Week ahead: US CPI inflation in view

Blowout NFP number

Friday’s US employment situation report revealed the US economy added an eye-popping 336,000 new payrolls in September versus the 170,000 median forecast (prior: 187,000). Echoing a resilient labour market, the latest jobs data triggered an immediate sell-off in US government bonds and further underpinned US yields; the benchmark 10-year yield clocked a 16-year pinnacle at 4.887%, though retreated throughout the remainder of the US session to test pre-announcement levels. In other markets, the S&P 500 opened lower and the Dollar Index rallied on the back of the release.

The US unemployment rate came in at 3.8%, matching the prior month (though above the 3.7% consensus), while average hourly earnings climbed 0.2% from August to September (expected: 0.3%; prior: 0.2%) and 4.2% in the twelve months to September (expected: 4.3%; prior: 4.3%).

The upside surprise in non-farm payrolls data not only increases the odds of a rate hike in November but adds weight to the higher-for-longer story. Money markets, as of writing, are still leaning towards another hold at the next Fed meeting on 1 November, with only a 30% probability priced in for a 25bp hike.

This week?

This week sees no major central bank decisions on the calendar, yet several key risk events are worthy of attention. The beginning of the week is expected to be quiet, with the US, Canadian and Japanese banks remaining closed in observance of Columbus Day, Thanksgiving Day and Health Sports Day, respectively.

Wednesday sees the minutes from the latest Fed decision at 6:00 pm GMT, which, you’ll likely remember, saw the FOMC press the pause button and keep the Fed Funds target range at 5.25%-5.50%. Another key risk event released Wednesday is the US Producer Price Index (PPI) at 12:30 pm GMT.

Since the last Fed meeting, we have seen Fed members emphasise a hawkish vibe. Minneapolis Federal Reserve Bank President Neel Kashkari recently communicated that the Fed will need to raise interest rates once more and maintain higher rates for longer if the economy is stronger than anticipated. This was echoed by Federal Reserve Bank of Cleveland President Loretta Mester, adding that the Fed will likely need to raise rates again this year and then ‘hold it there for some time as we accumulate more information on economic developments’. Mester added: ‘Whether the Fed Funds rate needs to go higher than its current level and for how long policy needs to remain restrictive are going to depend on how the economy evolves relative to the outlook’. Federal Reserve Bank of San Francisco President Mary Daly, however, recently commented on the bond market, noting that the ‘bond market has tightened quite considerably … equivalent to a rate hike’. Daly added that the need for additional tightening ‘is not there’ as the rise in yields has done the job for the Fed.

BoFA senior US Rates Strategist Meghan Swiber commented on the bond sell-off (and what stops it) in an interview on Bloomberg Television last week: ‘It’s one of two things. It is either more pressure on the equity market, driving more of this flight to quality back into Treasuries, or we need to see a more substantial turn in the data that gives the market more confidence that the Fed will be cutting eventually’. Swiber added that in the near term, further upside in rates is possible as a result of Friday’s blowout NFP number.

US inflation data for September will be widely watched on Thursday at 12:30 pm GMT. Since bottoming at 3.0% in June, inflation has increased by 3.7% in the twelve months to August, up from 3.2% in July and just north of economists’ estimates of 3.6%. Core inflation, which excludes energy and food prices, eased to 4.3% in August for the same period, as expected, down from 4.7% in July. Market expectations, at the time of writing, indicate that inflation is expected to have marginally ticked higher to 3.8% in the twelve months to September, with core inflation forecast to have slowed to 4.1% over the same period.

Another event released earlier on Thursday is the UK GDP for August at 6:00 am GMT. Sterling ended last week in positive territory against its US counterpart, up +0.3% and trimming a small portion of the 4-week losing streak. Interest rates remaining in restrictive territory, USD strength, higher unemployment, elevated inflation, weak retail sales and contractionary PMI prints highlight downside risks for the pound. However, should a hawkish BoE present itself on November 2, this could provide a temporary floor for the currency. For Thursday’s monthly GDP, it’s unlikely to be a market mover for GBP currency pairs, but nonetheless, one to pencil in the diary.

Friday will see inflation data—both consumer and wholesale (CPI and PPI)—out of China at 1:30 am GMT. We also have several notable central bank speeches on Friday, including Bank of England (BoE) governor Andrew Bailey, European Central Bank (ECB) President Christine Lagarde and Federal Reserve Bank of Philadelphia President Patrick Harker.

Also noteworthy, on Friday, the last major risk event of the week, we have the University of Michigan’s (UoM) preliminary consumer sentiment survey out at 2:00 pm GMT. This is released alongside the UoM’s inflation expectations.

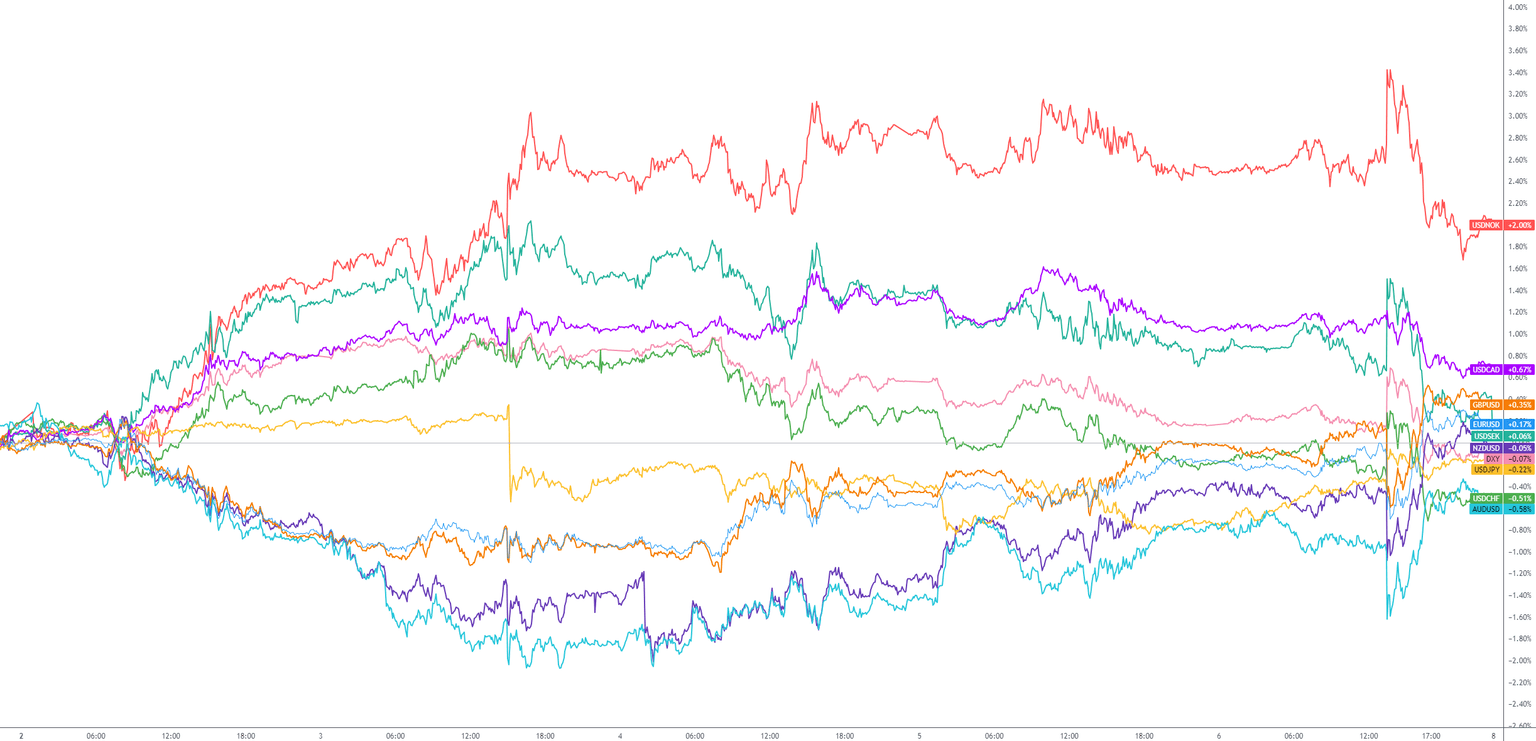

G10 FX (5-day change)

Charts: TradingView

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,