Weekly Market Brief: S&P 500 (SPX) has a possible recovery to at least 3,800

A week of strong declines that saw the main indices reach the lows of June 2022.

The strong downward extension suggests a short-term recovery: looking at specific indicators such as S5FI we are now in an area of extreme oversold.

DXY and US10 are very extended to the upside and their possible retracement could give the markets upside momentum.

|

Financial index |

Current price* |

Forecast |

S1 |

R1 |

S2 |

R2 |

|---|---|---|---|---|---|---|

|

FTSE100 |

6,858 |

Cons./ Bullish |

6,850 |

7,200 |

6,700 |

7,400 |

|

FTSEMIB |

20,930 |

Cons./ Bullish |

20,700 |

23,650 |

20,000 |

25,000 |

|

DAX40 |

12,437 |

Cons./ Bullish |

12,200 |

13,600 |

11,500 |

14,000 |

|

S&P 500 |

3,583 |

Cons./ Bullish |

3,550 |

3,900 |

3,400 |

4,100 |

|

NASDAQ 100 |

10,692 |

Cons./ Bullish |

10,400 |

12,000 |

10,000 |

12,700 |

|

DOW JONES |

29,635 |

Cons./ Bullish |

29,170 |

32,000 |

28,150 |

33,250 |

|

TADAWUL |

11,421 |

Consolidation |

11,250 |

12,270 |

10,900 |

12,650 |

|

FTSE ADX |

9,776 |

Cons./ Bullish |

9,615 |

10,200 |

9,160 |

10,500 |

|

DFM |

3,376 |

Cons./ Bullish |

3,270 |

3,500 |

3,100 |

3,730 |

|

Indicator |

Current price |

Forecast |

S1 |

R1 |

S2 |

R2 |

|---|---|---|---|---|---|---|

|

VIX index |

32.01 |

Cons./ Bearish |

20.00 |

35.00 |

11.00 |

41.00 |

|

US dollar index (DXY) |

113.298 |

Cons./ Bearish |

105.00 |

110.50 |

103.00 |

114.00 |

|

US10 years yield |

4.022% |

Cons./ Bearish |

2.900% |

3.500% |

2.500% |

3.650% |

|

S5FI* |

10.95 |

Cons./ Bullish |

40 |

80 |

30 |

90 |

Following the strong selling pressure that have just occurred, we believe it is appropriate to evaluate long positions: the strong bearish extension certainly does not exclude further declines, but we believe that the risk /reward is now very unbalanced and in favour of short-medium term rises.

FTSE 100 (UKX)

The FTSE100 index had a week down by - 1.89%

For the week ahead, we are in favor of a recovery to at least 7,150

Indicators

Week of further declines for the British index which saw the 6.700 area tested for the first time since March 2021.

The strong volatility of the last two days gives us little direction in the short to medium term and it is appropriate to wait for the price to consolidate.

At the moment we see two possible scenarios: the first sees a possible consolidation in the large area between 6,700 and 6,900 followed by a break to the upside at least up to 7,200. This hypothesis is supported by a slowdown in the 9-day moving average (red line) and a strong downward extension within the Bollinger bands.

|

Current price |

Forecast |

S1 |

R1 |

S2 |

R2 |

|---|---|---|---|---|---|

|

6,858 |

Cons./ Bullish |

6,850 |

7,200 |

6,700 |

7,400 |

The second scenario, on the other hand, takes into account the fact that if the support at 6.700 does not hold, the index could quickly fall to 6.500: it is in fact in situations of strong oversold that specific supports may not hold the downward pressure.

MACD and RSI, both very extended to the downside, suggest a possible recovery of vigor: especially when compared to past levels. We carefully monitor the bearish trendline in place on the RSI, with a slight positive divergence with the lows of the beginning of September.

We remain neutral on the FTSE100 looking for a more stable price.

Support at 6,850.

Resistance at 7,200.

FTSEMIB (FTSEMIB)

The FTSEMIB index had a week up by + 0.14%

For the week ahead, we are in favor of a recovery to at least 21,700

Indicators

A week that could be defined as one of substantial consolidation for the Italian index, the strong area between 20,000 -21,000 seems to slowdown the strong downward pressure in place since the beginning of 2022.

Although the large volatility of the last two days gives little direction, we can see how the level of 20,000 coincides with the strong resistance between June - November 2020,

|

Current price |

Forecast |

S1 |

R1 |

S2 |

R2 |

|---|---|---|---|---|---|

|

20,930 |

Cons./ Bullish |

20,700 |

23,650 |

20,000 |

25,000 |

Second aspect, assuming a bearish channel in place since the beginning of the year, we note a continuous price action on the upper part of this channel: this could in fact give rise to possible break to the upside.

MACD and RSI are both positive: the first is close to a cross of its respective doing averages and the second is close to break the bearish trendline that started in August 2022.

We are positive on the FTSEMIB but expect to break out of the 21,500-22,000 level.

Support at 21,500.

Resistance at 23,650.

DAX 40 (DAX)

The DAX index had a week up by + 1.34%

For the coming week we are in favour of a possible recovery to at least 12,800

Indicators

Positive week for the German index which saw the price remaining above the support at 12,200.

Another positive indicator is the close above the 9-day average (red line) which could support the hypothesis of short-term rises. At the same time, given the Friday's price action, the beginning of the week could see a back-test of the support at 12,200.

|

Current price |

Forecast |

S1 |

R1 |

S2 |

R2 |

|---|---|---|---|---|---|

|

12,437 |

Cons./ Bullish |

12,200 |

13,600 |

11,500 |

14,000 |

MACD and RSI are both recovering, which is favourable for short to medium term upside potential.

We are positive on the DAX40 but look forward to a further test at 12,200 and / or break above 12,750. The trend is still strongly bearish and at the moment the price is only consolidating within the wide range between 11,800 - 12,750.

Support at 12,000.

Resistance at 13,600.

S&P 500 (SPX)

The S&P500 index had a week down by -1.55%

For the coming week we are in favour of a possible recovery to at least 3,800

Indicators

A week that saw the August's bearish trendline being once again respected: only its gradual break could lead us to look for medium-term rises.

The price is now at mid-2020 levels and a break of 3,500 could quickly lead the SPX to reach 3,400 - 3,300.

While the price action does not give us particular direction, the internal MACD and RSI indicators are slightly recovering and in positive divergence with the price. Especially the second broke the bearish trendline in place since August 2022.

|

Current price |

Forecast |

S1 |

R1 |

S2 |

R2 |

|---|---|---|---|---|---|

|

3,583 |

Cons./ Bullish |

3,550 |

3,900 |

3,400 |

4,100 |

We are positive on the S&P500 and await a consolidation above 3,700 as a possible break of the 3,500 level could quickly change the scenario in favour of further declines.

Support at 3,645.

Resistance at 4,100.

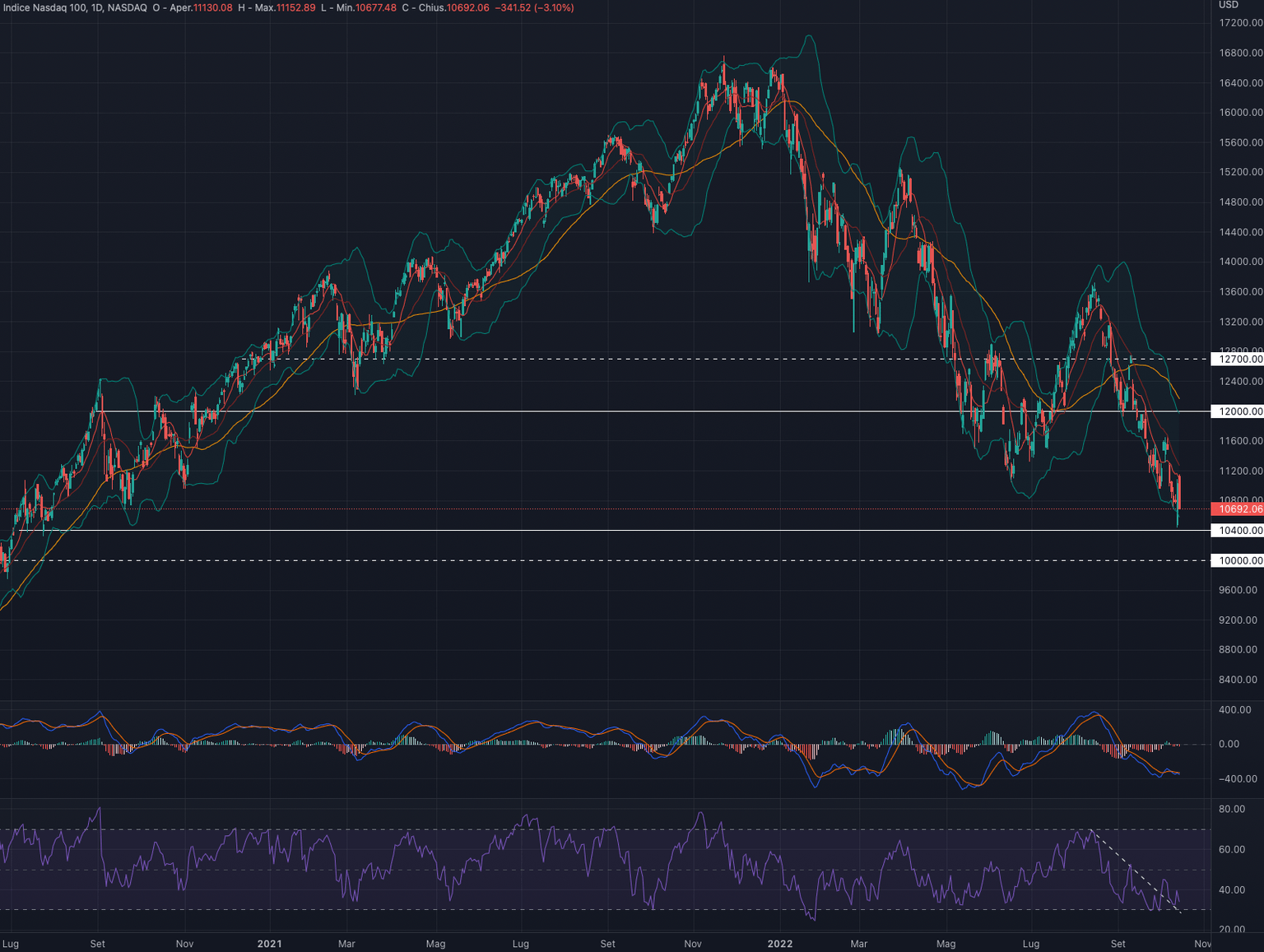

NASDAQ 100 (NDX)

The NASDAQ 100 index had a week down by -3.15%

For the coming week we are in favour of a possible recovery to at least 11,400

Indicators

Week that now sees the Tech index moving in the area tested in October 2021.

The declines continue to respect the bearish trendline started in August, where we see a price moving regularly between the bottom of the Bollinger band and the 9-day moving average (red line): as long as this scenario remains valid, the trend will continue to be on the downside.

|

Current price |

Forecast |

S1 |

R1 |

S2 |

R2 |

|---|---|---|---|---|---|

|

10,692 |

Cons./ Bullish |

10,400 |

12,000 |

10,000 |

12,700 |

Looking at previous swings, a consolidation above the 9-day moving average could be a good sign of price recovery.

The internal MACD and RSI indicators are slightly recovering and could support the index once it exceeds 11,200.

We are positive on the NASDAQ 100, also given the strong downward extension, but we prefer to wait for price confirmations.

Support at 10,400.

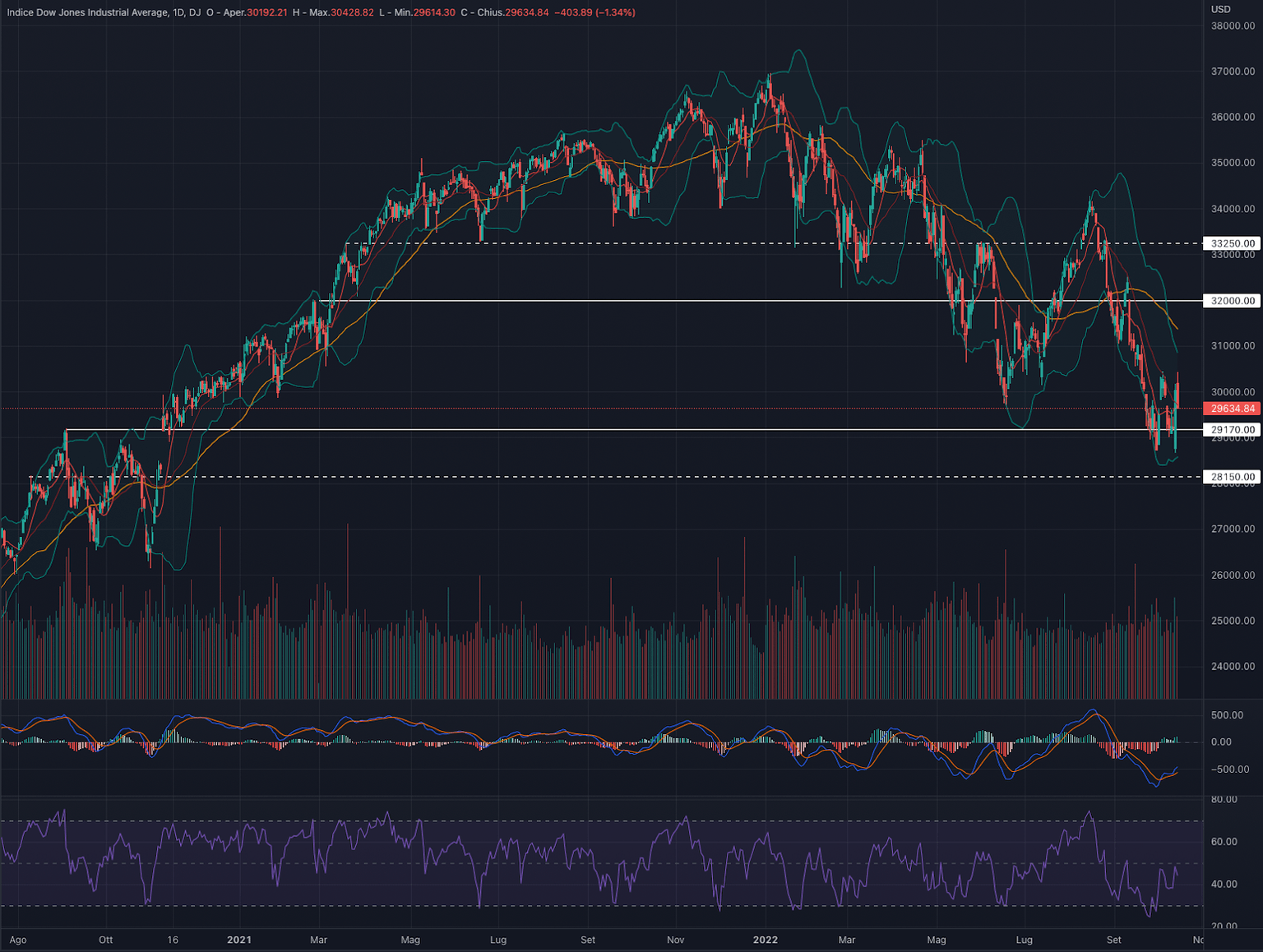

Dow Jones (DJI)

The DOW JONES index had a week up by + 1.15%.

For the coming week we are in favor of a possible recovery to at least 31,500.

Indicators

Positive week that seems to position the DJI towards possible short-medium term rises: after the strong falls in September, the index seems to consolidate in the wide area between 28.700-30.500 and only the break of one of the two levels will give us more information on the price action.

|

Current price |

Forecast |

S1 |

R1 |

S2 |

R2 |

|---|---|---|---|---|---|

|

29,635 |

Cons./ Bullish |

29,170 |

32,000 |

28,150 |

33,250 |

A bearish break of the 28,700 level could bring the index very quickly to the 27,000 level

MACD and RSI seem to suggest a bullish scenario, both finding themselves in a clear recovery and in positive divergence with the price action.

We are positive on the Dow Jones and ready to consider long setups in the event of a break to the upside.

Support at 29,170.

Resistance at 32,000.

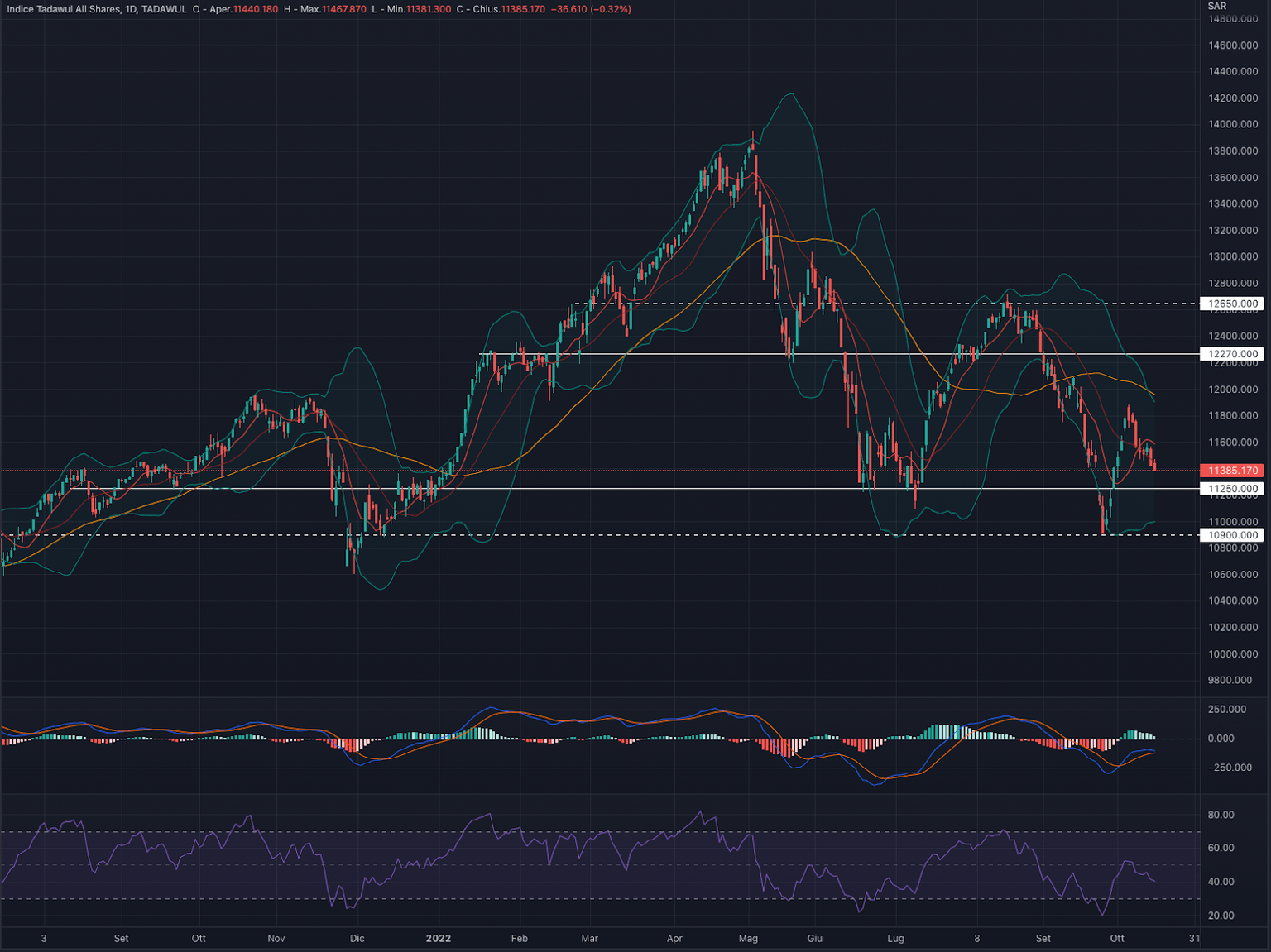

TADAWUL (TASI)

The TADAWUL index had a week down by -0.28%.

For the coming week we are in favour of a consolidation in the area of SAR 11,400 - 11,800.

Indicators

Week that saw the Saudi index dropping below the 9-day moving average (red line) and that leads us to a possible "risk off" mode

The key point will be to understand if the support at 11,250 can play the role of a reversal are a. MACD and RSI do not describe a positive scenario, as they are currently both slowing down and sharply decreasing compared to past weeks.

|

Current price |

Forecast |

S1 |

R1 |

S2 |

R2 |

|---|---|---|---|---|---|

|

11,421 |

Cons./ Bullish |

11,250 |

12,270 |

10,900 |

12,650 |

At the moment we prefer to remain neutral on the Tadawul to understand if the price will be able to consolidate in the area of 11,500 - 11,700: a similar scenario could in fact offer interesting long setups.

Support at 11,250.

Resistance at 12,270.

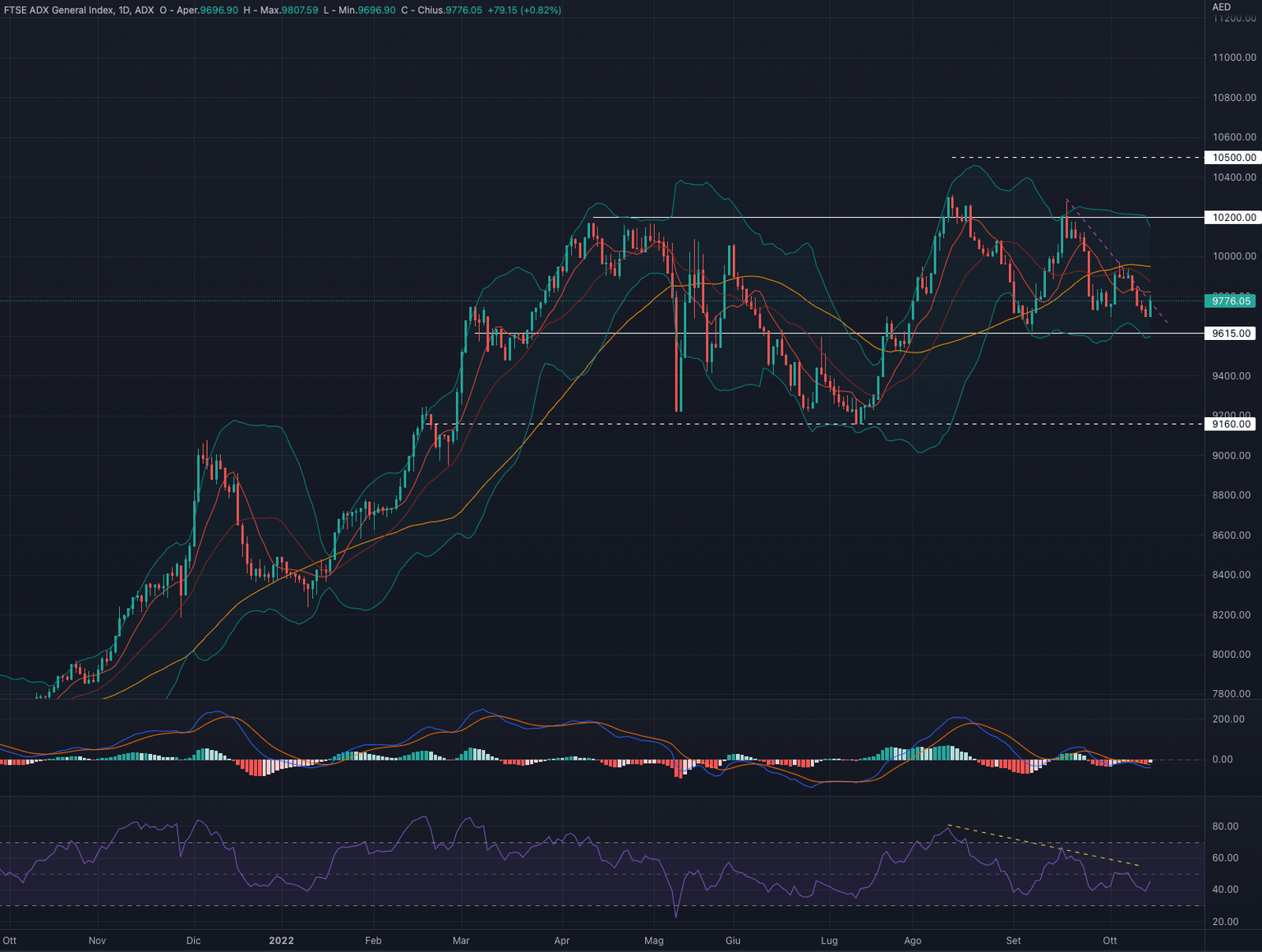

FTSE ADX GROWTH MARKET INDEX (FADGI)

The FTSE ADX index had a week down by -1.31%.

For the coming week we are in favor of a consolidation in the area of 9,900 - 10,115.

Indicators

Slightly bearish week that keeps the index near the strong resistance at AED 9,700

The trend reversal that took place in the final week is positive and could suggest a recovery at least up to the 50-day moving average (yellow line): confirmation would come only from an upward break in the bearish trendline that began in mid-September

|

Current price |

Forecast |

S1 |

R1 |

S2 |

R2 |

|---|---|---|---|---|---|

|

9,776 |

Cons./ Bullish |

9,615 |

10,200 |

9,160 |

10,500 |

MACD and RSI appear to be in favor of a resumption of strength but are both currently in bearish territory.

At the moment we prefer to remain neutral on the FTSE ADX: while the mere price action is very positive, we believe that some internal indicators may signal a possible short-term weakness.

Support at 9,615.

Resistance at 10,200.

DUBAI Financial Market General Index (DFMGI)

The DFM index had a week up by + 0.11 %%.

For the coming week we are in favor of a consolidation in the area of AED 3,350 - 3,400.

Indicators

Consolidation week that seems to position the index towards short to medium term rises.

The 50-day moving average (yellow line) is in fact playing the role of moving resistance and its exceeding could lead to interesting extensions.

|

Current price |

Forecast |

S1 |

R1 |

S2 |

R2 |

|---|---|---|---|---|---|

|

3,376 |

Cons./ Bullish |

3,270 |

3,500 |

10,900 |

12,650 |

MACD and RSI describe an encouraging scenario with the former close to a crossing of the bullish averages and the latter, above the 50 level.

We are positive on the DFMGI and identify 3,500 as a short term target.

Support at 3,270.

Resistance at 3,500.

Author

Francesco Bergamini

OTB Global Investments

Francesco, BSc Finance and Msc in Business Management, graduated with Merit, is a professional with experience in the financial services industry and a keen interest in the financial markets.