Weekly FX chartbook: Labor data holds the key to size of Fed’s rate cut

Key points

-

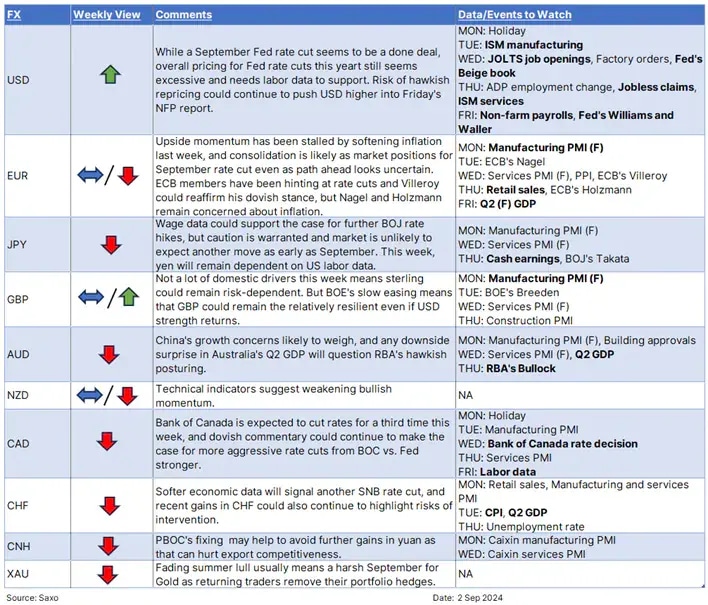

USD: Market’s aggressive rate cut pricing sees the labor data test.

-

EUR: Range play to remain as September rate cut looks certain, but path ahead still debated.

-

JPY: Cash earnings could support the case for more BoJ rate hikes, but urgency unlikely.

-

AUD: GDP risks questioning RBA’s hawkish stance.

-

CAD: BoC expected to cut rates again this week.

-

CNH and CHF: Recent gains could make authorities uneasy.

USD: Sharp speculator selling faces the labor market test

Last week’s Core PCE data came in line with expectations, showing a 0.2% MoM increase in July, which matched both the prior month and the expected figures. The unrounded number eased slightly to 0.1611% from the previous 0.1818%, signaling ongoing disinflation. The YoY Core PCE rose by 2.6%, slightly under the 2.7% forecast. This report reaffirms that disinflation remains on track, offering the Fed room to begin the easing cycle. However, the pace of rate cuts remains uncertain and could hinge more heavily on this week's labor data, especially the upcoming non-farm payrolls (NFP) report due on Friday.

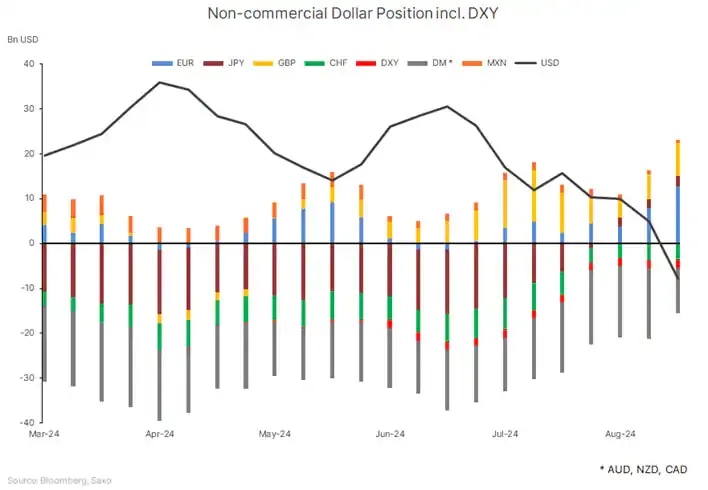

Speculative positioning has shifted to a net short in the week leading up to August 27 (see chart below), but the dollar could find support from geopolitical risks, US election uncertainty and the excessive Fed easing already priced in by the markets. This week’s overload of labor data, including JOLTS, ISMs, ADP, and NFP, will be crucial in breaking the debate between a 25 or 50 bps cut in September. If the data remains robust, a 25bps cut is more likely. However, a weak NFP, particularly if it falls below 130k with another jump higher in unemployment rate, could push the rates market closer to pricing a 50bps cut.

Additionally, Fed’s Williams and Waller are scheduled to speak on Friday, where markets will be looking for any hints on the Fed's thinking regarding the upcoming rate decision.

EUR: September rate cut looks certain, but uncertainty lingers beyond

Euro-area inflation softened further in the preliminary August report, with the headline figure at 2.2% YoY—the slowest since mid-2021—down from 2.6% in July. Core inflation also eased slightly to 2.8% YoY after three consecutive months at 2.9%. This cooling inflation could give the European Central Bank (ECB) room to cut rates at their upcoming meeting, although hot services inflation continues to make the path after the September meeting look highly uncertain and emphasizing the need for gradual easing.

ECB speakers are also generally hinting at a September rate cut, although some like Schnabel highlighted concerns about stalling service disinflation. Rehn pointed out that falling inflation and weaker growth support a September cut. Kazaks expressed openness to discussing policy easing in September, despite acknowledging sticky services inflation, and Muller indicated growing confidence in a September cut. Villeroy suggested that victory over inflation is within sight, making a September cut "fair and wise," though growth risks remain. Despite this broad consensus, this week’s ECB speakers have shown a more hawkish tilt, with Nagel and Holzmann expressing concerns about inflation, while Villeroy remains more open to a rate cut.

Speculators have responded by adding to long euro positions, pushing net long positioning to the highest levels since January. As the market anticipates further clarity on the ECB’s policy trajectory beyond September, the euro is likely to trade within the 1.08-1.12 range.

CAD: BoC set to cut rates despite stronger GDP

The Bank of Canada (BoC) is expected to cut rates by 25 basis points at its meeting on Wednesday. While Q2 GDP growth exceeded expectations at 2.1% annualized (compared to the 1.8% forecast and the central bank's 1.5% projection), the details were less encouraging. Growth was flat month-over-month, with much of the increase driven by population growth and government spending rather than underlying economic strength. Households are feeling the pressure from high interest rates, as evidenced by the slowdown in household spending to just 0.2% in Q2, down from 0.9% in Q1. Government spending, particularly on higher wages, was the primary driver of Q2 growth, surging by 11% annualized. Given these weak underlying details, the BoC is likely to look past the headline GDP strength and proceed with the expected rate cut.

Later this week, the focus will shift to the Canadian employment report on Friday, where the market expects 25,000 jobs to be added. However, the unemployment rate is anticipated to rise to 6.5% from 6.4% in July. From a fundamental perspective, yield differentials continue to point to further CAD weakness. On the technical side also, USDCAD bears appear to be losing momentum as the pair approaches the 1.34 level, with the RSI nearing oversold territory.

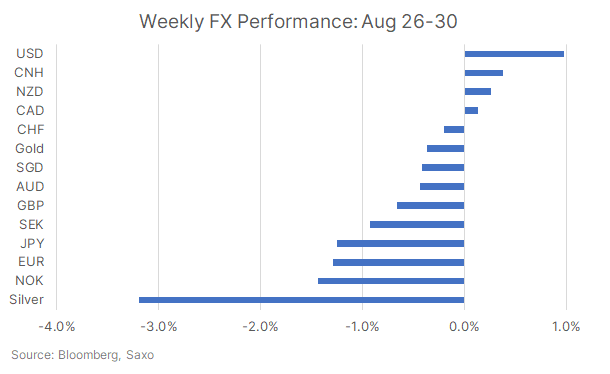

The US dollar recouped some of its recent losses as data did not yet support the case for a 50bps Fed rate cut in September. NZD and CAD outperformed in G10 with much easing priced in.

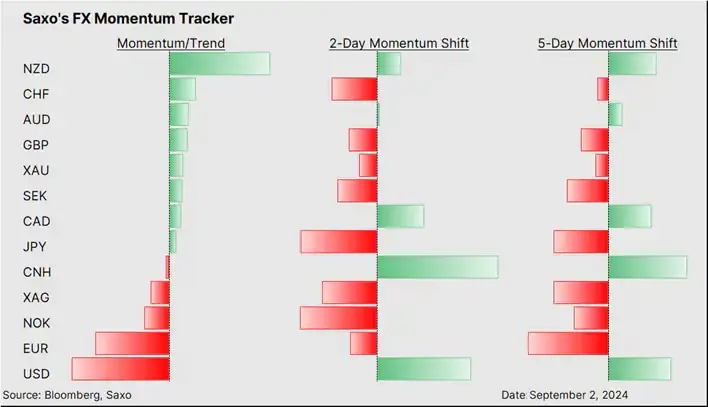

Our FX Scorecard saw bullish momentum in NZD fading but holding up in CAD. Bearish momentum is building in JPY and NOK.

The CFTC positioning data for the week of 27 August saw more USD selling by speculators and net positioning turning to a short for the first time since January. Massive longs added to EUR and short covering in CAD also extended further.

Read the original analysis: Weekly FX chartbook: Labor data holds the key to size of Fed’s rate cut

Author

Saxo Research Team

Saxo Bank

Saxo is an award-winning investment firm trusted by 1,200,000+ clients worldwide. Saxo provides the leading online trading platform connecting investors and traders to global financial markets.