Week Ahead: Will ECB make a stand against rising yields? [Video]

![Week Ahead: Will ECB make a stand against rising yields? [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/european-union-currency-5219766_XtraLarge.jpg)

With bond markets going berserk lately, investors will turn to the European Central Bank meeting on Thursday. Some senior policymakers have been vocal about ‘fighting’ this rise in yields, but immediate action seems unlikely. Meanwhile, the Bank of Canada will have to play down a solid economy when it meets on Wednesday. In the US, inflation data could be crucial for the Fed narrative, though all eyes will be on Capitol Hill, where Biden’s relief package is about to pass.

ECB: This is a US problem

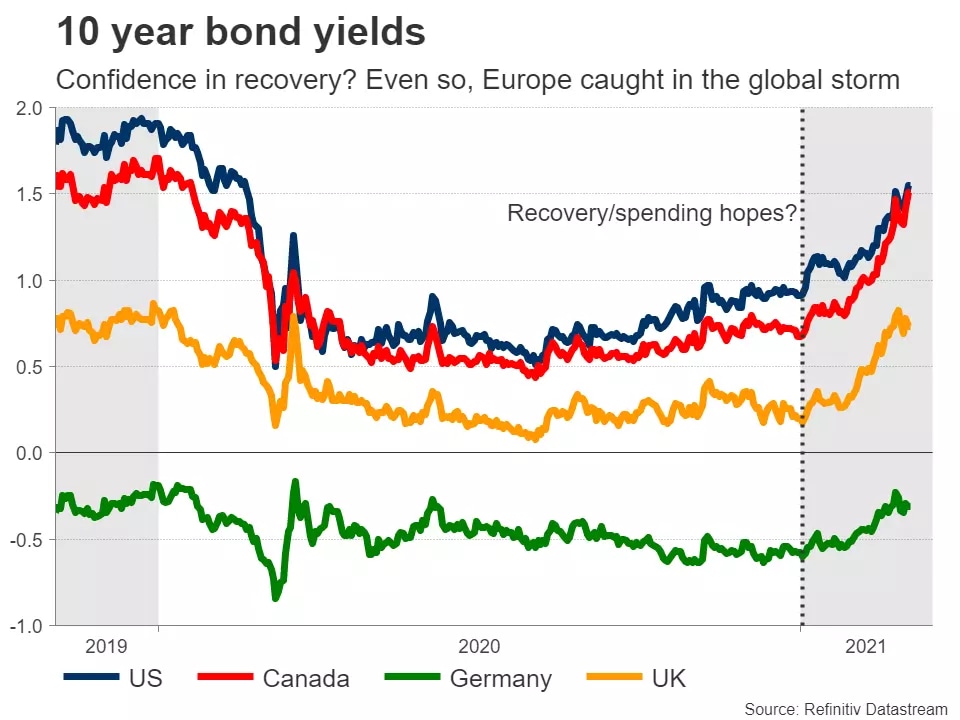

The mayhem in global bond markets has elicited very different responses from the major central banks. Higher yields can be a sign that investors are becoming more confident in the recovery and are thus bringing forward the timeline for rate increases, but they also raise the cost of borrowing for everyone, from governments to home buyers. Hence, sharp yield spikes are generally counterproductive for policymakers, as they could slow down the recovery.

The European Central Bank is the most concerned. From its perspective, this is mainly an American story that is spilling over into Europe for no good reason. The US is vaccinating its citizens quickly, and there’s a storm of federal spending coming to heal the economy. This is pushing US yields higher as Fed rate hikes are brought forward, which is spilling over into European yields.

The ECB’s problem is that Europe is not really healing. The economy is still fragile amid the ongoing lockdowns, vaccinations are very slow, and the recovery fund money still hasn’t been distributed. As such, senior ECB officials have been warning that this spike in yields is unwarranted and that the central bank could fight it.

This brings us to the upcoming ECB meeting. The key question is whether the central bank is concerned enough to characterize this as an unwarranted move that should be resisted, or whether the situation is not desperate enough yet to hit the panic button. In other words, will the ECB signal it is ‘ready to act’ or is it just ‘monitoring the situation’?

It’s a close call, but the second option seems more likely for now. While some ECB members like Panetta have called for increasing QE immediately, that doesn’t seem to be the consensus among the Governing Council yet. Hence, if the ECB falls short of signalling immediate action, that would likely boost yields and the euro during the meeting.

Having said that, how markets move until this meeting matters too. If yields continue to edge higher before Thursday for example, that could really alarm policymakers and drastically raise the odds of them signalling immediate action, which by extension sinks the euro.

BoC: Playing down a strong economy

The Canadian economy has performed very well lately, despite the lockdowns. The economy grew by more than the Bank of Canada expected in Q4, and preliminary data for January suggest GDP continued to grow at the start of 2021.

The BoC expected a sharp contraction in Q1, so their forecasts were probably too pessimistic. Indeed, the manufacturing sector is doing well, the housing market is booming, oil prices have skyrocketed, and some benefits from the massive fiscal spending in America are bound to spill over into Canada.

Of course, it’s not all rosy. The Canadian vaccine rollout has been painfully slow and the labor market is showing signs of stress. Plus, Canadian yields have been caught in the global rally, with the 10-year nearly doubling this year.

This puts the BoC in a tough spot. Policymakers have to acknowledge the economy is doing better, but sounding too optimistic could propel yields even higher. Markets are already pricing in a 25% probability for a rate hike this year. The BoC won’t be comfortable with that, so it might try to hammer home the message that rates will not rise for a long time. If it succeeds, the loonie could take a hit.

The nation’s jobs data for February are also out on Friday.

US inflation, Biden’s package, and the dollar

In the US, inflation data for February will top the economic calendar on Wednesday. Forecasts imply the headline CPI rate is likely to rise, but the core rate is expected to hold steady at 1.4% in yearly terms. That said, business surveys like the ISM PMIs suggest that price pressures have been on fire lately amid severe supply disruptions, so an upside surprise is certainly possible.

As for the Fed, it has taken the exact opposite stance of the ECB lately. Most Fed officials seem to think that yields are moving higher for ‘healthy reasons’, reflecting a stronger US economy thanks to all the federal spending and the swift vaccination campaign. This doesn’t mean the Fed will sit idle if yields go crazy, but it does imply that its pain threshold is much higher than the ECB’s.

Therefore, the risks surrounding euro/dollar seem tilted to the downside. The ECB will fight this yield move first, while the Fed will only intervene if things really get out of control. As such, yield differentials between Europe and America could widen further in the dollar’s favor.

Meanwhile, it seems that President Biden has the votes needed to pass his $1.9 trillion relief package through the US Senate. Any major market reaction seems unlikely though, as this is an old story that is probably fully priced in by now.

Pound eyes UK GDP

Elsewhere, British GDP numbers for January are out on Friday. After trading like a rocket ship in recent weeks, the pound has taken a breather lately as the US dollar came back to life and Brexit tensions resurfaced. The EU has threatened legal action after the UK delayed implementing part of the Brexit deal relating to Northern Ireland.

That said, the broader outlook for sterling still seems positive against the euro and the yen. The Bank of England has taken a similar stance to the Fed as far as rising yields are concerned, showing no real concern. Even though 10-year UK yields have quadrupled this year, policymakers view it as a natural reaction given Britain’s lead in the global vaccination race.

Hence, with the ECB threatening action and the BoJ already capping Japanese yields from rising, widening rate differentials could continue to push euro/sterling lower and sterling/yen higher.

Finally, China’s CPI and PPI data for February are out on Wednesday. The PPI data are viewed as a proxy for global factory demand, so they could play a crucial role in determining whether the selloff in stock markets continues.

Author

Marios graduated from the University of Reading in 2015 with a BSc in Economics and Econometrics. Prior to joining XM as an Investment Analyst in December 2017, he was providing financial analysis, reporting and consulting service