-

Investors see decent chance of another 50bps cut in November.

-

Fed speakers, ISM PMIs and NFP to shape rate cut bets.

-

Eurozone CPI data awaited amid bets for more ECB cuts.

-

China PMIs and BoJ Summary of Opinions also on tap.

Will the Fed opt for a back-to-back 50bps rate cut?

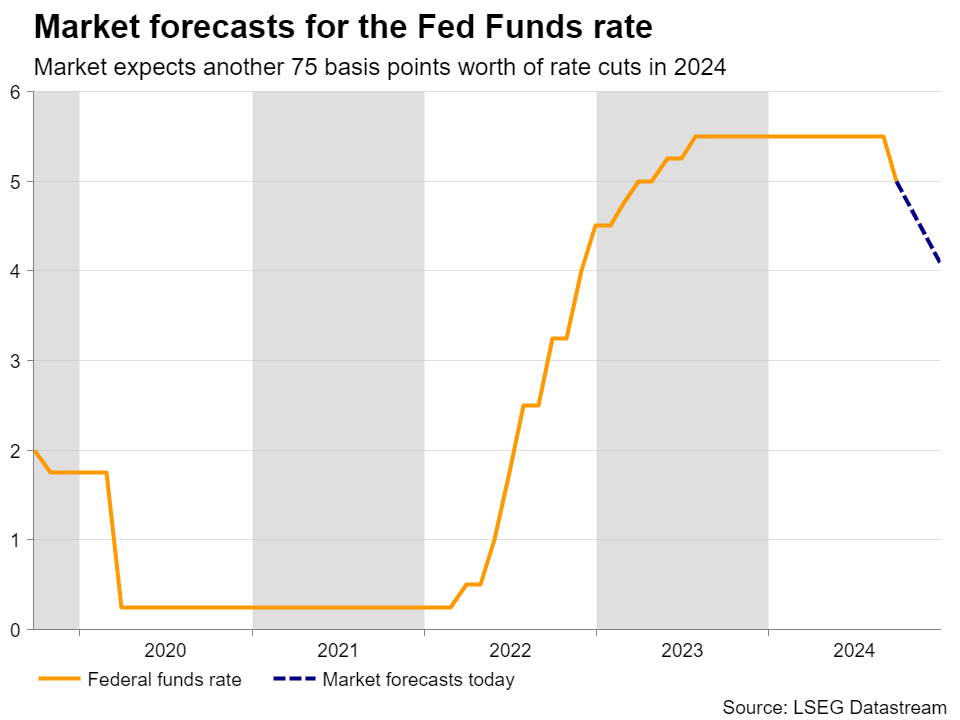

Although the dollar slipped after the Fed decided to cut interest rates by 50bps and to signal that another 50bps worth of reductions are on the cards for the remainder of the year, the currency traded in a consolidative manner this week even with market participants penciling around 75bps worth of cuts for November and December. A back-to-back double cut at the November gathering is currently holding a 50% chance according to Fed funds futures.

Ergo, with policymakers Christopher Waller and Neel Kashkari clearly favoring slower reductions going forward, the current market pricing suggests that there may be upside risks in case more officials share a similar view, or if incoming data corroborates so.

Next week, investors will have the opportunity to hear from a plethora of Fed members, including Fed Chair Powell on Monday, but given that the dot plot is already a relatively clear guide of how the Fed is planning to move forward, incoming data may attract more attention, especially Friday’s nonfarm payrolls.

ISM PMIs and NFP report to attract special attention

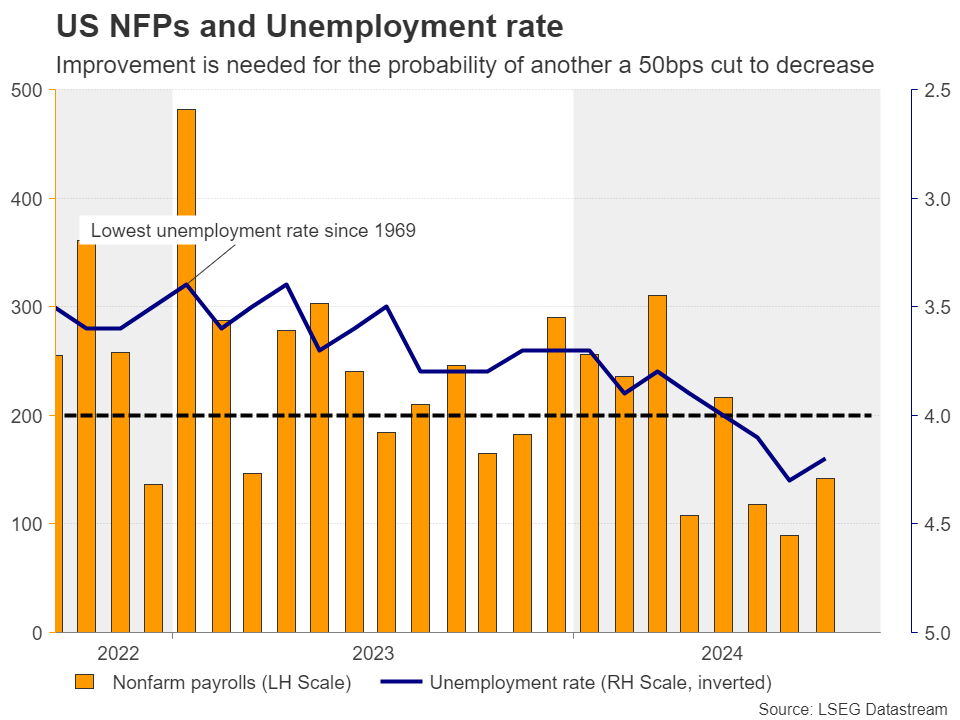

But ahead of the payrolls, the ISM manufacturing and non-manufacturing PMIs for September, on Tuesday and Thursday respectively, may be well scrutinized for early signs of how the world’s largest economy finished the third quarter. If the numbers agree with Powell’s view after last week’s decision that the economy is in good shape, then the dollar could gain as investors reconsider whether another bold move is necessary.

However, for the dollar to hold onto its gains, Friday’s jobs report may need to reveal improvement as well. Currently, the forecasts are suggesting that the world’s largest economy added 145k jobs in September, slightly more than August’s 142k, with the unemployment rate holding steady at 4.2%. Average hourly earnings are seen slowing somewhat, to 0.3% m/m from 0.4%.

Overall, the forecasts are not pointing to a game-changing report, but any upside surprise coming on top of decent ISM prints and less-dovish-than-expected commentary by Fed policymakers could very well act as the icing on the cake of a bright week for the US dollar. Wall Street could also cheer potentially strong data, even if it translates into slower rate cuts ahead, as more evidence that the US economy is not heading into recession is nothing but good news.

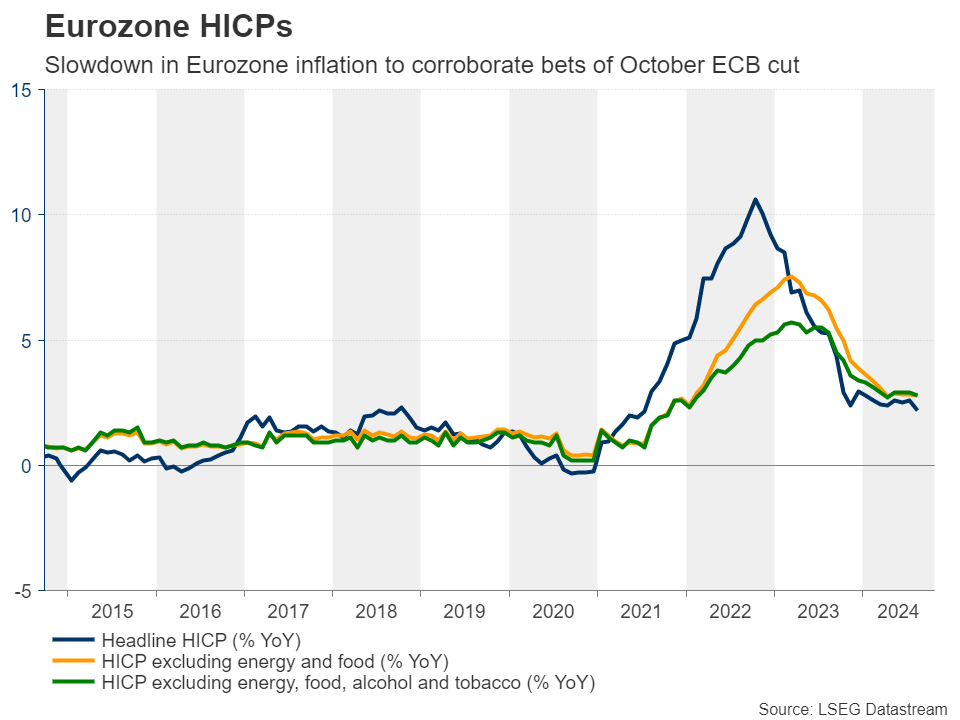

Eurozone inflation in focus amid split ECB

In the Eurozone, the spotlight is likely to fall on the preliminary CPI data for September, due out on Tuesday. Even though Lagarde and her colleagues did not offer explicit signals regarding an October reduction, the disappointing PMIs encouraged market participants to increase bets of such an action. Specifically, the probability of a 25bps reduction at the October 17 meeting is currently at around 75%.

Having said that though, a Reuters report citing several sources noted yesterday that the October decision is seen as wide open. The report mentioned that the doves will fight for a rate cut following the weak PMIs, but they will likely face resistance from the hawks, who will argue for a pause. Some sources are talking about a compromise solution in which rates are kept on hold but reduced in December if data doesn’t improve.

Yet, the market’s base case scenario is rate cuts in both October and December, and a set of CPI numbers pointing to further slowdown in Euro area inflation could solidify that view.

Euro/dollar could slip in such a case and extend its decline if the US data corroborates the notion that there is no need for the Fed to continue with aggressive rate reductions. That said, for a bearish reversal to start being considered, a decisive dip below the round figure of 1.1000 may be needed, as such a break may confirm the completion of a double top formation on the daily chart.

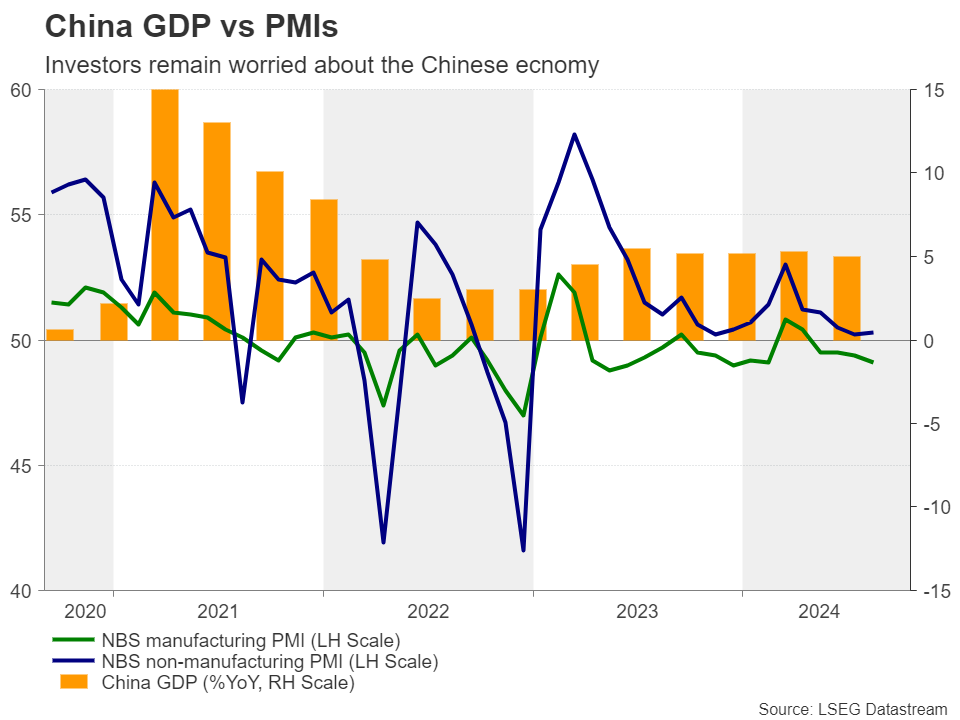

Will the Chinese PMIs signal contraction?

From China, we get the official PMIs for September on Monday. The composite PMI stood at 50.1 in August, just a tick above the 50 boom-or-bust zone that separates expansion from contraction, and it remains to be seen whether business activity improved this month, or whether it slipped into contractionary territory.

This week, the People’s Bank of China (PBoC) announced a series of stimulus measures to support economic activity and help the deeply wounded property sector. Yet, market participants were not particularly excited, with oil prices plunging due to easing concerns about supply disruptions in Libya and following reports that Saudi Arabia is ready to abandon its target of $100 per barrel.

The announcements of the Chinese measures did little to lift hopes that demand in the world’s top crude importer may be restored, as investors may still be holding the view that more fiscal help is needed.

With that in mind, a set of disappointing PMIs could encourage some further selling in oil prices, though any pullbacks in the aussie and the kiwi are likely to prove limited as these risk-linked currencies now seem to be enjoying the increase in broader risk appetite, which is evident by the latest rally on Wall Street.

BoJ’s summary of opinions also on the agenda

In Japan, the BoJ releases the Summary of Opinions from the latest decision, where policymakers kept interest rates unchanged but revised up their assessment on consumption due to rising wages. Governor Ueda said that they will keep raising rates if the economy moves in line with their outlook and thus, investors may dig into the summary for clues and hints on how likely another rate hike is before the end of the year.

Japan’s employment data for August, due out during the Asian session Tuesday, and the Tankan survey on Thursday, may also help in shaping investors’ opinion.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.