Week ahead: What are the financial markets watching this week

The week that was:

All about the Fed

The week started with US Federal Reserve (Fed) Chair Jerome Powell taking centre stage on Monday and effectively pouring cold water on rate-cut bets. Powell indicated that the Fed would likely opt for the more standard 25 basis point (bp) rate cuts; ‘This is not a committee that feels like it is in a hurry to cut rates quickly’, the central bank Chair added at the National Association for Business Economics Annual Meeting in Nashville.

The week also ended with a bang; the September US jobs report demonstrated robust employment growth that dashed expectations of another jumbo 50bp rate cut and, at least for now, helped to put fears over a weakening labour market to bed and shore up the soft-landing narrative.

The US economy added 254,000 new payrolls, comfortably surpassing the market’s median estimate of 140,000 (and bettered the maximum estimates of 220,000) and August’s upwardly revised reading of 159,000. Unemployment came in lower than expected at 4.1%, down from 4.2% in August (market consensus: 4.2%), while wage growth reported hotter-than-expected numbers on both the YoY (4.0%) and MoM front (0.4%).

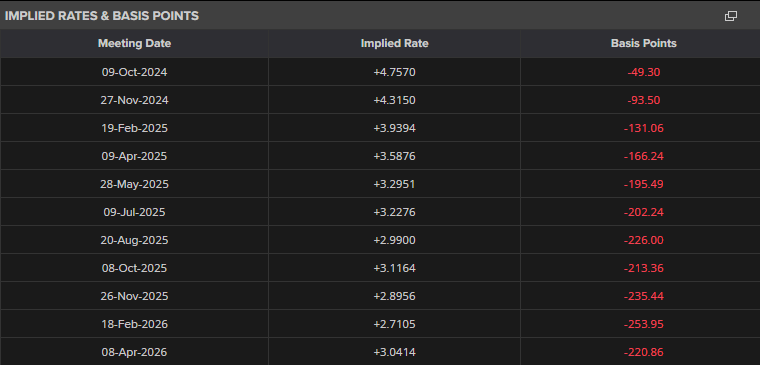

Speaking on Bloomberg, Chicago Fed President Austan Goolsbee noted that the latest jobs release was a ‘superb report’ but underlined the point of not putting too much stock into a single release. Markets and the Fed will get another employment situation report on 1 November before the Fed rate announcement. As of writing, investors are pricing in 53bps of easing until the year-end, meaning another jumbo 50bp cut is unlikely. This is according to Refinitiv data.

Geopolitics: Iran-Israel conflict

Tuesday witnessed Iran launch a missile attack on Israel, reportedly in retaliation for the assassination of Hezbollah’s leader, Hassan Nasrallah – the Israel Defence Force (IDF) acknowledged damage to a number of airforce bases. Oil prices surged last week due to concerns about a potential all-out conflict between the two nations with fears of a retaliatory attack on Iran. Analysts warn that oil prices could rise further should Israel target nuclear sites or oil plants.

The situation remains ongoing and fluid and thus remains important to monitor. The FP Markets Research Team covered recent events in more detail here.

The week that is:

Aside from geopolitical risk, this week’s macro drivers include the US CPI inflation report (Consumer Price Index), the Federal Open Market Committee (FOMC) meeting minutes, and the Reserve Bank of New Zealand’s (RBNZ) rate announcement.

FOMC meeting minutes

The FOMC meeting minutes will make the airwaves on Wednesday at 6:00 pm GMT. You will recall that in an 11-1 vote, the Fed opted for a bulkier 50 bp reduction at its September meeting, bringing the Fed funds rate to 4.75-5.00%. Since the last meeting, we have seen more of a hawkish rate repricing; investors are now leaning toward a 25bp cut at November and December’s meetings, aligning with the year-end September SEP projections.

Most Fed officials, including Fed Chair Powell (above), back rate cuts; consequently, this week’s minutes are unlikely to shed much light on that area. In his speech last week, Powell also emphasised that as long as the US economy continues as expected, reducing the Fed funds rate by another 50bps is on the table this year. Given the clear guidance and Friday’s hotter-than-expected jobs numbers, most of the attention will likely be on Thursday’s US CPI inflation data.

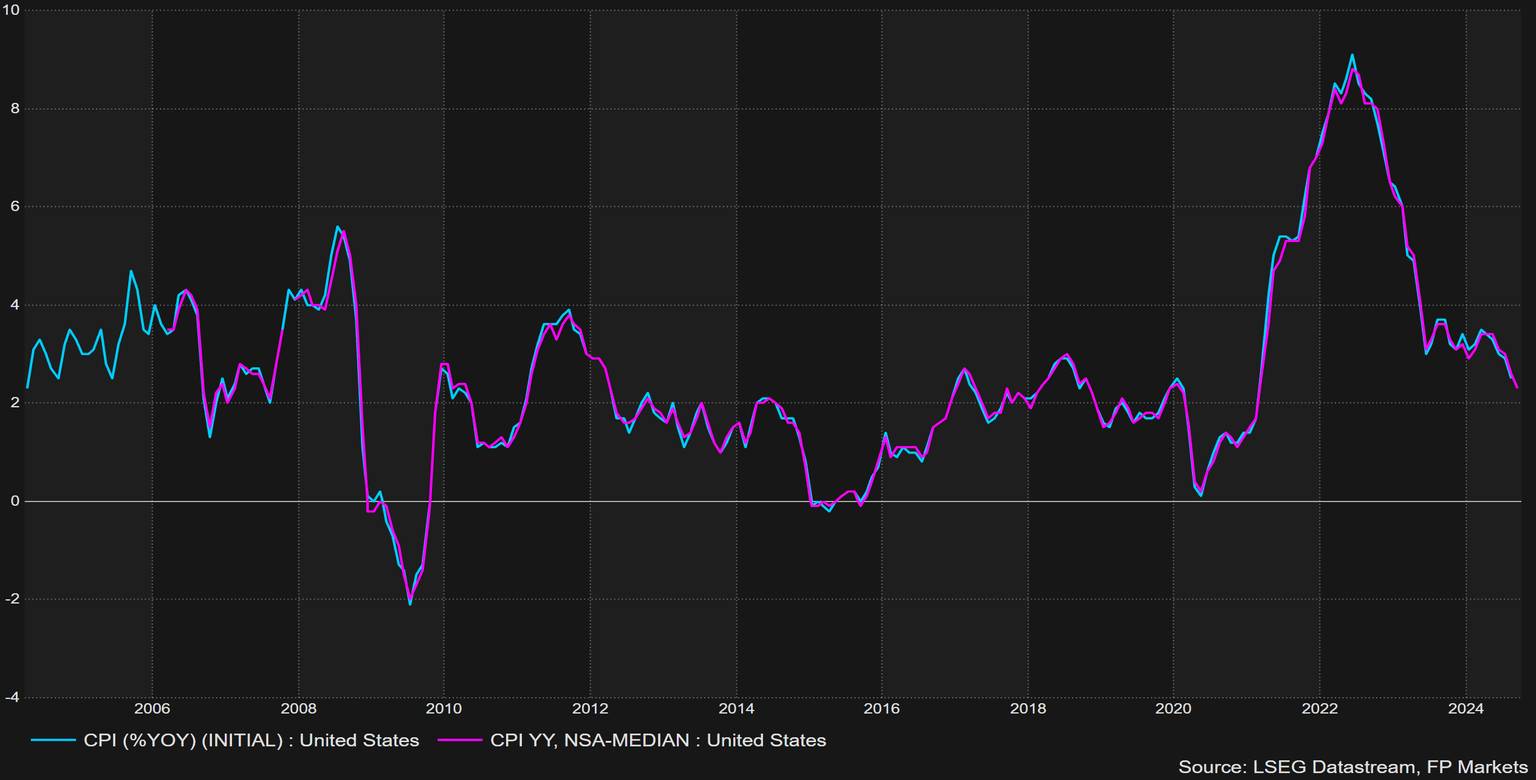

US CPI inflation

The September US CPI inflation report will be released on Thursday at 12:30 pm GMT. Expectations heading into the event are for headline YoY inflation to slow to 2.3% from August’s reading of 2.5% (estimate range between 2.4% and 2.2%), while core inflation – excludes food and energy components – is forecast to remain unchanged at 3.2% (estimate range between 3.3% and 3.0%). Between August and September, headline and core measures are anticipated to tick lower to 0.1% (from 0.2%) and 0.2% (from 0.3%), respectively.

Following Friday’s robust jobs data and headline inflation forecast to cool further will help reinforce the soft-landing narrative. However, it is worth noting that last week’s ISM services PMI revealed an increase in the prices paid component for September (from 57.3 to 59.4), thereby introducing some upside risks to this week’s release. Should the CPI report exhibit stickiness or print an upside surprise, the US dollar (USD) could see further outperformance. Of note, the US Dollar Index ended last week up by 2.1%.

RBNZ rate announcement

The RBNZ will be the focus of early Asia Pac on Wednesday at 1:00 am GMT. Markets largely forecast that the central bank will reduce its official cash rate (OCR) by 50bps this week (and again in November) amid softening price pressures and sluggish economic activity (note that the economy experienced a mild technical recession in the second half of 2023). A 50bp cut this week would bring the OCR to 4.75% following the 25bp reduction in August from 5.50% to 5.25%. The last meeting also witnessed a less hawkish approach; the central bank lowered its projections for the OCR, with further reductions projected for 2025.

Ultimately, although the New Zealand (NZD) is on the back foot at the moment – last week saw the currency fall nearly 3.0% versus the USD – we could see profit taking materialise this week. Should the RBNZ reduce rates by 50bps, this will not offer investors anything new and, given the recent depreciation of NZD, presumably ‘selling into the risk event’, an unwinding of short positions could unfold, thereby underpinning the currency. Were the RBNZ to surprise and opt for a 25bp cut, on the other hand, this would also reinforce a NZD bid. However, the RBNZ rate statement’s language could change things, so this will also be vital to assess.

Additional data on the radar:

- Reserve Bank of Australia’s (RBA) meeting minutes on 8 October at 12:30 am GMT

- European Central Bank (ECB) meeting minutes on 10 October (timing tentative)

- UK Gross Domestic Product (GDP) on 11 October at 6:00 am GMT

- Jobs data from Canada on 11 October at 12:30 pm GMT

- Core Producer Price Index (PPI) on 11 October at 12:30 pm GMT

- US Preliminary Consumer Sentiment Survey (University of Michigan) on 11 October at 2:00 pm GMT

G10 FX (five-day change):

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,

-638638454696856605.png&w=1536&q=95)