Fundamental Forecast for Dollar: Neutral

The US Dollar has rallied for a record 11 consecutive weeks, and the quarter is on pace for a 7-year record

Fed forecasts have done much of the heavy lifting to this point, but risk trends are increasingly important

How do you incorporate fundamentals into your trading? Read our DailyFX Trading Guides to learn how

We are only a few days from the close of the US Dollar’s best quarterly performance since the third quarter of 2008 – at the height of the financial crisis. Back then, the greenback was charging higher as panicked investors were seeking haven for their capital. Few assets and region’s could offer the level of safety traders were seeking, and the world’s most heavily used reserve currency backed by the largest economy stood as a beacon of shelter. Yet, with the current 11-week rally – the longest on record – circumstances are much different.

Volatiltiy levels are close to record lows and investors are still more concerned about yield than they are safety. ‘Fear’ is all consuming and reinforcing, thereby making it a strong fundamental backbone for the currency. Is the dollar’s current drive as enduring? Are there other outlets of strength ready to supplement bulls’ ambitions?

To this point, there have been two primary motivators for the Dollar: rate expectations and the relative deterioration of its major counterparts. Between the two, exceptional weakness for the Euro, Yen , Australian and New Zealand dollars is responsible for the bulk of the USDollar’s 6.4 percent climb over the past two months. With the Eurozone facing economic headwinds and a increasingly desperate ECB, Japan keeping the course on its open-ended stimulus program, Australia suffering China’s managed economic moderation and the Kiwi reeling from rate expectaitons whiplash; there was a potent appetite for strength and stability.

The question moving forward is whether the most liquid counterparts to the dollar will continue to face hardship that redirects capital towards its borders. From an economic standpoint, a downturn in developed and developing world forecasts bolster the robust US outlook. The monetary policy contrast is similarly paced in the Dollar’s favor. While the timing and pace for the FOMC’s return to rate hikes is up for significant debate, even a period of basing would outweigh the active growth in accommodation by the Fed’s three largest counterparts: ECB, BoJ and the PBoC. That said, a considerable discount has been afforded to these imbalances. Further progress requires development of these concerns.

Though it may be in second place as market impetus, rate speculation has played a considerable role in the Dollar’s progress. The central bank has just this month reiterated a forecast that a first hike is likely to come in the middle of next year and further upgraded its expectations for the pace of tightening. Yet, on this point, there is room for confidence or doubt to seep in. Where the currency and medium-term Treasury yields (2-year) have advanced, other key market elements have rebuffed the scenario. Fed Funds futures – which are direct hedges to rate forecasts – are showing a dramatic discount to the Fed’s own forecasts. Meanwhile, the ‘low volatility/high risk exposure’ conditions derived from the current glut of stimulus, remain undisturbed.

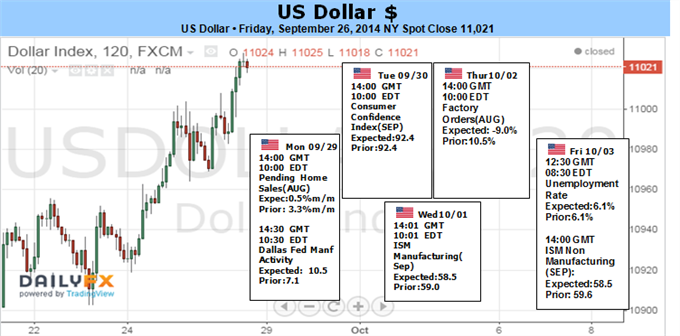

If there is one particular avenue of untapped potential that can most effectively charge the Dollar higher, it is a full-scale risk aversion – the source for the last rally of a comparable magnitude to this quarter. Volatility levels have not rocketed higher outside of the short-term build around scheduled event risk. However, there is a slow and steady build behind these measures. Volume has slowly started to pick up as well while tallies show capital outflows in riskier asset classes. This is an underlying current that will not shift all at once. That said, a sentiment change can carry the dollar much further than the other top fundamental themes. This week, the NFPs is top event risk, but Monday’s PCE inflation figure is just as important a factor in the Fed’s dual mandate – and thereby rate forecasting. If there is one outlet capable enough to unseat global risk trends, it may very well be monetary policy. – JK

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.