Week Ahead – Fed and ECB decisions set the stage for US payrolls [Video]

![Week Ahead – Fed and ECB decisions set the stage for US payrolls [Video]](https://editorial.fxstreet.com/images/Macroeconomics/MonetaryPolicy/ECB/ecb-european-central-bank-frankfurt-germany-60028418_XtraLarge.jpg)

An explosive week lies ahead for global markets, featuring central bank decisions in the United States, Eurozone, and Australia, alongside the latest edition of nonfarm payrolls. The Fed is expected to raise interest rates one final time, so the dollar will react mostly to any signals around future action. But the euro might enjoy even greater volatility, as traders are split on the size of the upcoming ECB rate increase.

Fed to play its final card

The US economic machine seems to be gathering momentum, with the latest business surveys pointing to a resurgence in demand and an acceleration in jobs growth entering the second quarter. Recession concerns have receded for now, especially after the banking stress calmed down.

Nonetheless, the bond market continues to scream that there is economic pain on the horizon, and even the Fed’s own research staff anticipated a “mild recession” later this year in its latest projections. The general sense among investors is that the downturn has merely been postponed, not canceled.

This is probably why market pricing continues to insist the Fed is about to deliver its last rate increase next week, and that rates will be slashed before the year is over. Traders currently assign a 90% probability for the Fed to raise rates by a quarter-point on Wednesday, in what is expected to be the ‘finale’ of this cycle.

Despite mounting signs that core inflation might be stickier than previously envisioned, there’s little concern in market circles about further rate increases beyond next week. And this is precisely the risk surrounding this meeting - will the Fed truly signal that its job is done or keep the door open for more action?

From a risk management perspective, it would be almost foolish to close the door for further tightening. After all, the economy is not rolling over yet and if inflation proves persistent, even higher rates might be required. Policymakers want to preserve optionality in such uncertain times, so the path of least regrets is to put emphasis on data dependence and signal that rates can still edge higher if needed.

Such a message could catch investors by surprise, since market pricing currently does not envision any higher rates. If that’s the case, or if Chairman Powell attempts to dispel speculation for rate cuts like he did at the previous meeting, the dollar could benefit.

On the data front, the ball will get rolling with the ISM manufacturing survey on Monday, ahead of the non-manufacturing index and the ADP jobs print on Wednesday that will serve as a prelude for Friday’s official employment report. Nonfarm payrolls are seen at 180k in April, which seems fair considering the mixed signals from early indicators.

Even though the S&P Global business surveys pointed to the fastest pace of job creation since last summer, applications for unemployment benefits rose during the NFP survey period, indicating a worrisome increase in worker layoffs. The data releases ahead of Friday’s employment stats will provide more color.

How hard will ECB swing the rate-hike bat?

Over in euro land, most financial hubs will remain shut on Monday for the Labor Day holiday, although things will fire up on Tuesday with the latest inflation numbers for the Eurozone.

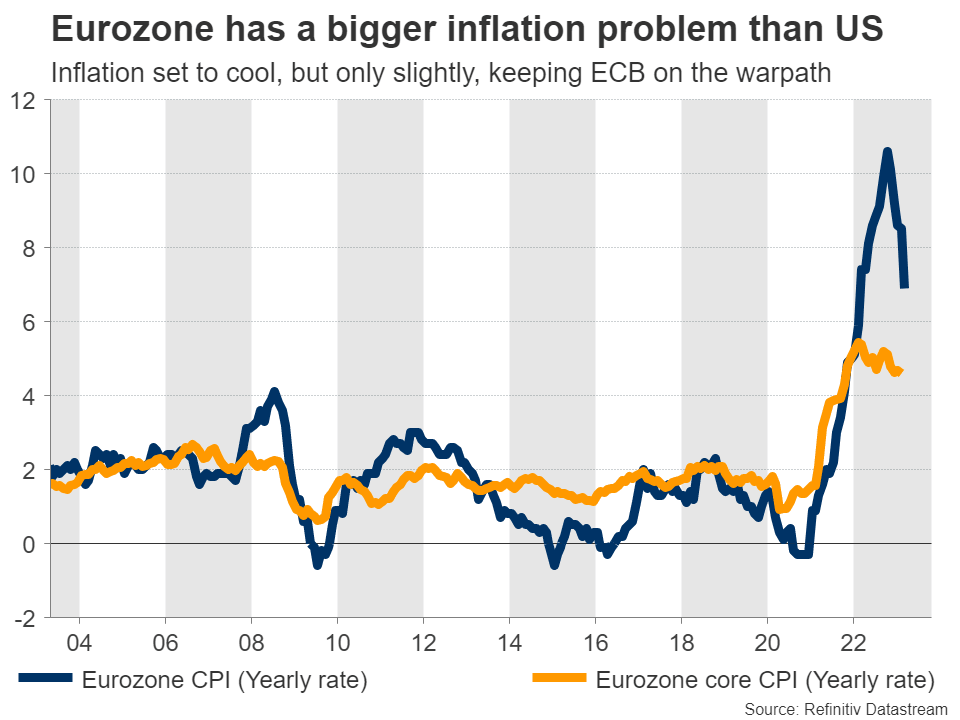

Forecasts point to a slight deceleration in inflation, something supported by the decline in oil prices but also by business surveys, which showed companies raising their prices at the slowest pace in over a year.

Still, these surveys stressed that the slowdown in price hikes was not very significant and that upward inflation momentum persists, concentrated mostly in the services sector. That’s a worrisome sign for the European Central Bank, which meets on Thursday.

Investors are ‘certain’ there will be a rate increase but are split on the size, assigning a 70% probability for a quarter-point move and a 30% chance for a larger half-point increase. It’s a tough choice because although the economy seems to be gathering momentum and inflation continues to rage, there’s also a risk of overdoing it, since the full impact of previous rate rises hasn’t been felt yet.

A middle-of-the-road solution would be to raise rates only by a quarter-point, but accompany that with hawkish language hinting at more to come. Of course that’s already baked into the cake, as markets think the ECB will keep tightening through the summer.

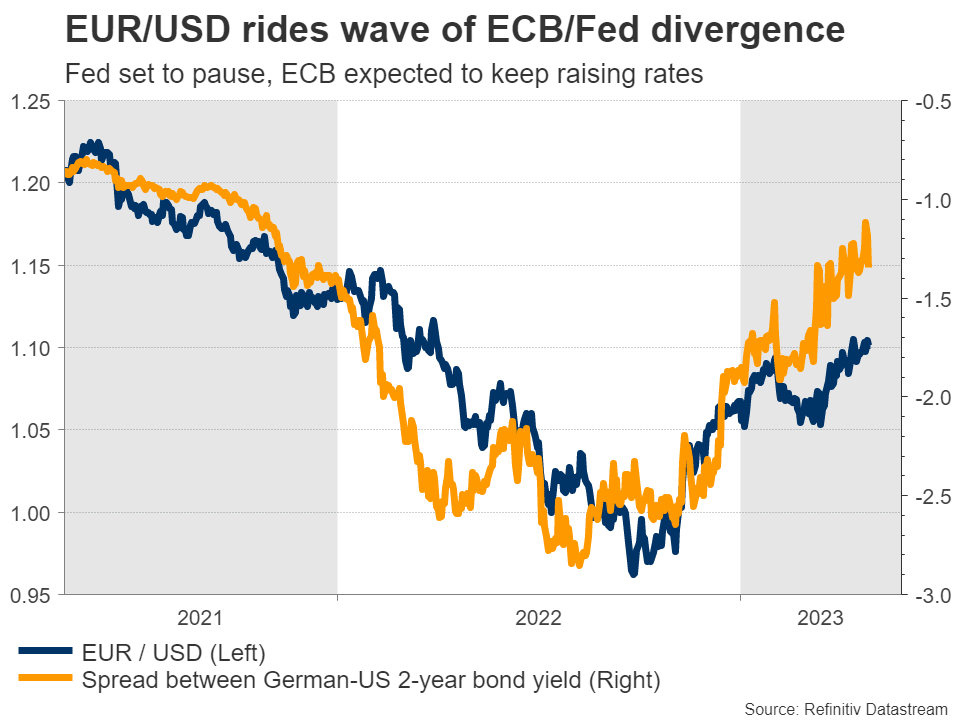

Such an outcome might be somewhat bearish for the euro, at least initially, given how markets have priced this decision. In the bigger picture, the euro seems to be riding the wave of central bank divergence with the ECB expected to race ahead of the Fed in raising rates, although a break above $1.11 in euro/dollar is needed to signal trend continuation.

RBA meets, New Zealand and Canada await data

Crossing into the realm of commodity-sensitive currencies, the Reserve Bank of Australia is expected to do nothing when it decides on Tuesday. Markets assign just a 10% chance for a rate increase.

With the RBA moving to the sidelines, the main variables of the Australian dollar moving forward might be how global risk sentiment and commodity prices evolve. The same is true for the Canadian and New Zealand dollars, as those central banks have also paused their tightening cycles or are about to.

Those economies will both see the release of employment data next week. New Zealand’s jobs report for Q1 will hit the markets Thursday, ahead of the monthly numbers from Canada on Friday.

Author

Marios graduated from the University of Reading in 2015 with a BSc in Economics and Econometrics. Prior to joining XM as an Investment Analyst in December 2017, he was providing financial analysis, reporting and consulting service