Weekly FX chartbook: Case for outsized Fed cut bets to be tested

Key points

-

USD: Receding risks of a recession but stagflation fears could return.

-

JPY: US macro still remains the key driver.

-

GBP: Inflation uptick could support the case for delay in further BOE rate cuts.

-

AUD: RBA hawkishness could be questioned by labor data.

-

NZD: RBNZ rate cut is not fully priced in.

-

CNH: Economic activity underperformance likely to continue.

USD: Hot CPI could cool recession fears, but beware stagflation threats

Last week was a roller coaster for markets, but by the end of it, markets are still left guessing about whether the US economy is headed for a recession, as hinted by the uptick in unemployment rate, or could it still achieve a soft landing. We addressed this confusion in an article last week title ‘US Economy: Soft Landing Hopes vs. Hard Landing Fears’. This narrative will be put to test this week as a bunch of key economic data is on tap – PPI on Tuesday, CPI on Wednesday and retail sales on Thursday.

Headline CPI turned negative in June on a MoM basis and core came in at the slowest since August 2021 at 0.1%. Consensus expectations for July are at 0.2% MoM for both headline and core. This means there is a risk of an upside surprise, even though disinflation trends may continue. A hot print could mean the markets may be forced to take down the probability of a US recession, and pare the amount of expected rate cuts from the Fed at the next meeting which is currently priced in at 38bps. However, markets could quickly move from recession threats to stagflation fears if CPI turns out to be very hot.

Worth noting that it would be key to assess the totality of wholesale and consumer inflation data to imply where core PCE, Fed’s preferred inflation gauge, could land up later this month.

Also, consumer data remains a key focus to understand how fast the economy can slow. This makes Thursday’s retail sales quite key along with consumer corporate earnings from the likes of Home Depot (Tuesday) and Walmart (Thursday). On the labor market front, jobless claims on Thursday will again be a key watch.

GBP: Inflation uptick vs easing wage pressure

After being resilient since the start of the year, sterling has started to come under pressure after an interest rate cut from the Bank of England and easing of political worries in Europe. Stretched long positioning and correlation to global risk sentiment has also led to the British pound pulling back from its highs. However, rate differentials could be back in focus to support the pound in this data-heavy week.

UK’s Q2 GDP is likely to show a robust growth for the British economy. Inflation data, out on Wednesday, is expected to show an uptick as the impact of energy bills is phased out from the year-ago base. Key will be whether services inflation cools or not, and there could be some one-off impact from Swiftonomics. Consensus expects headline inflation to come in at 2.3% YoY in July from 2.0% in June with services inflation cooling to 5.5% YoY from 5.7% in June.

Meanwhile, Tuesday labour data is likely to show wage pressures are cooling and unemployment rate could rise further. This, together with softer services inflation, could continue to fuel rate cut bets for the BOE. Market currently sees less than 40% odds of a September rate cut from the central bank.

Source: Bloomberg

US data could also have implications for broader risk sentiment, and hence, on GBP. Any slippage in US CPI or retail sales could bring recession concerns back to the fore, which could prove to be a positive for GBP.

NZD: RBNZ rate cut delay could be difficult

New Zealand's unemployment rate rose to 4.6% in the second quarter, up from 4.3% in Q1. Although this increase was slightly better than economists' expectations of 4.7%, it clearly indicates a cooling labor market, with unemployment reaching its highest level in three years. This, coupled with softening inflation and declining economic activity in Q2, raises concerns about a potential contraction in the second quarter.

The Reserve Bank of New Zealand (RBNZ) now faces a critical decision: either initiate its rate cut cycle this week or risk being perceived as 'behind the curve.' At its July 10 meeting, the RBNZ adopted a dovish stance, and with growing calls for significant Fed rate cuts since then, there is a possibility the RBNZ may find justification for a rate cut. While there is a slight chance of a 50bps cut, a 25bps cut remains the most likely scenario. Markets have priced in a rate cut in August with about 70% probability, suggesting potential downside pressure on the NZD, particularly if the cut is accompanied by dovish language.

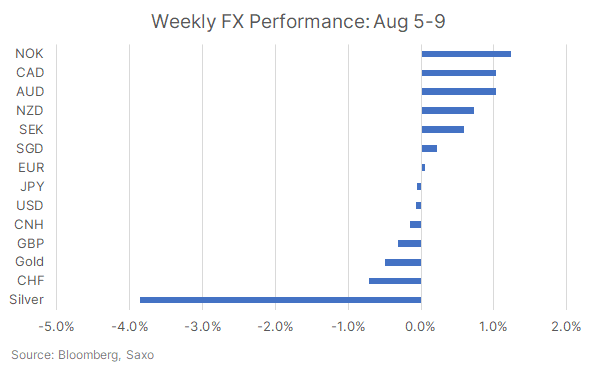

Fates of FX turned around in the turbulent week with JPY ending nearly unchanged and activity currencies coming on top as US recession bets were pared by end of the week after an initial jerk higher. NOK and CAD also supported by strong gains in oil prices.

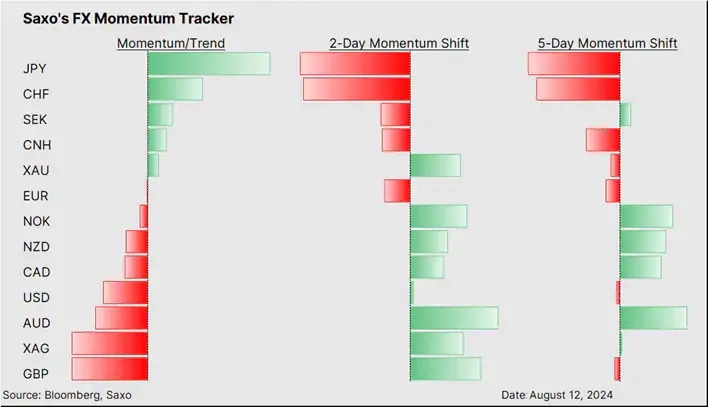

Our FX Scorecard saw Japanese yen's bullish momentum turning bearish again, while AUD's turned bullish.

The CFTC positioning data for the week of 6 August saw large speculator moves once again. The long positioning in US dollar was cut by 38% to $10.5 billion, led by demand for JPY where shorts were covered massively indicating the unwinding of carry trades. Shorts were also covered in CAD and CHF, while longs were added to EUR. Another notable positioning shift was in GBP where 37k short contracts were added.

Read the original analysis: Weekly FX chartbook: Case for outsized Fed cut bets to be tested

Author

Saxo Research Team

Saxo Bank

Saxo is an award-winning investment firm trusted by 1,200,000+ clients worldwide. Saxo provides the leading online trading platform connecting investors and traders to global financial markets.