Weekly FX Chartbook: Powell keeps the door for 50bps rate cut open

Key points

-

USD: Downside bias could extend, if risk sentiment continues to hold up.

-

EUR: Inflation print is unlikely to bring aggressive rate cut expectations.

-

JPY: Three-legged tailwinds from hawkish Ueda, dovish Powell and Mideast escalation.

-

GBP: Nothing in pipeline to question BOE’s cautious easing stance.

-

AUD: CPI and retail sales to test RBA’s rate cut delay resolve.

-

CAD: BOC rate cuts could remain relatively more aggressive.

USD: Powell keeps the door open to 50bps cut

The U.S. dollar was the weakest performer in the G-10 forex space last week, As Fed Chair Powell delivered another policy pivot at the Jackson Hole conference. Powell’s message that the ‘time has come’ for rate cuts provided greater conviction to the markets on a September rate cut. More importantly, he did not close the door for even a 50bps rate cut as he avoided the more careful words used by other Fed members last week hinting at more ‘gradual and ‘methodical’ easing. Chair Powell’s speech also showed greater sensitivity to labour market weakness, in an effort to ensure a soft-landing, suggesting that any further rise in unemployment rate could keep the markets hoping for a 50bps rate cut in September.

This makes the second estimate of Q2 GDP and initial jobless claims (both due Thursday) the key metrics to watch this week. While core PCE deflator remains the Fed’s preferred inflation gauge, the Fed is currently more focused on growth metrics than inflation. This suggests that any upside surprise in core PCE will have to be of significant magnitude to re-ignite inflation concerns.

While the door remaining open to larger Fed rate cuts could mean further US dollar downside this week, there are a few other critical factors to watch, including:

-

Nvidia’s earnings remain key for overall risk sentiment that continues to hint towards a soft landing for now. However, any risks of pullback in demand or spending on AI could trigger a sharp reversal in risk sentiment, fueling gains in the US dollar.

-

Risks of an escalation in geopolitical tensions also remains a key barometer of risk sentiment.

-

The CFTC positioning data showed massive selling in the US dollar during the week of August 20, signaling room for short-term consolidation.

-

Month-end demand for the US dollar could also underpin.

EUR: Aggressive rate cuts remain unlikely

The euro has remained remarkably resilient last week despite the dismal PMI numbers from Germany. This is clear proof that unlike the Fed, markets remain more concerned about inflation and wage dynamics in the Eurozone rather than the growth dynamics for now. While the ECB’s measure of negotiated wages did show a slowdown from 4.7% to 3.6% in Q2, the German wage data painted a more concerning picture suggesting that inflation may remain elevated for some time.

Markets are seemingly comfortable expecting less than 25bps of rate cut at the ECB’s September meeting, and less than three full rate cuts priced in for this year. Inflation data this week will have to show a significant upside or downside surprise for this to change. As such, the euro could remain a play on USD moves, rather than on ECB policy expectations for now.

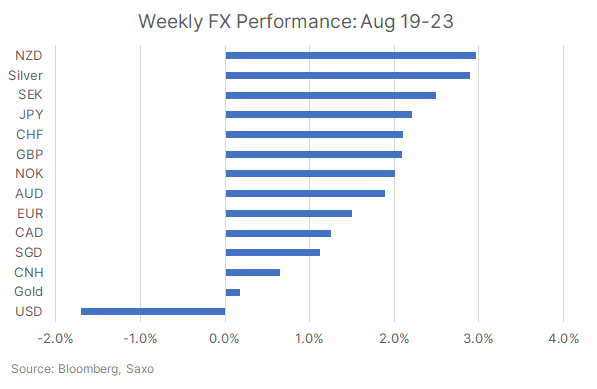

The US dollar pushed to fresh lows last week as Powell out-doved the markets. Sustained soft-landing hopes propelled NZD and SEK while AUD and CAD underperformed. Silver outperformed Gold.

Our FX Scorecard saw bearish momentum on the US dollar could have more legs. Meanwhile, SEK momentum could turn bearish after the Riksbank rate cut last week, while bullish momentum is sustained in JPY and NZD.

The CFTC positioning data for the week of 20 August saw massive USD selling by speculators and net long positioning down 56% to its lowest since March 2024. The euro and sterling longs built further but yen longs remained stable. Meanwhile, short positions were added to CHF.

Read the original analysis: Weekly FX chartbook: Powell keeps the door for 50bps rate cut open

Author

Saxo Research Team

Saxo Bank

Saxo is an award-winning investment firm trusted by 1,200,000+ clients worldwide. Saxo provides the leading online trading platform connecting investors and traders to global financial markets.