Week ahead: Key central banks in focus

This week will be an interesting one for the financial markets. In addition to several tier-1 data, the focus will be on the US Federal Reserve (Fed), closely shadowed by the Bank of England (BoE) and the Bank of Japan (BoJ).

Fed rate announcement (Wednesday 18:00 GMT)

The Fed is gearing up to reduce policy for the first time since 2020. The question for many, nevertheless, is whether the Fed opts for a 50 or a 25 basis point rate reduction; it remains a close call.

The July Federal Open Market Committee meeting minutes revealed most Fed members noted that if data continued to come in as expected, it would be appropriate to begin easing policy at the September meeting. In his widely anticipated speech at the three-day annual event held in Jackson Hole last month, Fed Chairman Jerome Powell also said, ‘The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks’.

Fed rate pricing has been somewhat of a rollercoaster of late and concluded last week pricing in 114 basis points of easing this year and 36 basis points for this week’s meeting. This is quite something, considering most Fed officials signalled just one rate cut this year as little as three months ago, and a rate reduction was not on the table for September’s meeting.

On the data front, all eyes were on the August Employment Situation Report (6 September) to provide some clarity on the potential direction of the Fed. However, it came up short and further muddied the waters. While non-farm payroll change grew by 142,000 jobs and bettered July’s reading of 114,000, it fell short of economists’ expectations (160,000). Average hourly earnings also gathered steam between July and August, and the unemployment rate fell to +4.2% from +4.3% in June.

Following this, investors shifted their attention to the August US CPI inflation release (Consumer Price Index) last week, which came in lower than expected on the headline front, and core inflation remained sticky. This triggered a hawkish rate repricing, dropping to 27 basis points of cuts for September’s meeting. However, as aired above, markets finished the week repricing a dovish stance.

Even with August’s softer headline inflation and the lower-than-expected jobs growth, this does not scream recession, particularly with unemployment pulling back to 4.2% and real Gross Domestic Product (GDP) running at an annualised rate of +3.0% in Q2 24 (second estimate).

Should the Fed cut rates by 50 basis points, this is unlikely to create much surprise as this has been a possibility for some time now. As such, the USD downside could be limited, and we also have to account for the possibility that a bulkier reduction could trigger recessionary fears and support the USD from a safe-haven perspective, moving the greenback more to the left side of the Dollar Smile. And even if the Fed does not proceed with the 50 basis point cut and opts for a 25 basis point reduction, this may trigger a hawkish repricing in money markets and be equally supportive for the USD.

The reaction in the USD will also depend on the updated economic projections, the language in the rate statement and, of course, Fed Chair Powell’s press conference.

BoE rate announcement (Thursday 11:00 GMT)

The BoE is widely anticipated to keep its Bank Rate on hold at 5.0%, following August’s 25 basis point rate cut.

Following the rate reduction, BoE Governor Andrew Bailey commented that the central bank needs to ‘make sure inflation stays low and be careful not to cut interest rates too quickly or by too much’. Bailey emphasised this point at Jackson Hole. Given this and the latest macroeconomic data, markets expect the central bank to remain unchanged. Overall, investors are currently pricing in a little more than 50 basis points of cuts this year; therefore, back-to-back 25 basis point rate cuts at November and December meetings could be seen. As a result, this week’s focus will be on the accompanying rate statement’s language and the Bank Rate votes (consensus suggests a 7-2 vote, with Swati Dhingra and Dave Ramsden dissenting and voting for back-to-back cuts).

The July CPI inflation data showed headline inflation (YoY) rose +2.2%, up from +2.0% in June, and core inflation cooled to +3.3% from +3.5% in June. Services inflation remains elevated, albeit slowing to +5.2% from +5.7% in June.

The August CPI report will be released a day before the central bank’s rate announcement. Expectations heading into the event forecast headline inflation to hold at +2.2% (YoY), though the current estimate range falls between +2.4% and +2.0%. Core inflation is expected to return to +3.5%, and services inflation is forecast to rise to +5.5%.

While the economy grew +0.5% in the three months to July 2024, albeit softer than the market’s median estimate of +0.6% and lower than June’s reading of +0.6%, real GDP flatlined again in July, defying economists’ expectations of +0.2%. Of the three primary sectors, production and construction curbed growth in July, falling -0.8% and -0.4%, respectively. Services output was the only one to show growth in July (up a paltry +0.1%). This follows a decline in June (-0.1%).

Regarding the July labour data, unemployment fell to +4.1%, down from 4.2% in June, while employment growth witnessed a sizeable jump to 265,000, up from 97,000 (June). Wages in the three months to July slowed for regular pay (+5.1% versus +5.4% prior) and pay including bonuses (+4.0% versus +4.6% prior).

BoJ rate announcement (Friday 4:00 GMT)

Like the BoE, the BoJ is anticipated to remain on the sidelines this week, keeping its Policy Rate at 0.25%. This follows the central bank raising rates by 15 basis points at July’s meeting from a 0.0%-0.1% range, along with BoJ officials signalling further policy firming down the road. Swaps traders are pricing in the possibility of a 9 basis point hike by the end of the year.

As such, a no-change at this week’s meeting will offer the markets little to go on and is unlikely to trigger much volatility. The meeting’s focus will be on the Monetary Policy Statement and BoJ Governor Kazuo Ueda’s press conference for clues of further policy adjustment. Any language supporting a rate hike this year could see the Japanese yen (JPY) strengthen further and weigh on the USD/JPY currency pair, which is down -3.7% month to date.

In its latest report, Fitch Ratings noted that the central bank is ‘bucking the global trend of policy easing and hiked rates more aggressively than we had anticipated in July’. Fitch added: ‘This reflects its growing conviction that reflation is now firmly entrenched’.

Fitch forecasts that the BoJ will raise rates to 0.5% by the year-end, 0.75% by the end of 2025, and 1.0% by the end of 2026.

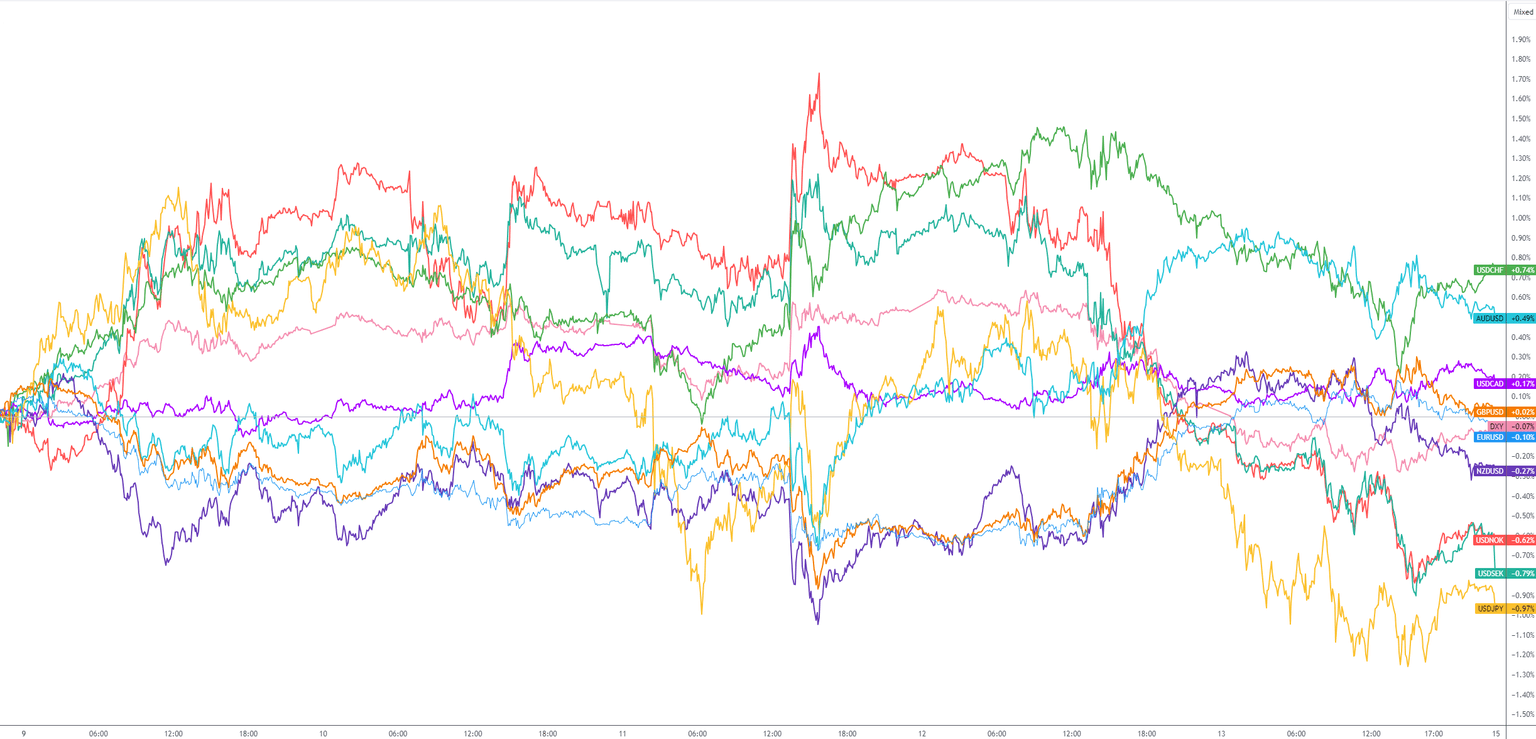

G10 FX (five-day change):

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,