Week Ahead on Wall Street (SPY) (QQQ): Powell pivots again and markets look set for more losses

- Jackson Hole revives hawks and bears so equities turn lower.

- Bitcoin also suffers as risk appetites turn sour.

- The week ahead is set for more volatility as bond markets reprice and the curve flattens again.

The week finally got its finale with a hawkish Jackson Hole on Friday culminating in a bad week of data on nearly all front bar perhaps inflation. Global PMIs turned south as economies look to be heading straight down the recession route. The PMI debacle spread like a virus with Australia spreading to the UK, Europe, and then the US. Europe started to reprice rate hikes as more and more ECB members came out all hawkish and now 75 basis points may be the tonic for the next ECB meeting. Despite this, the Euro was still unloved due to the energy situation in Europe. The price of European electricity and gas prices continued to soar on the back of the ongoing ramifications of the Russian invasion of Ukraine. This has put added pressure on inflation projections from the EU and so caused the hawkish tilt from ECB members. Sovereign bond yield spreads continued to widen in Europe between the core (Germany, France) and the periphery (Italy, Greece). Not yet at a critical level but it's worth keeping an eye on. This was the source of the near collapse of the Euro during the GFC. This time the ECB has pledged to intervene if the spread gets too wide so the market is likely to test it at some stage. Meanwhile, the Bank of Japan continues to hold rates down and so the yen remains pressured as the dollar/yen is still above 137. Asia it seems is embarking on monetary easing just as the rest of the developed world is tightening. China is increasingly looking to monetary and fiscal stimulus measures to deal with a growing property crisis that could blow up into another GFC event.

Meanwhile back to the week at hand and Powell's description of needing "below trend" growth. Ned Davis has some interesting research showing us that below-trend growth with inflation means underperformance for equities.

In his speech yesterday, Powell said that addressing inflation will require a "sustained period of below-trend growth". High inflation and below-potential growth has been a bad combination for stocks, historically. 1/2 @NDR_Research pic.twitter.com/yQkkfMw6GQ

— Rob Anderson (@robanderson_stl) August 27, 2022

The main take to take if you'll excuse the language, from Jackson Hole is this. Powell had all summer to craft exactly what he wanted to say. These were not off-the-cuff remarks. He knew exactly what he wanted to do to equity prices by citing Volcker and saying pain ahead. He needed to bring some sense back to equity valuations and he thought long and hard about what to do to say that. So these remarks are much more important than off-the-cuff interviews, leaks, etc. This was crafted well in advance to have the desired effect of tightening financial conditions.

Week ahead

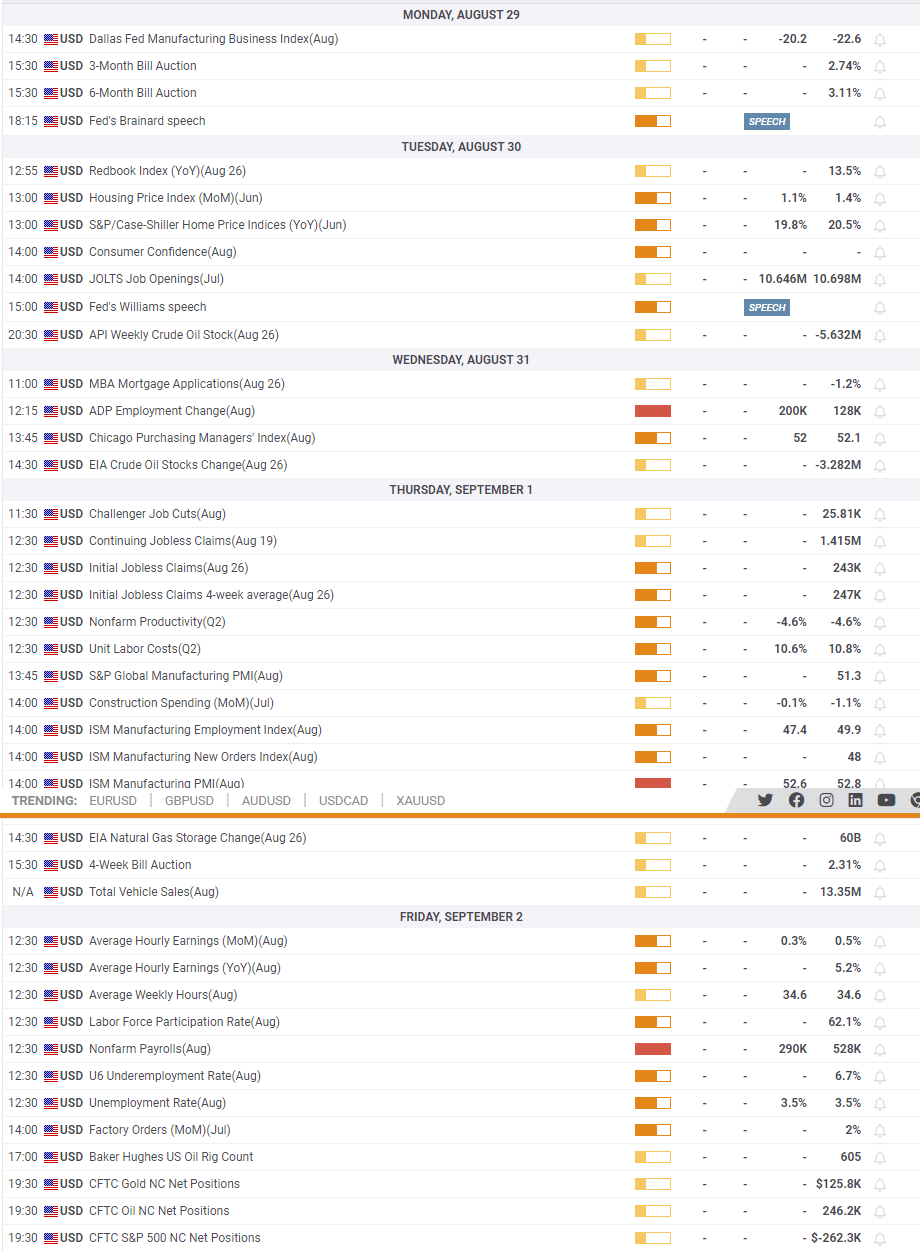

After Friday's repricing of risk and equity assets, we can expect continued to follow through next week. Remember we get proper QT from the Fed this week as the amount ramps up and banks' reserves cannot offset this anymore. Added to that will be the weekend thoughts of the longer-term institutional players who will have digested Jackson Hole and begin shifting portfolios accordingly. This is likely to be a quarterly event so will mean some big size moving markets so best be prepared. VIX moved up sharply on Friday as equities sold off but bond market volatility (MOVE) remains stationary so this may be the next event to drive equities lower.

QT is about to enter $95bn a month. Reserves fall has paused for a couple of months but will start again.

— PPG (@PPGMacro) August 28, 2022

Note @crossbordercap highlights.https://t.co/HqnMQIdH7p https://t.co/Pvz5B2njfK pic.twitter.com/IDijLNPmYW

Earnings week ahead

Earnings season is now well past its sell-by date and partly explains the equity rally. The earnings season was good, much better than expected with profit margins rising.

US corporate profits top $2 trillion in Q2 for the first time ever pic.twitter.com/H84x074Gu6

— Jamie McGeever (@ReutersJamie) August 25, 2022

This week we get some more retailers Best Buy, Big Lots, and some consumer discretionary Lululemon.

#earnings for the week https://t.co/lObOE0uRjZ $CRWD $BBY $PDD $CHPT $BIDU $AVGO $CHWY $CTLT $BIG $FUTU $SLQT $HPQ $PSEC $MDB $OKTA $LULU $ITRN $BMO $NSSC $HTHT $PLAB $VEEV $GAMB $AMBA $EXPR $AI $NAT $S $HEI $FIVE $IQ $CPB $HPE $HRL $PVH $TTC $CONN $YY $AMWD $REX $DBI $PSTG pic.twitter.com/GWMYT2cIom

— Earnings Whispers (@eWhispers) August 27, 2022

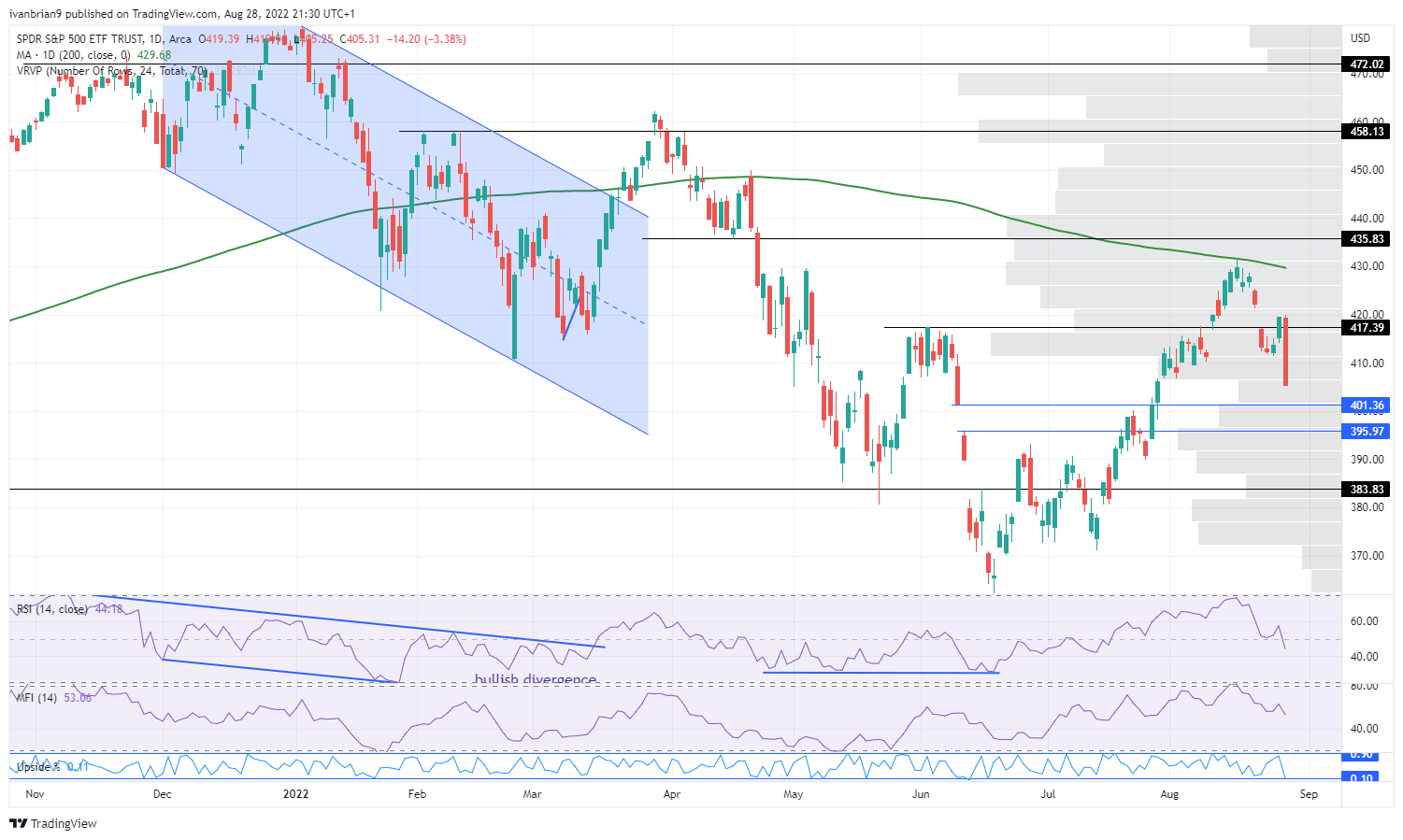

SPY forecast

A perfect failure then at the 200-day moving average now brings $401 back in sight as the next main support. Holding below $417 though means ultimately we need to hit a new low for this leg so that means taking out $362. Break back above $417 and the 200-day moving average becomes the target.

SPY daily

Economic releases

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.