Week ahead: What are the markets watching this week?

It’s here. The FINAL full week of the trading year!

While liquidity will begin to thin as we close in on the festive holiday, a number of tier-1 data are in the headlights this week.

Tuesday

Tuesday entertains the minutes from the Reserve Bank of Australia (RBA) and the Bank of Japan (BoJ) Policy Rate announcement, followed by CPI inflation numbers out of Canada.

12:30 am GMT welcomes the RBA minutes; this will provide traders and investors with an in-depth review of the central bank’s latest rate decision. You may recall that the RBA held the Cash Rate at 4.35%, as expected, which followed a 25bp hike in October. Notes from the latest rate announcement saw the policy statement echo the data-dependent tone. The no-change follows inflation cooling to 4.9% on a year-on-year basis for October, according to the monthly CPI indicator, and Aussie unemployment jumping to 3.9%. The next quarterly inflation number due on 31 January next year will be an important watch, just ahead of the next central bank meeting on 6 February. According to rate pricing, markets are currently pricing in another no-change for this meeting.

At 3:00 am GMT, the BoJ policy announcement is scheduled to hit the wires and the central bank is widely anticipated to leave its Policy Rate unchanged at -0.10%. Expectations of a policy shift out of negative territory increased exponentially recently on the back of commentary from BoJ Governor Kazuo Ueda, noting that ‘handling monetary policy will get tougher from the year-end and through next year’. This, of course, sparked demand for the Japanese yen (JPY) and weighed on the USD/JPY currency pair. However, reports later surfaced that Ueda’s comments were not intended to provide direction of a potential rate change, which naturally caused the yen sell-off only to later rebound following the Fed’s dovish turn on Wednesday. Ultimately, though, according to a Reuters poll, the BoJ is expected to put a cap on negative interest rates by the end of 2024. Reuters also noted: ‘While none of the economists in the poll predicted changes at this week’s meeting, six of 28 economists, or 21%, said the BoJ would start dismantling current monetary conditions in January’.

1:30 pm GMT will see the latest inflation numbers from Canada. Current expectations for headline inflation is that consumer price inflation is anticipated to nudge back under 3.0% in the twelve months to November on the back of slowing prices in food and gasoline, down from 3.1% in October. Interestingly, a sub-3.0% print would mark the second time since early 2021 that we have been under 3.0% (the only other time, of course, was June 2023 at 2.8%). The estimate range for the release is currently between 3.0% and 2.7%. The most recent policy statement (6 December) erased October’s language regarding increasing inflationary risks, though it retained that it remains ready to act ‘if needed’. The post-rate statement added that the Governing Council ‘wants to see further and sustained easing in core inflation, and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour’.

Wednesday

Wednesday welcomes UK CPI inflation data at 7:00 am GMT.

The current median estimate for UK inflation data (All Items) for November is for the year-on-year measure to slow to 4.4%, down from 4.6% in October, alongside the core measure, which excludes energy, food, alcohol and tobacco, to also cool slightly to 5.5% over the same period, down from 5.7%. Following the Bank of England’s (BoE) hawkish hold at 5.25% last week, and the MPC expressing that the Bank Rate will need to remain in restrictive territory for ‘sufficiently long’ to bring inflation back down to the 2.0% target, the BoE also kept the door ajar for further policy tightening in the event of ‘persistent inflationary pressures’. However, while the central bank essentially backed away from the idea of rate cuts at this point (unlike the Fed), OIS swaps are pricing around 110bps of cuts for 2024.

Friday

Friday’s headline event will be the Fed’s favoured measure of inflation at 1:30 pm GMT: the Core PCE Price Index.

Following the Fed’s dovish turn last week, the focus will be November’s US Core PCE Price Index release. As of writing, the year-on-year measure is forecast to cool slightly to 3.4% in November from 3.5% in October (the estimate range is currently between 3.5% and 3.1%), while from October to November, forecasts are for a 0.2% increase, matching the prior month. Should data come in as expected, rate pricing and the buck are unlikely to see much change. A miss, on the other hand, could increase the odds for a March rate cut (63% probability according to Fed Fund futures pricing) and encourage dollar shorts and underpin equities and bonds.

Additional data of interest this week

Wednesday:

US Conference Board’s Consumer Confidence number and existing home sales at 3:00 pm GMT.

Thursday:

Final reading of US GDP (third estimate), US weekly jobless filings, the Philadelphia Fed Manufacturing Index and Canadian retail sales, all at 1:30 pm GMT.

Friday:

UK retail sales data at 7:00 am GMT.

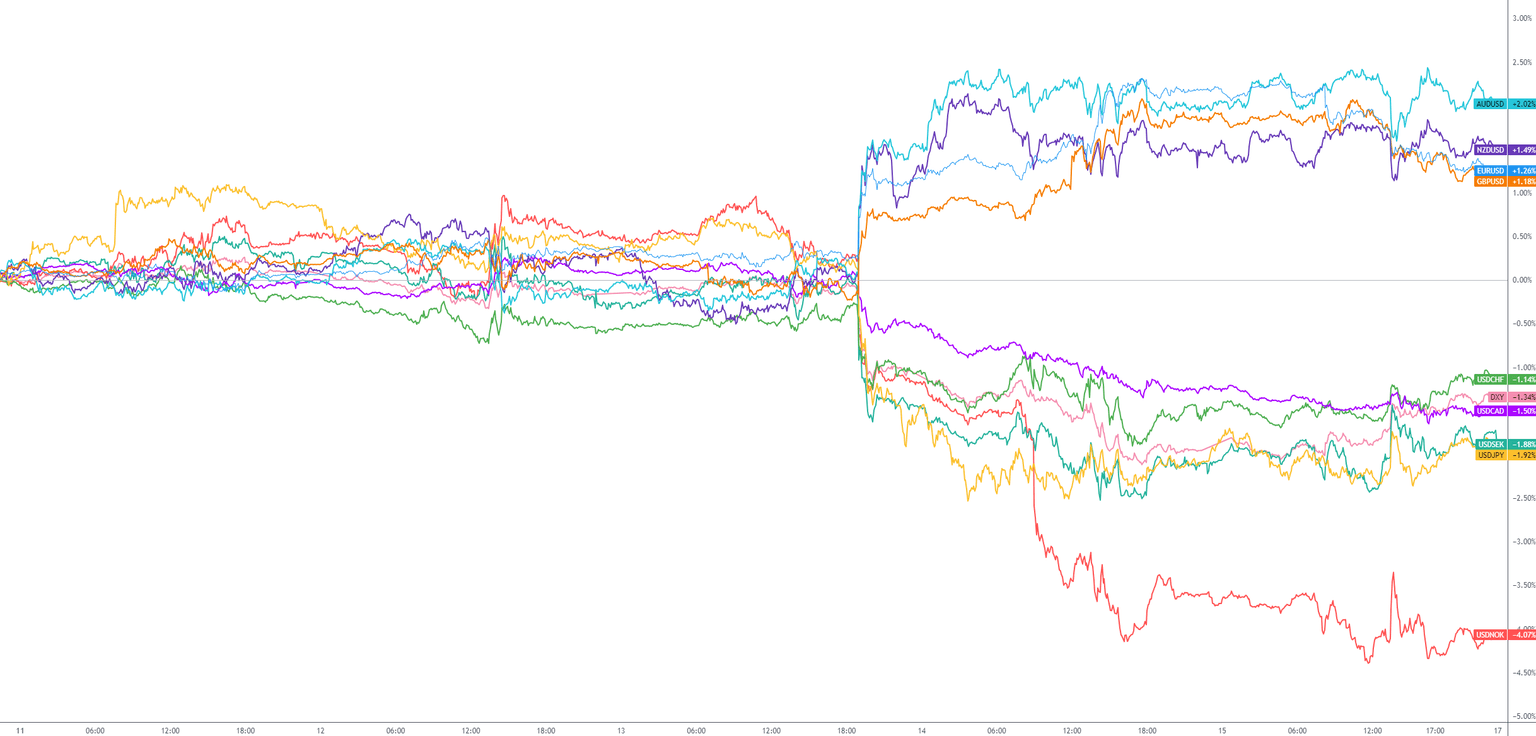

G10 FX (5-day change):

Charts: TradingView

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,