Week ahead: February’s PCE rates to be USD’s next big test

As the week is coming to an end we turn our attention to what next week has in store for the markets. On Monday, we get the preliminary PMI figures for March of Australia, Japan, France, Germany, the Euro Zone as a whole, the UK and the US. On Tuesday, we get Germany’s Ifo indicators, UK’s CBI distributive trades and the US consumer confidence, all being for March. On Wednesday we get Australia’s CPI rates, Japan’s chain store sales, UK’s CPI rates, the US durable goods orders, all for February, while on a monetary level, we note from the Czech Republic’s CNB repo rate decision. On Thursday, we get from Norway Norgesbank’s interest rate decision, and from the US the final GDP rate for Q4, and the weekly initial jobless claims figure. On Friday, we get from Japan tokyo’s CPI rates for March, UK’s retail sales for February, Germany’s GfK Consumer Sentiment for April, UK’s GDP rate for Q4, France’s preliminary HICP rate for March, Switzerland’s KOF indicator for March, Euro Zone’s Business Climate for March, the US consumption rate for February, the US PCE rates also for February, Canada’s GDP rate for January and the US preliminary University of Michigan consumer sentiment.

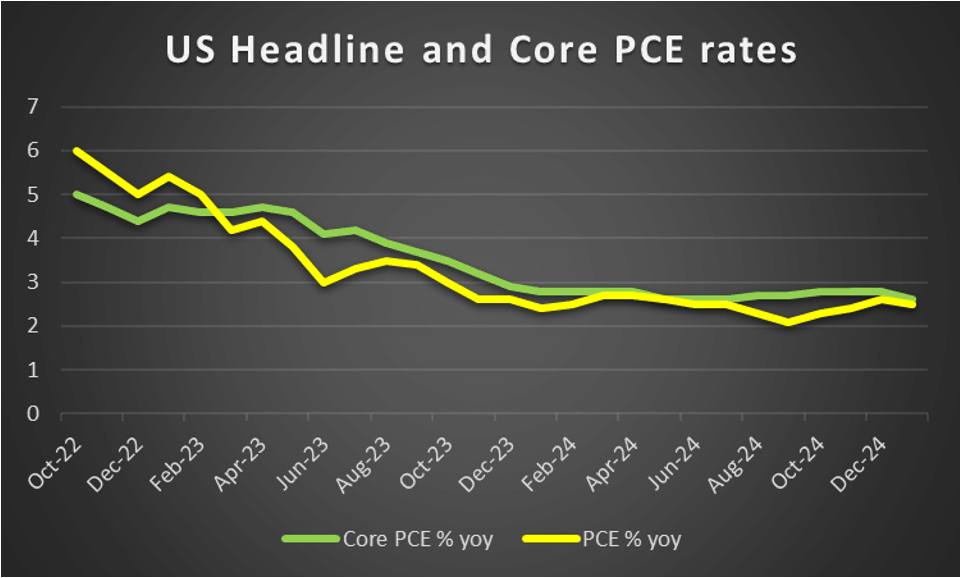

USD – February’s PCE rates ahead

The Fed’s interest rate decision last Wednesday may have been the key event for the USD in the past few days. The bank, as was widely expected, kept rates unchanged and signaled that more easing is in the pipeline, yet seems in no hurry to cut rates. It also cut its growth forecast for the US economy while at the same time enhanced its inflation expectations allowing for stagflation concerns to emerge. Overall the release, intensified the market’s dovish expectations, increasing the number of expected rate cuts until the end of the year, from two to three. On a fundamental level, US president Trump’s request for the Fed to proceed with rate cuts may have alienated market participants and any indications for further tariffs on US imports could weigh on the USD as they could enhance worries for the US economic outlook. On a macro level, we note the release of the final GDP rate for Q4 24, yet the highlight of the week may prove to be the release of the US PCE rate for the past month, next Friday. A possible acceleration of the rates could enhance the Fed’s narrative for an inflationary effect from the tariffs allready imposed and thus provide support for the USD.

Analyst’s opinion (USD)

"With the Fed’s interest rate decision out, we expect fundamentals to be swayed primarily by any Trump surprises. Yet Fed policymakers are scheduled to speak in the coming week and should they sound dovish enough could weigh on the USD. On a macroeconomic level, the release of the final Q4 24 GDP rates and the February PCE rates are expected to generate interest."

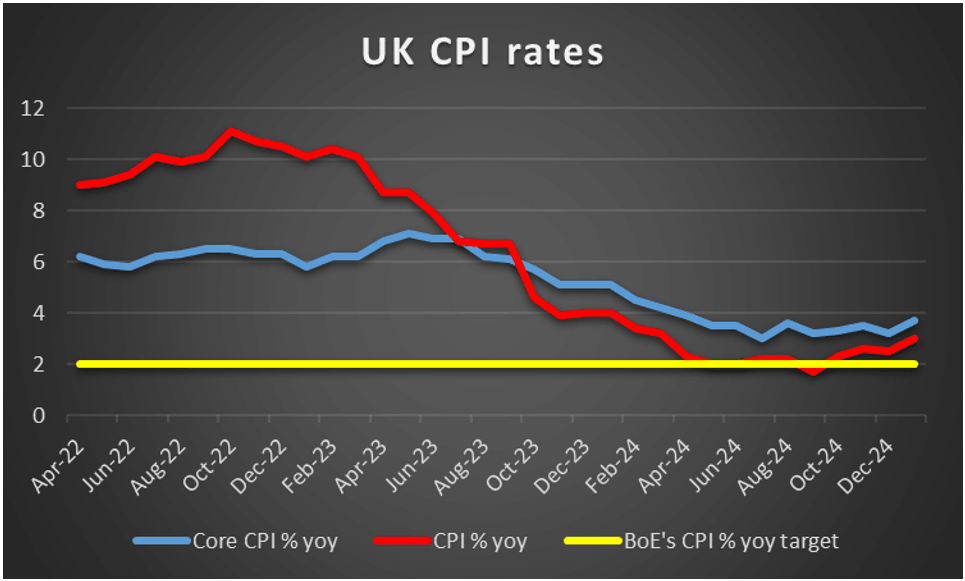

GBP – BoE remained on hold, UK’s February CPI rates coming up

As for pound traders, we make a start by noting that BoE remained on hold as expected yesterday, and the comment in its accompanying statement that “a gradual and careful approach to the further withdrawal of monetary policy restraint is appropriate”, may have tilted the tone to the hawkish side. Yet we still see the bank’s orientation being on more easing of its monetary policy which could weigh on the pound and its characteristic how market expectations for a rate cut in the bank’s next meeting intensified after the release. On a macro-economic level we note the tightening of the UK employment market for January, with the employment change figure rising beyond expectations, yet the average earnings growth rate slowing down. In the coming week, we note the release of the preliminary March PMI figures and the January retail sales rate, yet the main release is expected to be the CPI rates for February. A failure of the rates to slow down or even a possible acceleration could provide some support for the pound as the release would imply persistent inflationary pressures in the UK economy, while a slowdown could weigh on the sterling as it would be encouraging for the BoE to proceed with more rate cuts.

Analyst’s opinion (GBP)

“We see the case for UK’s CPI rates to play a central role in the pound’s direction next week, while on the fundamental side, any dovish comments in the coming week, by BoE Governor Bailey and MPC member Dhingra could weigh on the pound.”

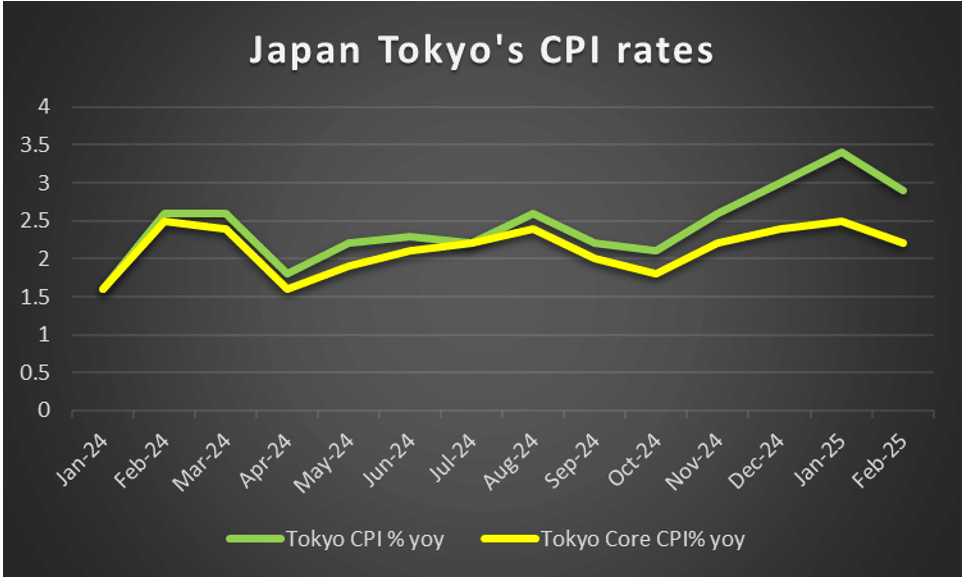

JPY – BoJ remained on hold, inflation eased

BoJ remained on hold on Tuesday as was expected and seems to maintain a hawkish orientation, which in turn may allow for rate hikes to come. Yet the bank also in its accompanying statement highlighted the risks in international trade by stating that “there remain high uncertainties surrounding Japan's economic activity and prices, including the evolving situation regarding trade and other policies in each jurisdiction and developments in overseas economic activity”. Overall we note that should the market’s current expectations for the bank to tighten further its monetary policy within the year, intensify, we may see JPY getting some support. Hence we note the release of the meeting summary of opinions next Friday, which could shed more light on the bank’s intentions. Should we see some persistence in hiking rates in the future, the release could support JPY, while any doubts could weigh. On a macroeconomic level, we note the easing of inflationary pressures in the Japanese economy as February’s CPI rates slowed down, practically contradicting BoJ’s narrative. In the coming week we note the release of Tokyo’s CPI rates for March which tend to act as a barometer for the inflation in the nation as a whole and a possible acceleration could provide some support for JPY.

Analyst’s opinion (JPY)

“We continue to view the market’s expectations for BoJ’s intentions as the main issue determining JPY’s direction. Furthermore we also highlight the possibility of safe haven flows which could also affect the Yen to either direction depending on the market sentiment. ”

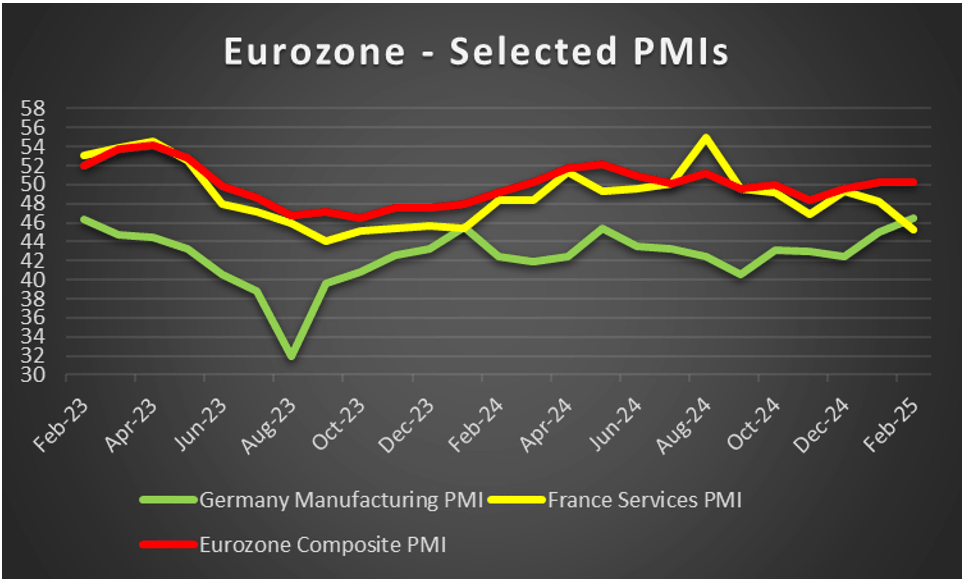

EUR – Preliminary March PMI figures eyed

EUR traders were preoccupied primarily with fundamentals surrounding the common currency in the past few days. The recent voting of the newly elected German Parliament to ament the German constitution’s clause for a 0.35% deficit in Germany’s budget practically has created the conditions for a substantially expansionary fiscal policy in the Euro Zone. Key sectors to be invested in by the German government are infrastructure and defence. We see the case for any further signals of more government spending nationwide or at an EU level, to have a supportive effect of the single currency. On the other hand the trade war with the US and any further escalation of tensions in the trade relationships with the US could have a detrimental effect on the EUR. It’s characteristic that ECB President Lagarde, stated to the EU Commission today that the EU needs to be ready for a tariff blackmail from the US. On a monetary level, we see the case for ECB’s dovish intentions to remain present and thus could weigh on the EUR in the coming week should they be intensified. One issue that tends to impose some doubts on further easing of ECB’s monetary policy could be exactly the expansionary fiscal intentions of the EU as they could boost prices. On a macro-economic level we highlight the release of the preliminary PMI figures for March on Monday and intend to focus on the Germany’s manufacturing sector. An improvement of economic activity could play an auxiliary role for the EUR.

Analyst’s opinion (EUR)

“We expect fundamentals to continue to lead the way for the single currency in the coming week, and intentions for further expansion in EU’s fiscal policy could support the EUR. On the flip side any dovish statements by ECB officials could weigh on the single currency in the coming week.”

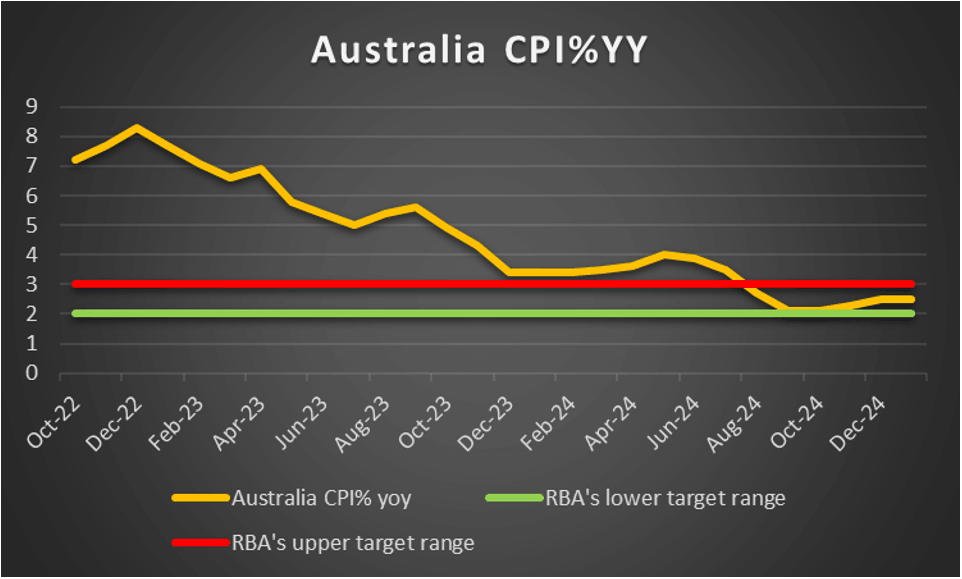

AUD – February’s CPI rates in focus for Aussie traders

The Aussie seems to be losing ground as a risk off sentiment dominated the markets in the last days of the week. On a fundamental level, given the market’s perception that the Aussie is a riskier asset in the FX market, should we see risk aversion being enhanced in the coming week, we may see the Aussie losing further ground and vice versa. Also let’s not forget the close Sino Australian economic ties, and a possible improvement in the conditions for the Chinese economy could support the Aussie. On a monetary level we expect the RBA to maintain its doubts for extensive rate cuts to come and to remain data driven, possibly even shorten its horizon given the uncertainty in the international economy and Australia’s outward orientation. Even the drop of the employment change figure for February into the negatives could be omitted, which normally tends to suggest an easing of RBA’s monetary policy, given that the unemployment rate remained unchanged at relatively low levels, implying a tight Australian employment. Hence we highlight on a macroeconomic level, coming Wednesday, the release of Australia’s CPI rates for February. Should the rates show a persistence of inflationary pressures in the Australian economy, we may see the Aussie getting some support as it could intensify further any doubts of RBA for extensive rate cuts, as the bank’s main focus is on inflation.

Analyst’s opinion (AUD)

“In the coming week a possible risk averse approach by the market could weigh on the Aussie, while the highlight of attention for Aussie traders is expected to be the release of Australia’s February CPI rates and a possible persistence of inflationary pressures could support the Aussie.”

CAD – Elections coming up?

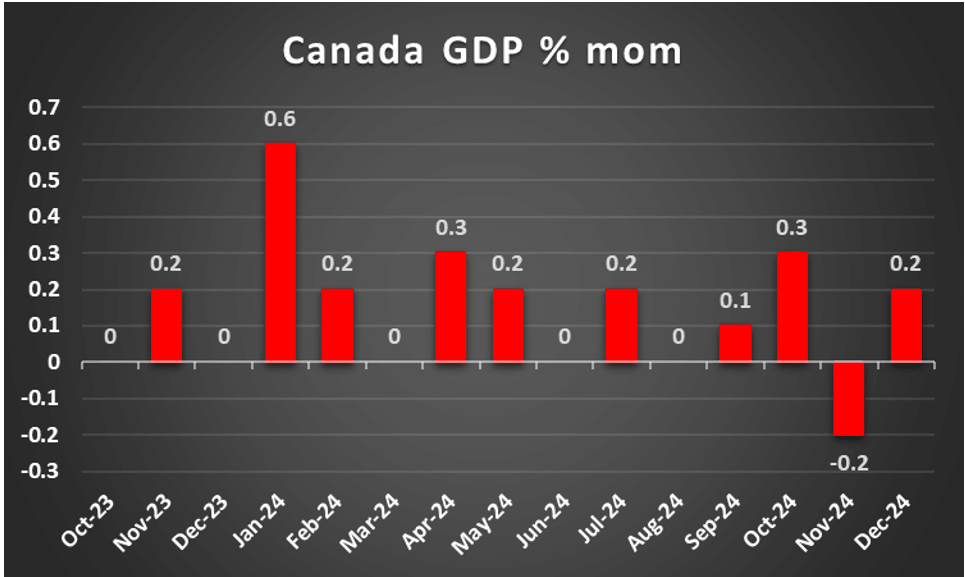

On a political level, CAD traders got a surprise as Mark Carney, former Governor of BoC and new leader of the Liberal Party and PM of Canada is expected to call for a snap election on the 28th of April. Given that the Liberal party has being doing great in the polls recently, having recovered the lost ground against the Conservatives and then some, PM Carney may try to stabilise his position now,rahter than later, given the trade war with the US and given that an election must be held anyway by October this year. On a fundamental level, any further escalation of the trade war with the US could weigh on the CAD, as could any isk averse market sentiment. Also on a fundamental level, we note the rise of oil prices yesterday and today and furhter advances of the prices of black gold in the coming week, could support the Loonie, given Canada’s status as a major oil producing economy. On a monetary level, BoC seems to be easing its dovishness further given BoC Governor Macklem’s comments yesterday and should that become more evident in the coming week, it could be supprotive for the CAD. On a macreconomic level, it’s a rather empty calendar in the coming week for CAD traders, at least until Friday, when Canada’s monthly GDP Rate is to be released and a possible slow down could weigh on the Loonie.

Analyst’s opinion (CAD)

“We expect fundamentals to lead the CAD in the coming week, with a possibly less dovish BoC supporting it. At the same time, a risk off market sentiment could weigh on the CAD while on a macroeconomic level we note the release of Canada’s GDP rate for February next Friday. ”

General comment

As an epilogue, we expect the USD to ease its dominance in the FX market as the US releases are expected to be reduced in number and gravity if compared to the past few days. Such a scenario may allow other currencies to come under the spotlight thus creating a more a balanced mix in the FX market. We also note the weakening of the TRY given the political unrest in Turkey and a possible escalation of the political tension could weigh on the TRY further. In US equities markets we note the doubts of the bears given that major US stock market indexes seem to have halted their four week freefall. Nevertheless, increased uncertainty among market participants could lead to further losses in the coming week for US equities and vice versa. As for gold’s price, the precious metal has reached new record high levels and the bulls seem to maintain their dominance, yet the precious metal’s price may have reached overbought levels and may be ripe for a correction lower.

Author

Peter Iosif, ACA, MBA

IronFX

Mr. Iosif joined IronFX in 2017 as part of the sales force. His high level of competence and expertise enabled him to climb up the company ladder quickly and move to the IronFX Strategy team as a Research Analyst. Mr.