Week ahead: Tariff risks and macro themes ahead

Another month has nearly passed, and just like that, we find ourselves in Q2 25. The week ahead promises to be eventful, with the majority of focus on US President Donald Trump’s so-called ‘Liberation Day’ on 2 April.

Last week, moderate downside was observed in US Treasury yields and the US dollar (USD), and US equities exhibited choppy trading conditions, as US exceptionalism is dented at this point. On the other hand, Spot Gold (XAU/USD) continues to shine and navigate unchartered territory, comfortably north of US$3,000 and poised for further outperformance.

Where we were

March’s S&P Global PMIs (Purchasing Managers’ Indexes) landed at the beginning of last week and took centre stage. The eurozone’s services PMI slowed to 50.4, down from 50.6 in February, while manufacturing activity remained in contractionary territory, albeit rising to 48.7 from 47.6. UK PMIs showed the service sector expanded to 53.2 from 51.0, offsetting a sizeable decline in manufacturing activity – dropping to 44.6 from 46.9. In the US, despite the manufacturing PMI dipping into contractionary terrain (49.8 versus 52.7), the services PMI data surged to 54.3 from 51.0.

Australian and UK CPI inflation data (Consumer Price Index) also captured some of the macro spotlight last week, with headline year-on-year (YY) CPI inflation decelerating for both Australia and the UK in February, easing to 2.4% (down from 2.5% in January) and 2.8% (down from 3.0%), respectively. The Reserve Bank of Australia’s (RBA) preferred inflation measure – the ‘trimmed mean’ – also cooled to 2.7% YY from 2.8%, while YY UK core CPI inflation eased to 3.5% from 3.7%.

UK Chancellor Rachel Reeves delivered her widely anticipated Spring Statement to Parliament. However, amid all the noise and political banter, the Statement was mainly in line with what most had anticipated, and the markets did little to write home about.

The tail end of last week witnessed US GDP growth (Gross Domestic Product) come in a touch higher; bolstered by consumer spending, real GDP reported an annualised rate of 2.4% for Q4 24 (final estimate). Whether the US can maintain this growth rate given fears of trade concerns and policy uncertainty is now the question. Interestingly, according to the US Federal Reserve (Fed) of Atlanta nowcast model, 2025 is poised for a gloomy start, with the latest estimate indicating a 1.8% contraction in Q1 25. That said, the alternative model forecast, adjusted for imports and exports of gold, is 0.2%.

US PCE (Personal Consumption Expenditures) data for February was also released on Friday, which, as I am sure you are aware, is what the Fed uses to track inflation. Headline month-on-month (MM) and YY prints aligned with estimates and matched January’s data at 0.3% and 2.5%, respectively. Core PCE data, however, rose by 0.4% MM (from 0.3%) and 2.8% YY (from 2.6%). This indicates persistent inflation – data likely to see the Fed hold steady and wait on the sidelines for now. Markets expect a no-change Fed decision in May, though June’s meeting remains possible for a 25 basis point cut (-20 bps).

Where we are

Without question, despite a slew of US jobs numbers on the docket this week, developments surrounding Trump’s reciprocal tariffs will dominate sentiment. In a nutshell, the Trump administration is expected to remove trade imbalances with other countries. Tariff threats, of course, will likely continue to claim headlines leading up to 2 April. Recently, Trump announced that a 25% tariff would be imposed on all cars imported into the US, which will take effect on 3 April, and stated, ‘This is the beginning of Liberation Day in America’. Additionally, via Trump’s Truth Social platform, he targeted the European Union (EU) and Canada, warning that were the EU and Canada to work together ‘to do economic harm to the USA’, he would impose ‘large scale tariffs’ (see below).

Ultimately, while Trump’s announcement this week increases the overall weight of tariffs, analysts hope that Liberation Day will help clear the fog of uncertainty. In my opinion, a decisive direction from Trump seems unlikely. Time will tell. As you have likely already seen, markets have been somewhat gun-shy in their reactions, given the chopping and changing we’ve observed from him in the past.

Macro developments

Macro drivers in focus for me this week will be US employment data, an update from the Reserve Bank of Australia (RBA), as well as Eurozone CPI inflation numbers.

The March US employment situation report, released on Friday, is expected to show the US economy added

140,000 new payrolls, down from February’s reading of 151,000 (estimate range is currently between 175,000 and 80,000). Unemployment is forecast to have remained at 4.1% (estimate range between 4.2% and 4.1%). Of note here, you may recall that in the Fed’s latest round of quarterly economic projections, unemployment is forecast to increase to 4.4% this year (see below). Average hourly earnings are expected to remain unchanged MM, rising 0.3%, while YY data are projected to slow to 3.9% from 4.0% (estimate range between 4.3% and 3.9%).

According to the S&P Global PMIs for March, job creation has been soft. Furthermore, in light of the Department of Government Efficiency (DOGE) government job layoffs and federal hiring freeze, this will likely be reflected in the March payroll figures. Should jobs data come in as forecast, this is unlikely to materially change much from a policy perspective and unlikely to prompt the Fed into a reactive easing stance.

Ahead of Friday’s report, however, we have several tier-1 jobs numbers to get through, including manufacturing and services PMIs (both expected to come in lower in March), JOLTS Job Openings for February, ADP employment change for March, and weekly jobless claims for the week ending 29 March.

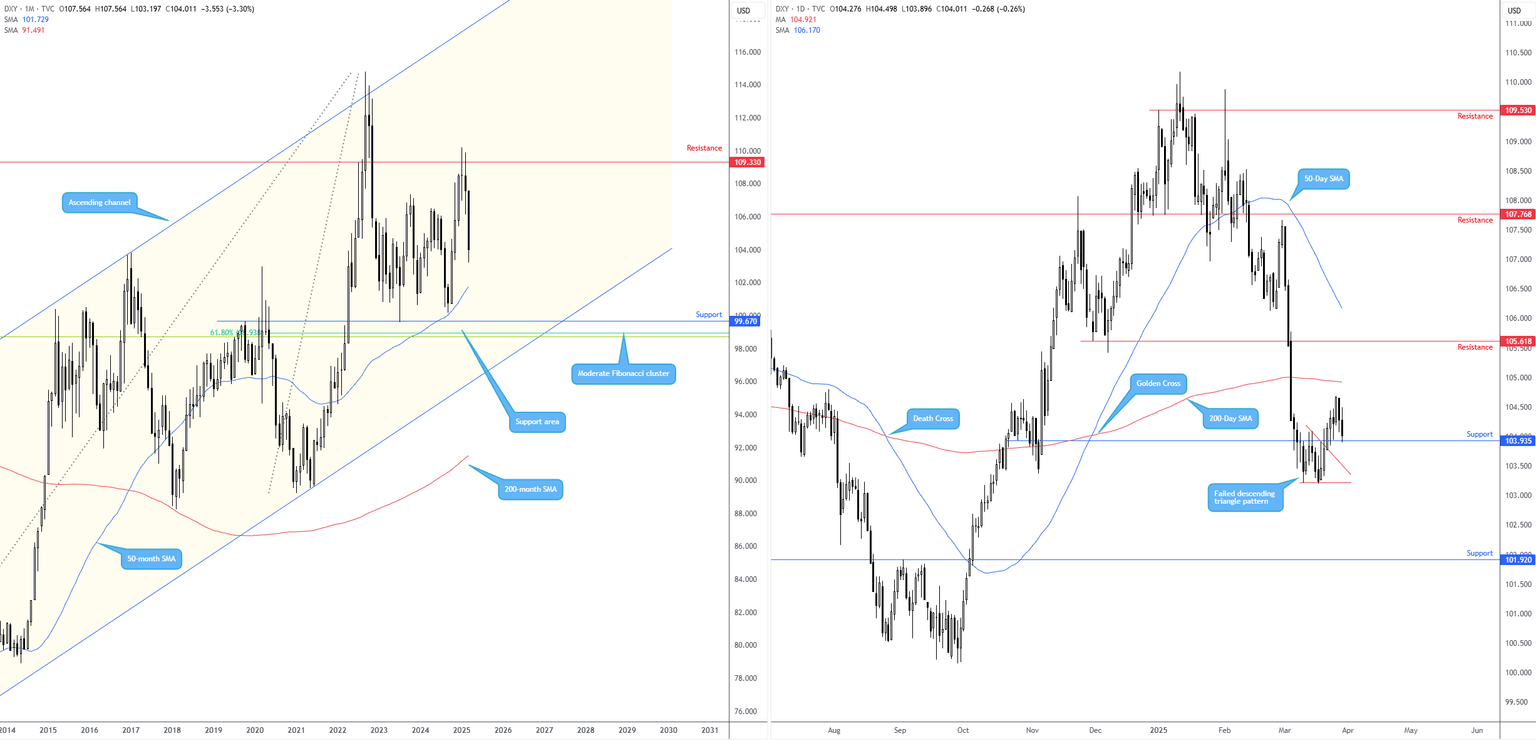

Regarding the USD’s technical position, the USD Index (see below) continues to exhibit scope to explore lower levels on the monthly chart until the 50-month simple moving average (SMA) at 101.73. This follows a rejection of resistance at 109.33 at the start of this year. Meanwhile, price action on the daily timeframe ended last week testing resistance-turned-support at 103.94. Given what I see on the monthly scale, USD bulls are unlikely to print anything meaningful from 103.94, especially with the 200-day SMA circling above at 104.92. As a result, I expect sellers to eventually change gear and breach 103.94, opening the door for a bearish scenario towards support at 101.92 – located just north of the noted 50-month SMA.

The RBA’s rate announcement will take some of the week’s limelight on Tuesday; economists and markets widely expect the central bank to maintain the Cash Rate target at 4.10%. According to the ASX 30-Day Interbank Cash Rate Futures, markets currently assign a 92% probability that the Cash Rate will remain unchanged. This follows the RBA reducing the rate by 25 bps at its February meeting, its first (albeit cautious) rate cut in over four years. Since the last policy meeting, While Aussie inflation easing in February increases the odds of a rate cut at May’s meeting, investors are fully pricing in a 25 bp rate cut for July.

As shown below, the AUD/NZD cross (Australian dollar versus the New Zealand dollar) is in the early stages of a downtrend (price structure) on the daily chart and, following a pullback from N$1.0903 is now testing the underside of resistance made up of a horizontal base at N$1.1002 and a trendline support-turned resistance line, extended from the low of N$1.0564. Adding to the bearish vibe, you will note that the pair has completed a double-top pattern (N$1.1178) by breaching the neckline taken from the low of N$1.0942. Although these bearish elements could prompt speculative selling interest, my concern is the support level from N$1.0978; this base is a yearly opening level (2018).

European CPI inflation data for March is out on Tuesday and is forecast to rise by 2.3% YY, matching February’s data, while YY core inflation is expected to slow to 2.5% from 2.6%. Despite money markets pricing in an 88% probability of a 25 bp cut for April’s meeting, in an interview with CNBC, Governing Council member Pierre Wunsch recently commented that the ECB should at least have the possibility of a rate pause ‘on the table’, adding that US trade concerns complicate the decision-making process. Should CPI inflation slow by more than expected, this could prompt increased rate cut bets and add to euro (EUR) weakness. Conversely, a meaningful upside surprise would likely see a bid in the EUR.

Therefore, this week, I will watch the EUR/GBP cross (euro versus the British pound) closely (see below). The monthly chart shows support is in play at £0.8229-£0.8315. While price is poised to end March on the front foot from the noted support, the previous rebound (2022) failed to print a meaningful higher high, suggesting that a push higher is likely to be contained by trendline resistance, taken from the high of £0.9504. Out of the daily chart, the ‘alternate’ AB=CD I highlighted earlier last week at £0.8331 (1.272% Fibonacci projection ratio) held the pair higher into the close last week and saw price test the 38.2% Fibonacci retracement ratio from £0.8367, derived from legs A-D (a common initial profit objective). With AB=CD longs now likely eyeing the 61.8% Fibonacci retracement ratio at £0.8398 (common second profit objective), H1 supports from £0.8348 and £0.8358 are worth keeping an eye on at the open this week.

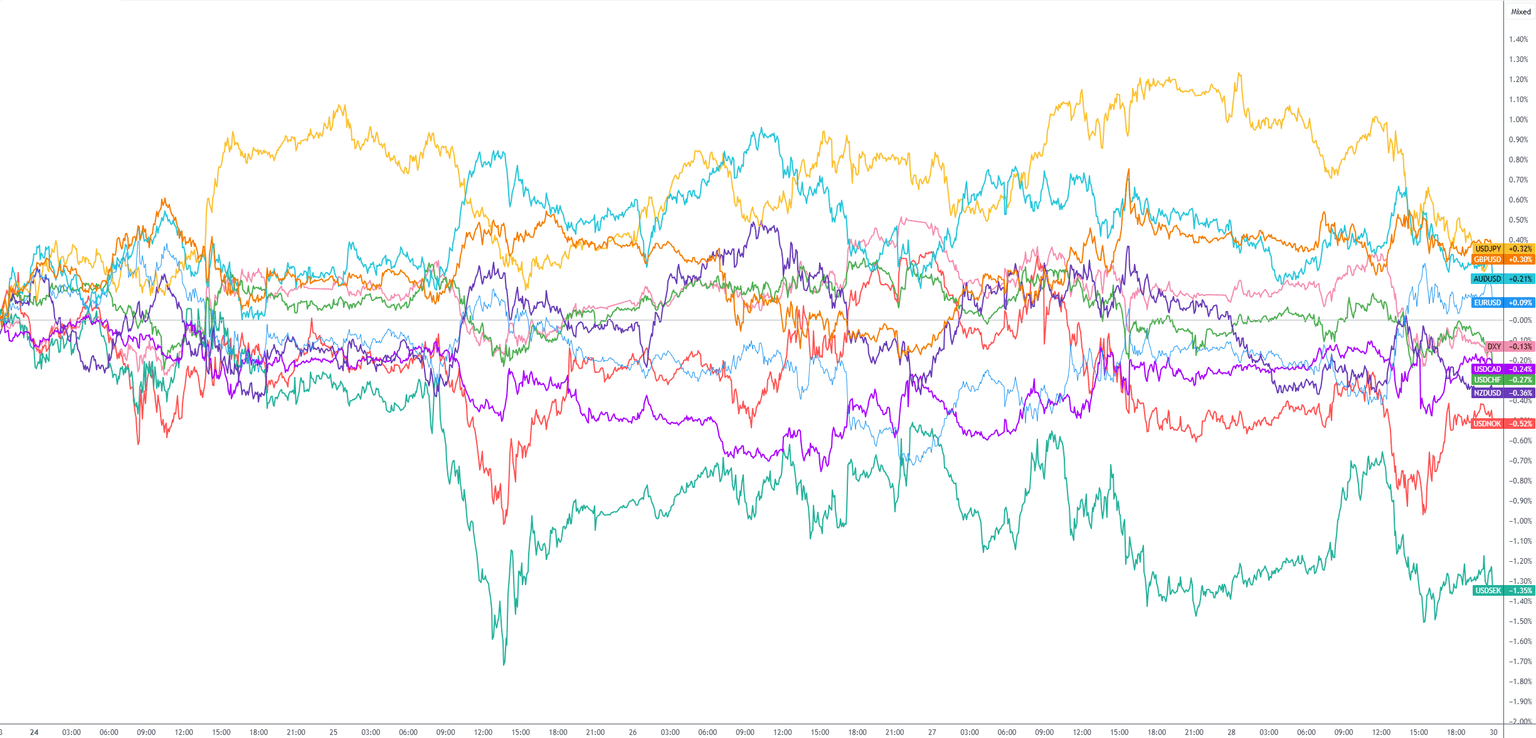

Weekly G10 FX performance:

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,