Fundamental Forecast for Dollar: Bullish

NFPs are scheduled for release on Good Friday – key event risk stirring a key trend on a low liquidity day

After Yellen’s remarks, the focus intensifies on Fed timing with FF futures still dovish but swaps hawkish

Sign up for a free trial of DailyFX-Plus to have access to Trading Q&A's, trading signals and much more!

The Dollar came dangerously close to a nasty speculative spill this past week. While the medium-term fundamental picture supports the currency’s progress over its counterparts, there is enough evidence that the market has ran beyond its quantifiable advantage and is therby exposed to a rebalance. However, it seems to realize a correction in the Dollar’s incredible run, their needs to be a more motivated thrust for profit taking. Soon to close out a record nine consecutive month rally (on the ICE Dollar Index), we face a market more sensitive to week-to-week event risk and a docket that can strike exposed nerves.

Not all market movement must have an academic, fundamental reasoning. In a market derived from a variety of views and objectives, irrationality is unavoidable and pure speculative shifts is inevitable. Therein lies the Dollar’s greatest risk. It has plenty of theortecal advantages it can fall back on for its bullish bearing. Yet, it’s exceptional one-way drive has drawn in more than just the interest rate watchers. Speculators looking to ‘ride the wave’ have different mandates and risk profiles. They act on technical levels, hold no commitment to the long-term and are ready to bail when their profit draws down. For that reason, the distinct trend channel the Dow Jones FXCM Dollar Index (ticker = USDollar) has carved out in its impressive run looks like a moving cliff. Slipping into a dense nest of stops and short entry orders can result in the same tumble as a particularly bad piece of event risk.

With a ‘trader’s’ mentality in mind, bulls head into the new trading week with a little more breathing room. Fed Chairwoman Janet Yellen lended support to to the run in her Friday afternoon speech. As is her method, she offered enough balance to her comments to feed both a dove’s and a hawk’s convictions on where monetary policy is heading. Though potentially interpretive, Yellen remarked that they should not wait until they have returned to the 2 percent inflation target before they move. Given it takes time for policy to filter into the economy, that makes sense. However, from an investor’s perspective, this fits a concerted effort made by the central bank to ready the market for the inevitable – with heavy insinuation that it can happen earlier than many expect.

Indeed, when we look at what the market’s expectations for pricing in monetary policy paths, it is clear that there is plenty of room for adjustment on both sides. The Dollar is perhaps one of the most hawkish reflecting instruments, but that may be due in part to its exceptionally dovish counterparts (particularly the BoJ and ECB). On the other end of the spectrum, we find Fed Fund futures – specifically tailored to hedging rate forecasts – pricing the first hike way out into November and no follow up until March/April of next year. This is enough skepticism in the market that a steady march to mearly meet what is the consensus amongst analysts, economists and primary dealers can generate further Dollar gains.

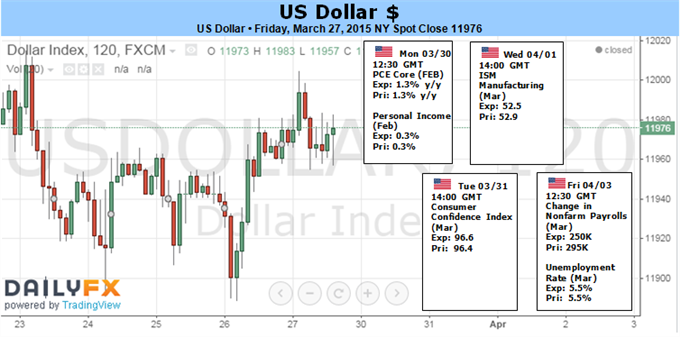

After the FOMC rate decision two weeks ago and Yellen’s remarks this past week, it is clear that the first hike is increasingly data dependent. That will emphasize the importance of significant fundamental developments in the rates picture. In the register of event risk, few items will outshine the BLS labor conditions report for influence. That said, the March update is due on Friday (Good Friday). From this data though, the wage growth report should be paid specific attention. This is the connection between labor growth and inflation. And, on the topic of inflation, the Fed’s preferred reading – the PCE deflator – is due on Monday. And, between those two high profile book ends, we have no fewer than 10 Fed speeches scheduled. This should be an interesting, speculative week.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund and function similarly to a traditional stablecoin.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.