Recommendations:

Medium: Short the EURUSD at 1.3350, SL 1.3400, targets 1.330, 1.3150, 1.2800.

Risky: Short the USDJPY at 101.70, SL 102.50, targets 101.20, 100.50, 100.00.

Risky: Buy the USDJPY at 96.50, SL 95.70, targets 97.50, 99.00, 101.50.

Very Risky: Short the GPBUSD at 1.5450, SL 1.5510, targets 1.5400, 1.5200, 1.4850, 1.4250.

Analysis:

The giant money printing program unveiled by the Bank of Japan has been a major event last week, causing the USDJPY to fly swiftly +500 pips. The Euro also appreciated due to no interest rate cut by the ECB and some strong buying in EURJPY. We expect the USDJPY to continue to progress next week, however at a more moderate pace. The EURUSD should show some weakness in its upward march, and we would look for short entries. The US employment number have a mixed effect on the dollar: on one hand the unemployment figure went slightly down to 7.6% (a bit closer to the no-QE area of 6%) and on the other hand the job creation tumbled to 88k. If we have another month with NFP numbers below 50k, the chances of an increase in the QE flows of the fed become will become significant. The only significant event next is the FOMC meeting minutes which should be rather bullish for the USD since the meeting was held prior to the terrible NFP numbers of Friday. Finally, the SP500 remains silently stuck in the 1560 area

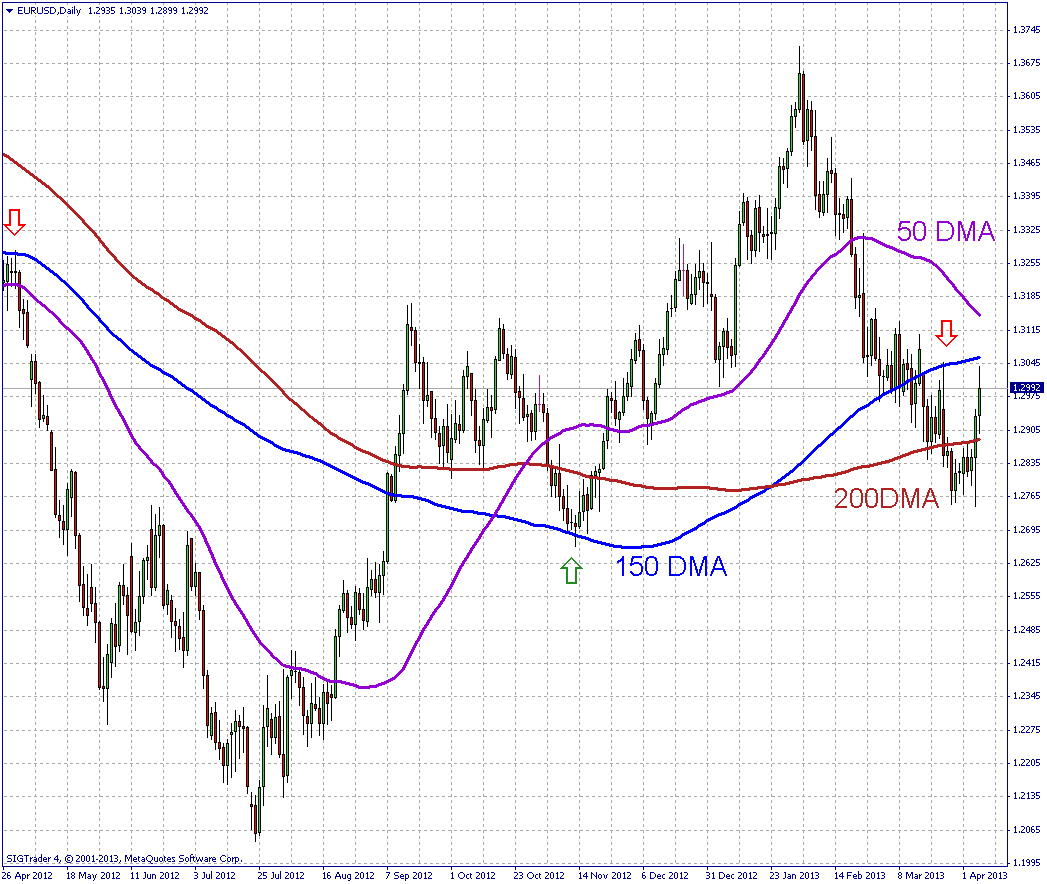

EURUSD: We doubt that the push higher in EURUSD will exceed 1.33, despite the uncertainty caused by low NFP numbers. We still think the trend is downside oriented in EURUSD, and we would look for a short entry around 1.3350 (61.8% Fibonacci retrace from 1.37 to 1.2750).

USDJPY: The massive money printing of the BOJ has taken the market by surprise. Next week we expect the USDJPY to test 100. A risky trade but possible would be to short the USDJPY above 101.50 next week, since this would be a very overbought level according to our mathematical models. Similarly risky and worth a try is to enter long at the previous highs around 96.50. With this BOJ easing, the trend for the yen is going to be more weakness in the coming weeks. The major trend line resistance comes now around 107.00

GBPUSD: The GBPUSD went up as we suggested last week and we are now very close to the decisive moment in this pair. Either we break above 1.54-1.55 and the trend becomes neutral. Or we fall heavily back below 1.50. A short entry is worth a try although we consider it very risky.

EURUSD Daily Chart

USDJPY Monthly Chart

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.