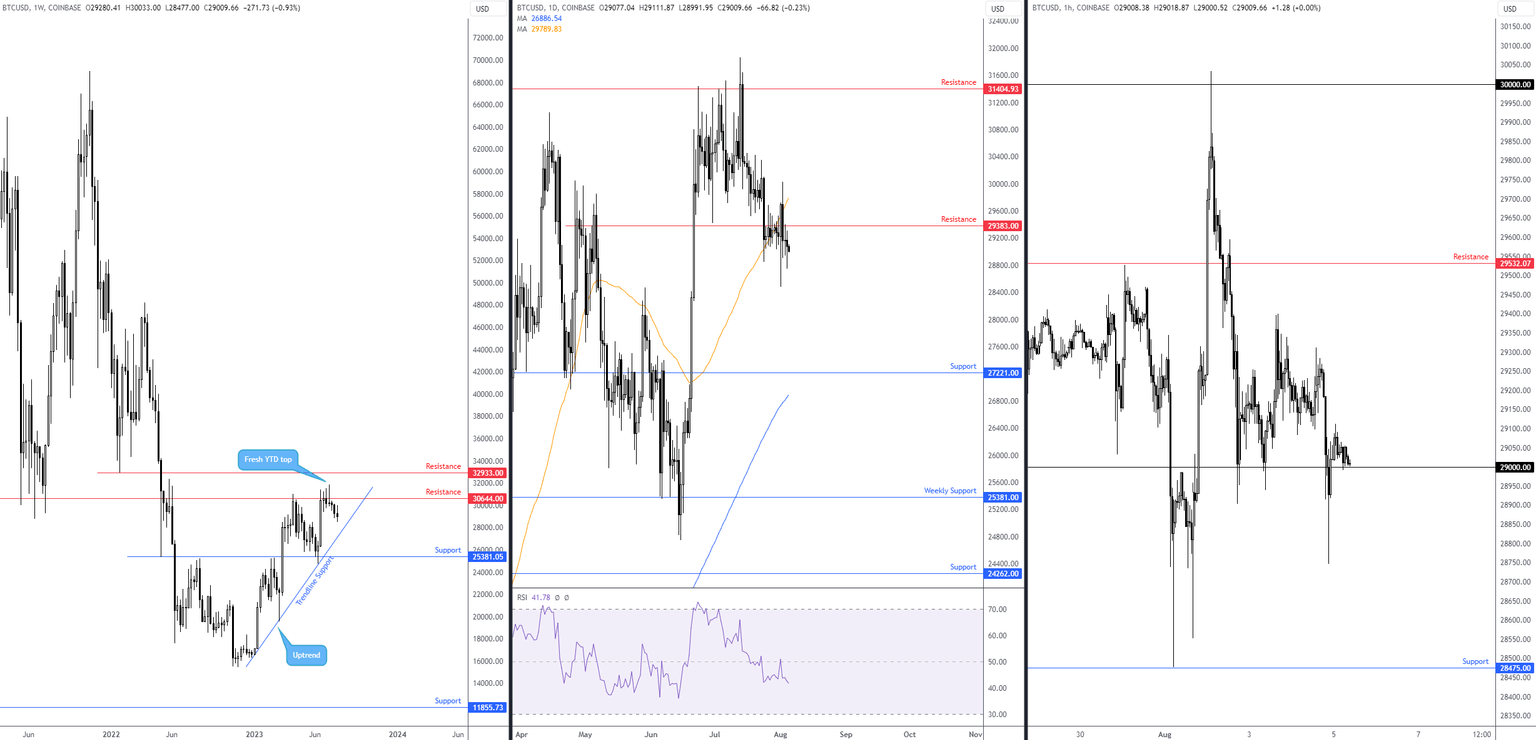

BTC/USD vulnerable to the downside

It was a subdued week for Bitcoin. Against the greenback, we ended Friday down around -0.8% and formed a weekly indecision candle. While these individual candlestick formations can reveal exhaustion, particularly after a moderate down move from weekly resistance at $30,644, the weekly chart indicates room to move lower until trendline support, taken from the low of $16,326.

Across the daily chart, the major cryptocurrency dipped under support at $29,383 and the 50-day simple moving average at $29,790 last week, unearthing a potential move as far south as support from $27,221. This is also supported by the Relative Strength Index (RSI) venturing beneath its 50.00 centreline (negative momentum).

From a short-term perspective, we have recently seen the price rebound from the $29,000 psychological level. Clearance of this level opens the door to support from $28,475, while any further upside on the H1 scale this week could see price target resistance at $29,532, with a break here exposing the widely watched $30,000 level.

In light of the weekly timeframe exhibiting scope to elbow lower until trendline support and room to manoeuvre below daily resistance from $29,383 towards support at $27,221, a H1 close under $29,000 may attract bearish players into the market to target at least H1 support from $28,475. Alternatively, a bullish push this week could see the unit retest the aforementioned daily resistance, which closely shares chart space with H1 resistance at $29,532. Therefore, sellers may also welcome this area if the unit pushes this week.

Charts: TradingView

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,