Week ahead: US jobs data in focus

The first full week of December places the spotlight on US jobs data. Employment metrics from the ISM (Institute for Supply Management) manufacturing and services PMIs (Purchasing Managers’ Indexes) land on Monday and Wednesday, respectively, JOLTs data (Job Openings and Labor Turnover Survey) airs Tuesday, ADP jobs numbers (Automatic Data Processing) are out Wednesday, weekly unemployment claims on Thursday and, of course, the employment situation report makes the airwaves Friday.

In addition to US numbers, CPI inflation data (Consumer Price Index) from Switzerland, GDP (Gross Domestic Product) numbers from Australia, and Canadian jobs figures are released this week.

Fed expected to cut by 25 basis points

According to the latest market pricing, investors are leaning in favour of the US Federal Reserve (Fed) reducing the target on the funds rate by another 25 basis points (bps) over a no-change decision at the next meeting on 18 December.

US inflation remains ‘sticky’ north of the Fed’s 2.0% inflation target, with YY (year on year) CPI inflation rising to 2.6% in October from 2.4% in September, YY PPI inflation (Producer Price Index) rising to 2.4% from 1.9%, and YY PCE data (Personal Consumption Expenditures), according to a report released last week, elbowed to 2.3% from 2.1%. Core YY CPI inflation – excludes food and energy prices – remained at 3.3%, core PPI inflation rose to 3.1% from 2.9%, and core PCE data rose to 2.8% from 2.7%. So, while inflation has slowed considerably since the pandemic, inflationary pressures show evidence of stubbornness. PCE data, the Fed’s preferred measure of inflation, is holding just north of 2.0%, and core PCE has stalled around the 2.8% mark amid increased consumption, particularly in services.

This week’s US job numbers will be critical and is the last employment report before the Fed rate announcement. These data will provide a fresh perspective on the health of the world’s largest economy and help determine the trajectory of the Federal funds rate. According to data from Refinitiv, following the economy adding 12,000 new payrolls in October – influenced by the recent hurricanes and strike activity – the median estimate for the November non-farm payrolls data is 190,000, with a max/min estimate range between 270,000 and 160,000. The unemployment rate is also expected to have ticked higher to 4.2% in November from 4.1% in October, with average earnings growth expected to slow on both MM (month on month) and YY measures.

According to Q3 24 data released last week (second estimate), US economic activity (GDP) remains resilient, running at an annualised pace of 2.8% and was primarily underpinned by personal consumption. With the economy resilient, should job creation report higher-than-expected numbers and unemployment decline, investors could re-evaluate the prospect of a rate cut later this month and lift the US dollar (USD) and US Treasury yields.

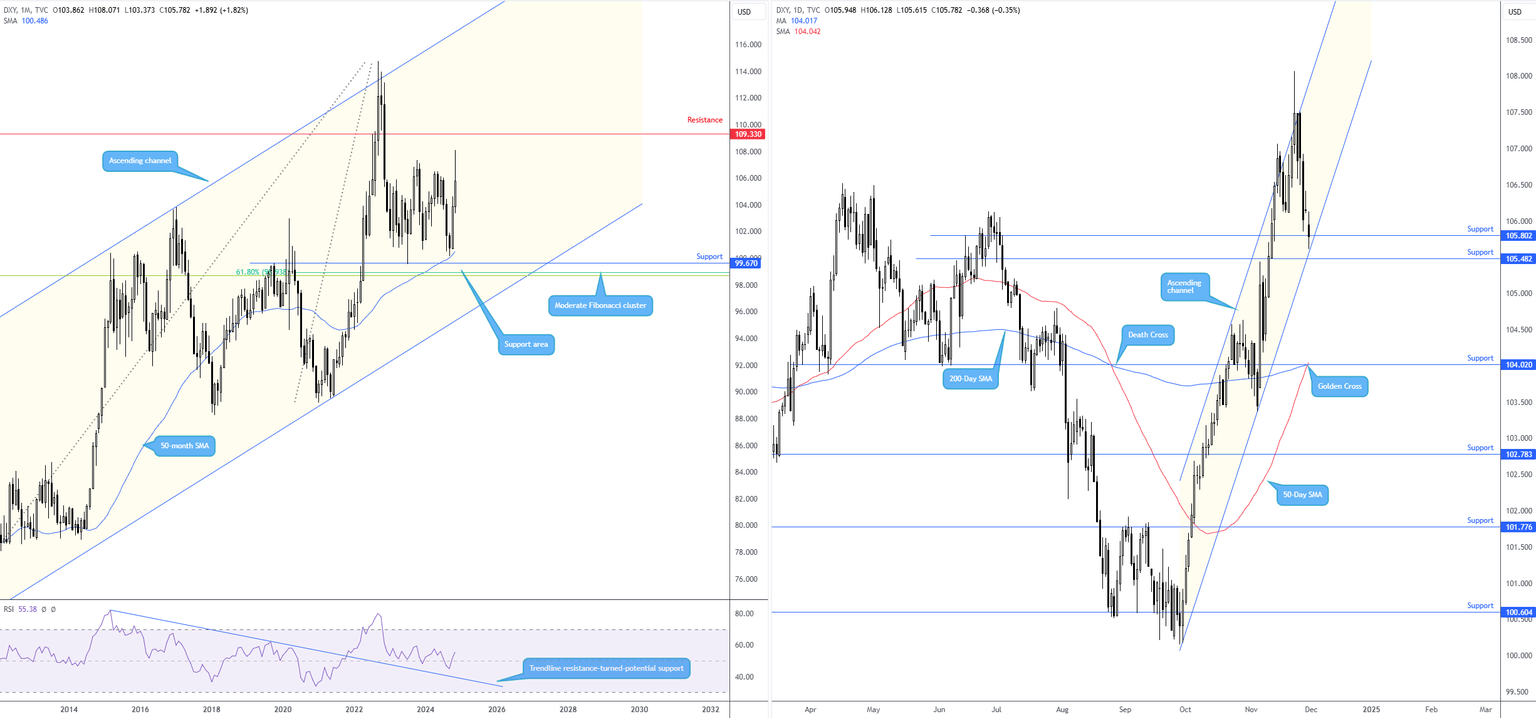

US Dollar Index ahead of data

While the USD caught an early bid off the back of President-elect Donald Trump’s tariff threats, the Dollar Index – a geometrically weighted average of the USD’s value against a basket of six currencies – concluded the week on the back foot down 1.6% and dominantly snapped a three-week bullish phase.

With scope to continue exploring higher terrain on the monthly chart until resistance from 109.33, the recent correction positions price action at technically noteworthy daily support between 105.48 and 105.80. Couple this with the area sharing chart space with channel support, extended from the low of 100.18, and the Golden Cross – the 50-day simple moving average (SMA) crossing above the 200-day SMA, which suggests a long-term bull market could be on the table – in addition to the USD’s current trend and room to punch higher on the monthly scale, this support area could be a zone that buyers make a show from.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,