- S&P 500 finally enters official bear market territory.

- Equities swing wildly after Fed hikes by 75 basis points.

- Does the Bank of Japan open the door to H2's best trading opportunity?

The weeks keep on racking up and so too do the nerves of investors who are kept on the rack by the latest developments. Let us just have a quick recap and see where we might go from here. We entered the week in nervous territory but for the most part, expecting a 50 basis point hike from the Fed. This had been well telegraphed and despite last Friday's shock CPI print most felt 50 was the way forward. However, we then got word via the WSJ that 75 basis points were the tonic required and the markets headed for the exit doors. The worst fears were confirmed on Wednesday when the Fed did indeed hike by 75 basis points, the first rise of such magnitude since 1994. Most of us were not in the market to remember the last time and so perhaps that explains our bizarre reaction to what patently is bad news. The main indices went on a relief rampage with the Nasdaq nearly up 5% at one stage and the other main indices all up over 3%.

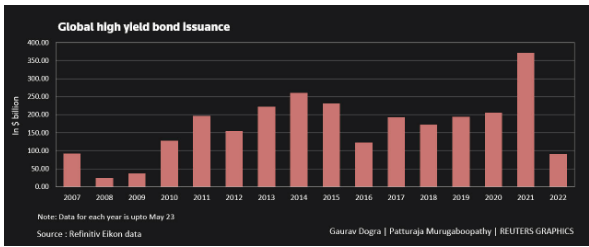

A relief rampage from what exactly? Well, the narrative was that the Fed was stepping up to the plate, finally and it would tame inflation and ensure a soft landing. Reality swiftly set in on Thursday and risk assets dumped sharply. We have pointed out numerous times now that the Fed has a truly terrible record in ever engineering a soft landing. This is the Fed of irrational exuberance and pandemic printing. Inflation was always going to uncork once the pandemic lockdowns ended and we had too many consumers chasing to make up for lost time and too few goods to sate them. The initial Fed response may have been appropriate but the gorging on bond markets and Fed printing has created the massive bubble that we are now in the middle of deflating. Debt issuance went through the roof and most of it was of the junk variety. Investors were encouraged to buy junk and if you buy junk then you should expect junk in return. That is what many bond investors will now be finding out, now that the Fed has pulled the rug out from the credit markets. High yield spreads are surging, mortgage-backed securities (MBS) had no bids last week at one stage and junk bond issuance has fallen off a cliff.

JNK ETF High Yield Junk Bond ETF Price.

The macro environment continues to worsen. We have touched on this before but we have University of Michigan Sentiment at decade lows, falling retail sales, falling savings rates, and increasing credit card debt. Inflation remains out of control and so really risk assets have only had one option for 2022.

The increasingly obvious question is how long does this last and when will we bottom out? Again a bit of repetition to readers from our daily SPY post but the last leg to go will be earnings. It always is the last leg to go as markets are forward-looking while earnings are historical. But next quarter's earnings are not too far away now and we expect a significantly bearish tone from CEO's and CFO's. CEO speech turned bearish last quarter and it appears they have been putting their money where their mouth was in the last quarter. Insider selling has picked up markedly this quarter.

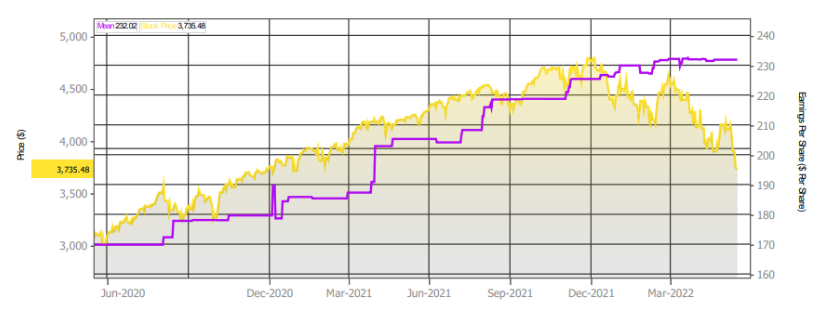

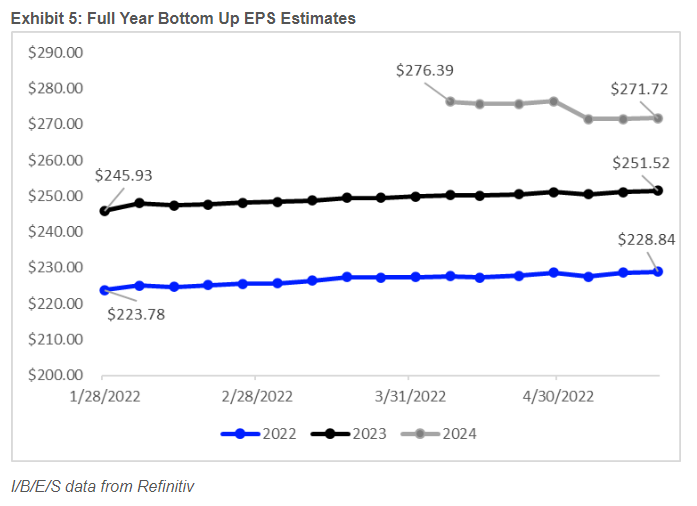

But average EPS forecasts for 2023 remain way too high. Notice from below how 2022 and 2023 EPS estimates for the S&P 500 are still being upgraded. Upgraded I hear you scream incredulously. Indeed these Wall Street analysts are an optimistic bunch. This upcoming quarter will see reality set in and earnings estimates will be brought down. This naturally will bring the S&P 500 and other main indices down with it. The S&P 500 (SPX) is trading on 16 times forward earnings and 21 times trailing earnings. This is about the historical average but it tends to fall below its average in recessions and obviously above in periods of expansion or bubble such as 2021. At the end of 2021 the S&P 500 was trading on over 40 times earnings

S&P 500 index (yellow) versus average EPS estimates (purple), source: Refinitiv.

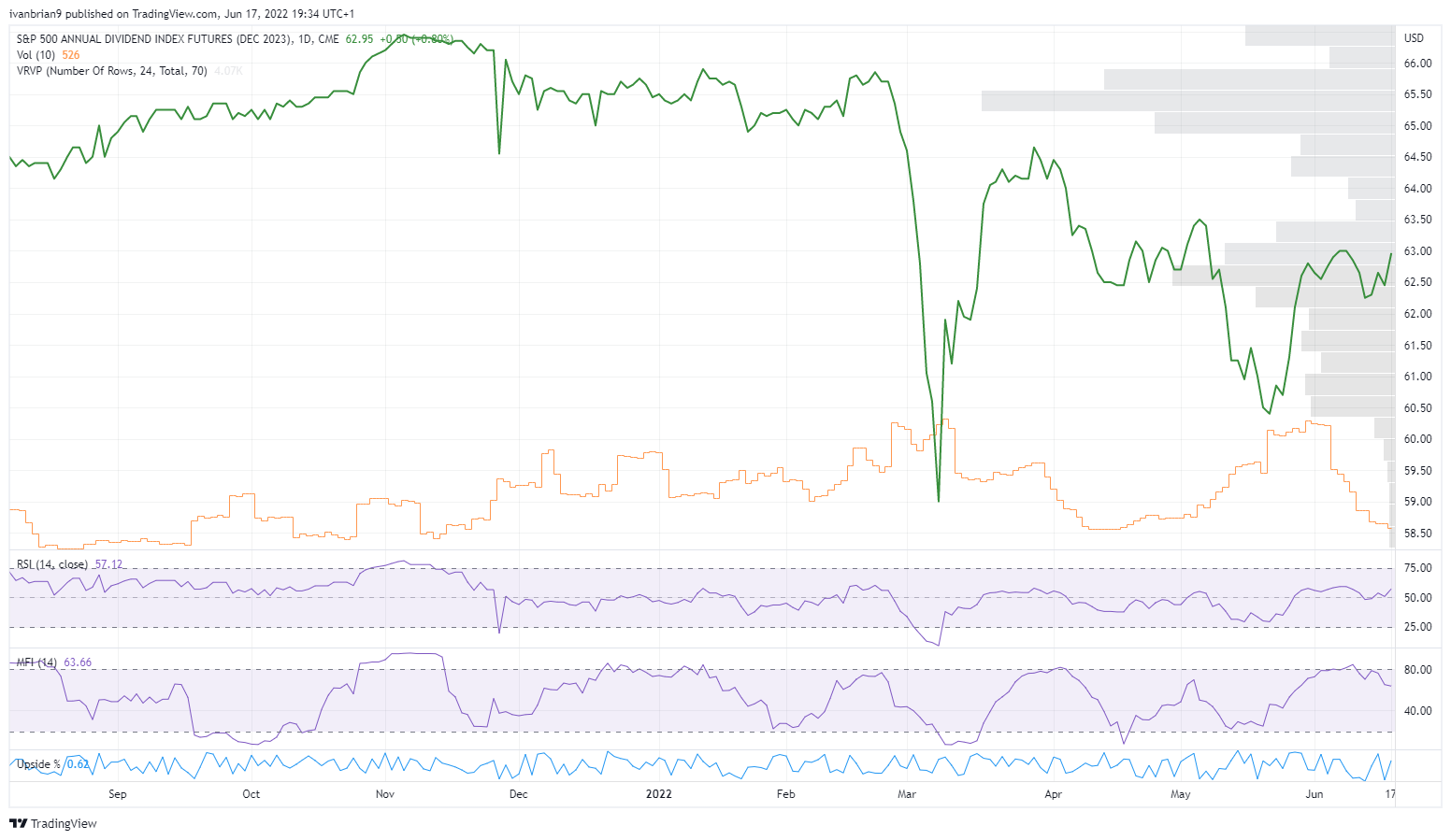

While EPS estimates appear way too high that is a function of analysts being uniformly optimistic and usually drinking the cool-aid from company executives. Thank you to Saxo for first bringing this to our attention but dividend futures on the other hand are not subject to analyst forecasts but are based on the investor community. Dividend futures for 2023 are already marking a decline in the expected future dividend stream from the S&P 500. This is due to economic headwinds and profits falling. If dividends are lower it is natural to assume earnings will be.

S&P 500 dividend futures Dec 2023

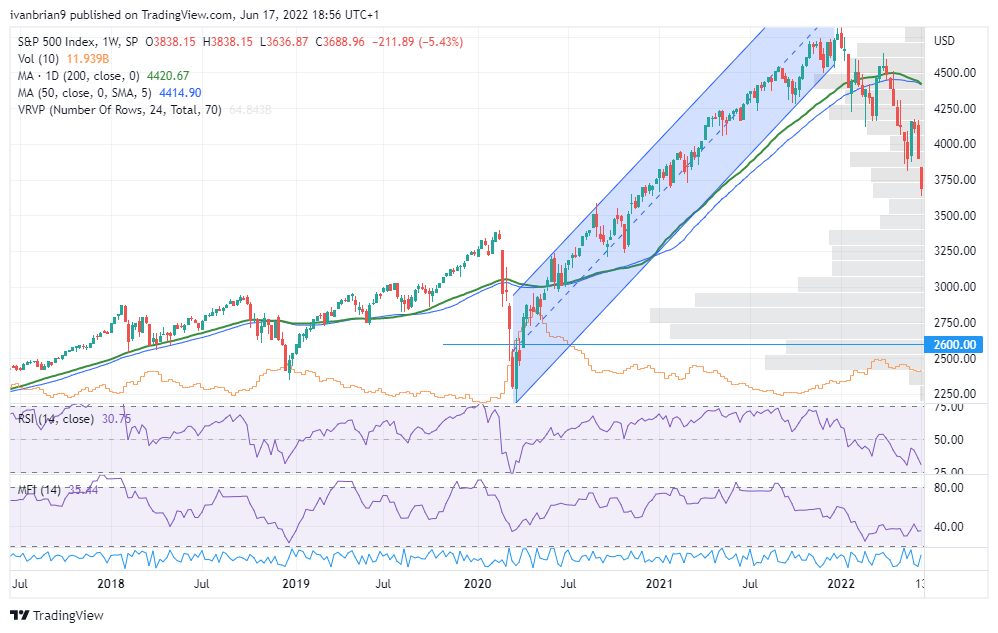

Taking EPS down by 20% to $200 and moving the S&P 500 price/earnings multiple back to 13 would give a price target of 2600. Rather shocking and probably the extreme case of a deep recession. We feel a recession is now odds on but do not think it will be a deep one. So somewhere around 3,000 looks more likely. That marks another 20% lower and a 40% decline from the peak. That is the average decline for bear markets.

SPX weekly

Bank of Japan the lone dove

In other related news, the Yen keeps on falling and has moved back up to 135 now versus the dollar. The BOJ remains the sole dove now in a sea of hawkish central banks. Investors and speculators had begun betting that the limit on JGB yields would break and that the BOJ would announce it at today's meeting. But the central bank reaffirmed its commitment to keeping a lid on yields at 0.25% and the yen fell from 132 to 135 versus the dollar. We outline this due to the large amount of hedge fund carry trade involved in the dollar-yen pair currently and the systemic risk a break could pose. Knock-on effects from hedge fund liquidations could affect equity markets.

Earnings due

Next week sees earnings from Nike which should give us a guide on how those supply chains are looking and how consumer demand is holding up. Carnival (CCL) should be interesting, bookings and earnings should be ok but will they bow to the inevitable and downgrade guidance. We covered this one today and chapter 11 is a distinct possibility, see more on Carnival (CCL) here

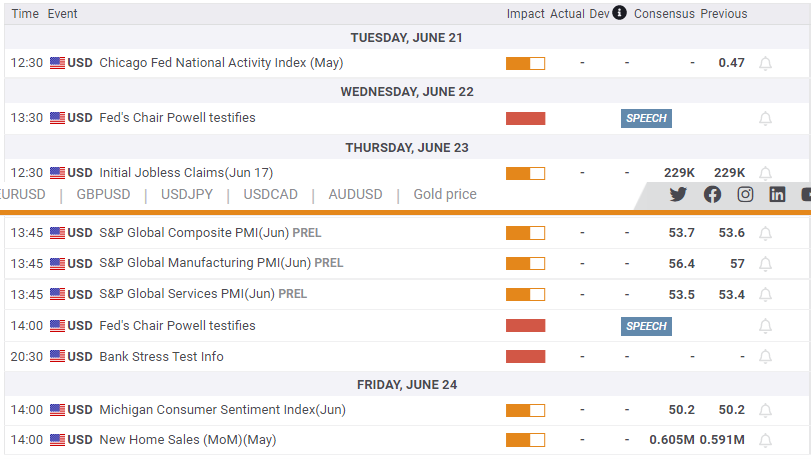

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.