Weekly FX chartbook: Policy divergences remain in the driving seat

Key points

-

USD: Fed speakers, including Powell, Williams and the dissenter Bowman on tap.

-

JPY: Sell on rallies likely as both safe-haven trade and policy divergence theme on the backfoot.

-

AUD: RBA’s relative hawkishness, soft-landing and China stimulus could paint a bullish picture.

-

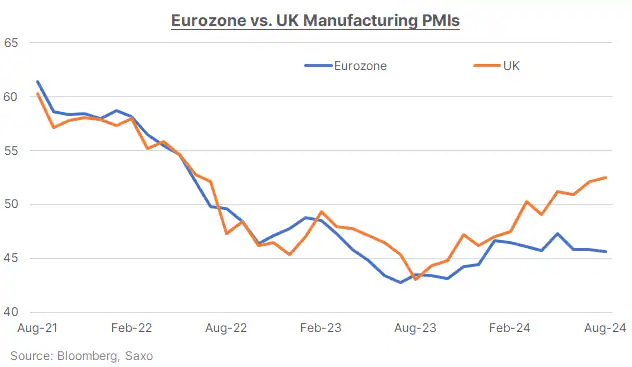

EUR/GBP: PMI divergence in focus.

-

CNH: China’s economic weakness and Fed’s jumbo cut provide room to ramp up stimulus.

-

Gold: Strong momentum, but be wary of profit-taking.

AUD: RBA has room to stay hawkish

The Reserve Bank of Australia (RBA) is widely expected to keep rates unchanged at their upcoming meeting, as inflation remains elevated and the case for easing is weak. Although July’s headline inflation figure of 3.5% seems close to the RBA’s target of 2-3%, the decline from 3.8% was mainly due to temporary electricity rebates. Inflation could soon fall into the 2-3% but this does not seem to be coming from underlying demand cooling. Q2 GDP growth also showed weaker-than-trend growth, largely due to softening household consumption, while government spending remained resilient. However, the RBA continued to see the labour market remaining tight, with vacancies, unemployment, and hours worked still at healthy levels.

Despite this, markets continue to price in a rate cut this year, even though the RBA has been pushing back on such expectations. The Fed’s large rate cut has increased speculation that the RBA may be forced to follow suit sooner than anticipated. However, the RBA is likely to stick to its hawkish stance for now, aiming to keep inflation expectations anchored. A potential pivot may come only at the November 5 meeting at the earliest, depending on further labor market data and the Q3 CPI report.

The Australian dollar stands to benefit in the near term from a soft-landing scenario, the RBA’s relative hawkishness, and additional stimulus measures from China.

EUR/GBP: PMI Divergence in focus

The pound has shown strong performance against the euro this quarter, with EURGBP now trading below the key 0.84 level that has held since 2022. This reflects the diverging economic outlooks and policy approaches between the Eurozone and the UK. Both regions are set to release flash PMIs for September on Monday, and the contrast in manufacturing performance is evident, especially as the UK's momentum has outpaced that of the Eurozone, particularly Germany.

The ECB has already cut rates twice in this cycle, but persistent inflation and a rapidly slowing economy—especially in Germany—are making policymaking challenging. Markets are pricing in an additional 40bps of easing by year-end, with little resistance from ECB officials. In contrast, while the Bank of England began easing in August, its stance remains cautious. Services inflation in the UK is still above 5%, and economic growth remains steady. Governor Andrew Bailey has emphasized that any rate cuts will be gradual, with the need for policy to remain restrictive for an extended period.

Sterling's outlook is further supported by the global environment. With the Federal Reserve starting its rate-cutting cycle, the dollar could weaken, and the pound, with its higher beta, is well-positioned to benefit. This suggests further downside potential for EURGBP, with the April 2022 low of 0.8278 coming into focus.

Risk-on mood in FX markets saw activity currencies like NOK, AUD and GBP outperform while JPY and CHF underperformed. JPY weakness was accentuated by BOJ's dovish turn.

Our FX Scorecard shows bullish momentum increasing in precious metals and sterling. Momentum skewed negative for JPY and CHF, and also turning bearish for SEK with the Riksbank meeting on tap this week.

The CFTC positioning data for the week of 17 Sept saw further short-covering in USD, mostly coming through longs being liquidated in GBP, EUR and more shorts being added to AUD. Meanwhile, further longs were added to JPY and shorts covered in CHF.

Read the original analysis: Weekly FX chartbook: Policy divergences remain in the driving seat

Author

Saxo Research Team

Saxo Bank

Saxo is an award-winning investment firm trusted by 1,200,000+ clients worldwide. Saxo provides the leading online trading platform connecting investors and traders to global financial markets.