Week ahead – BoJ, Fed and BoE meetings: A hike, a hold and a cut? [Video]

-

A trio of central bank decisions coming up from the BoJ, Fed and BoE

-

One might hike, one might stand pat and the other cut rates

-

ECB to also be in focus as Eurozone flash GDP and CPI data are due

-

Week will culminate with crucial US jobs report

![Week ahead – BoJ, Fed and BoE meetings: A hike, a hold and a cut? [Video]](https://editorial.fxstreet.com/images/Macroeconomics/CentralBanks/BOJ/Bank_of_Japan_2016_XtraLarge.jpg)

BoJ expected to taper; will it hike too?

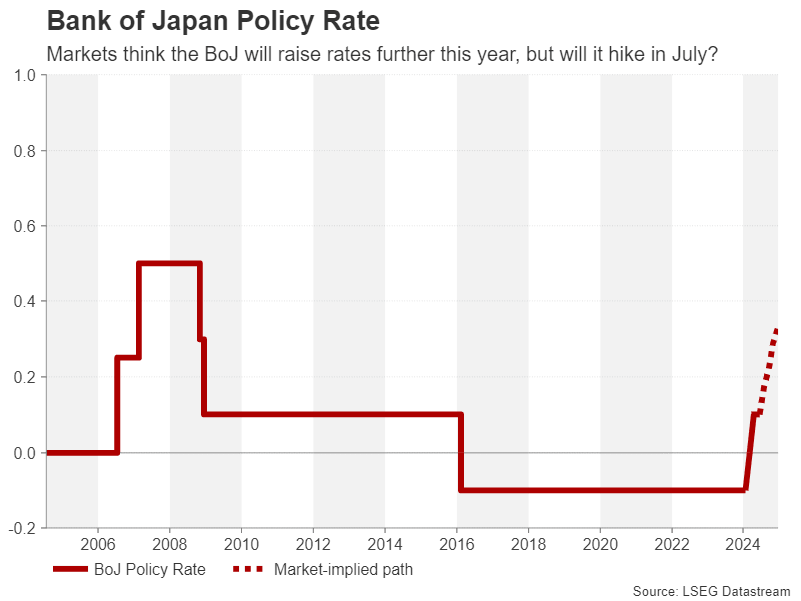

The Bank of Japan has barely left the headlines lately. Whether it’s speculation about rate hikes, the constant hints about bond tapering or suspicions of intervention in foreign exchange markets, Governor Ueda has certainly been making his mark since taking over.

Next week’s gathering on July 30-31 looks set to give the bank more prime airtime as policymakers have already flagged that a decision will be made at this meeting on how much to reduce bond purchases by. Reuters has reported that the current monthly purchases of six trillion yen could be halved in the coming years based on what sources have said.

However, there is less clarity about the likelihood of a rate hike as policymakers do not appear to have made up their minds yet on the precise timing of one even though most agree that further increases will be necessary this year. Investors on their part have upped their bets of a July move and a 10-basis-point hike is now about two-thirds priced in. Hence, there’s a lot of room for disappointment if the bank keeps rates unchanged.

The sluggish economy and concerns about weak consumer demand could justify the need for caution, particularly when inflation, whilst above target, is far from being rampant. Moreover, the yen’s impressive rebound in July has potentially provided policymakers some breathing space on the urgency of rate hikes.

However, even if there are no major surprises on Wednesday and the only announcement is the expected decision on scaling back bond purchases, it’s unlikely that policymakers would risk sounding dovish as this could derail the yen’s recovery. The bank’s latest outlook report may offer some additional clues on the future policy course in such a scenario. Nevertheless, given the scale of the yen’s rally, a hawkish hold could still trigger some profit taking in yen crosses.

No Fed rate cut in July

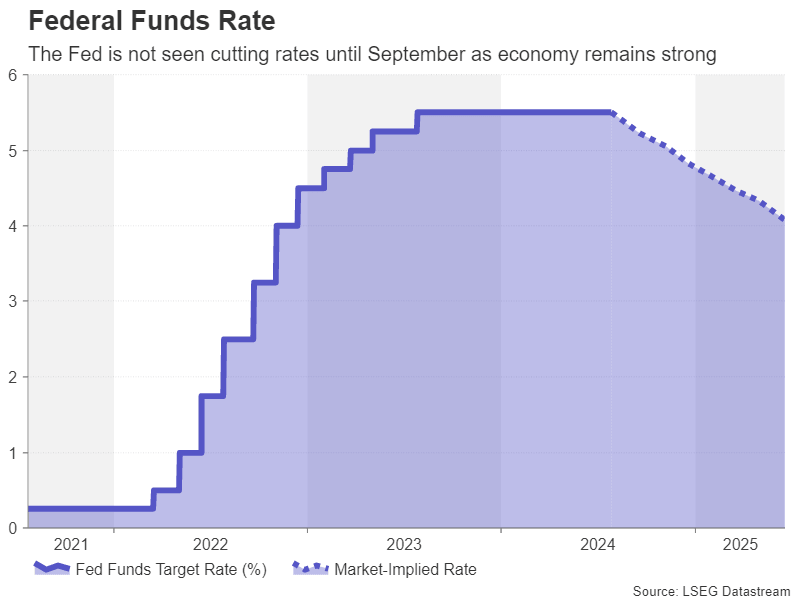

The Federal Reserve will announce its decision a few hours after the BoJ on Wednesday. Out of the three central banks, the Fed is the least likely to announce any policy change. If there was a remote possibility of a surprise cut, those odds were slashed even more after the stronger-than-expected GDP reading for the second quarter.

The US economy is displaying only mild signs of a slowdown and the same is true for the labour market. This backdrop has made it difficult for Fed officials to say with certainty that inflation is on a sustained path towards 2%. However, their most recent remarks indicate growing confidence that the target is within reach and the policy statement will likely be tweaked to reflect this, signalling a dovish tilt.

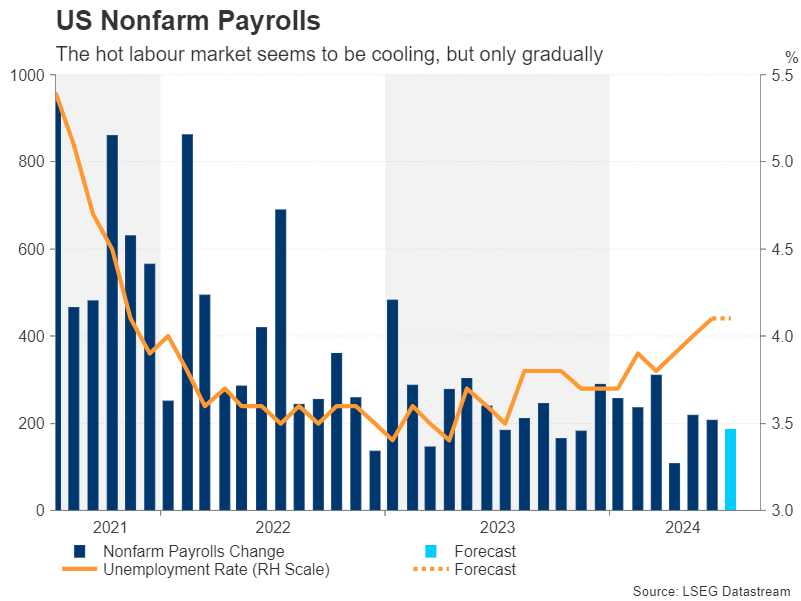

July NFP to keep Powell in check

Yet, Jay Powell will probably stop short of mentioning a specific timeframe for when the Fed will start its easing cycle so the downside risks to the US dollar from the meeting are limited. With the July nonfarm payrolls report due just a couple of days later on Friday, Powell will not want to risk pre-committing to a rate cut in case the data surprises to the upside.

After rising by 206k, the American labour market is projected to have added another 185k jobs in June. The unemployment rate is forecast to have remained steady at 4.1% and average hourly earnings growth is also anticipated to have maintained a similar pace to May month-on-month.

Weaker-than-expected jobs numbers could go some way in boosting sentiment on Wall Street but hurt the dollar, as it would reinforce the aggressive rate cut bets, while another strong print could exacerbate the current selloff in equities.

Investors will get the chance to pore over plenty of other data as well over the coming week, including the consumer confidence index and JOLTS job openings on Tuesday, the ADP employment report, Chicago PMI and pending homes sales on Wednesday, and of course the ISM manufacturing PMI on Thursday.

Will the BoE take the plunge and cut?

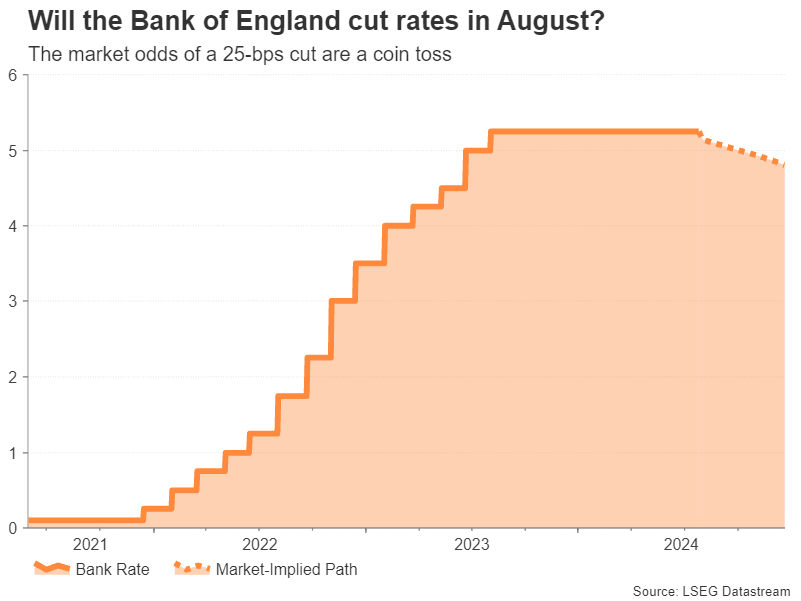

The Bank of England will round up next week’s central bank decisions and even though the UK election uncertainty has been removed, it’s unclear what the outcome will be on Thursday as a tight vote looms. After a few setbacks, inflation in the UK has fallen sharply this year, hitting the bank’s 2% target in the past two months. But BoE policymakers remain concerned about the still high services inflation and the very slow decline in wage growth.

The latest commentary suggests there is no unanimity within the MPC on whether or not to cut rates in August and market opinion is split 50-50 too. But there have been subtle hints from policymakers that rates don’t need to stay as high as the current 5.25% to maintain restrictive policy so the odds are tilted somewhat towards a 25-bps reduction.

What may ultimately sway MPC members’ minds is the bank’s updated quarterly projections. If they decide to start easing, it will likely be a close call and be communicated as a hawkish cut amid the persisting upside risks to inflation. So, despite a cut not being fully priced in, the pound may not necessarily slide much on the news.

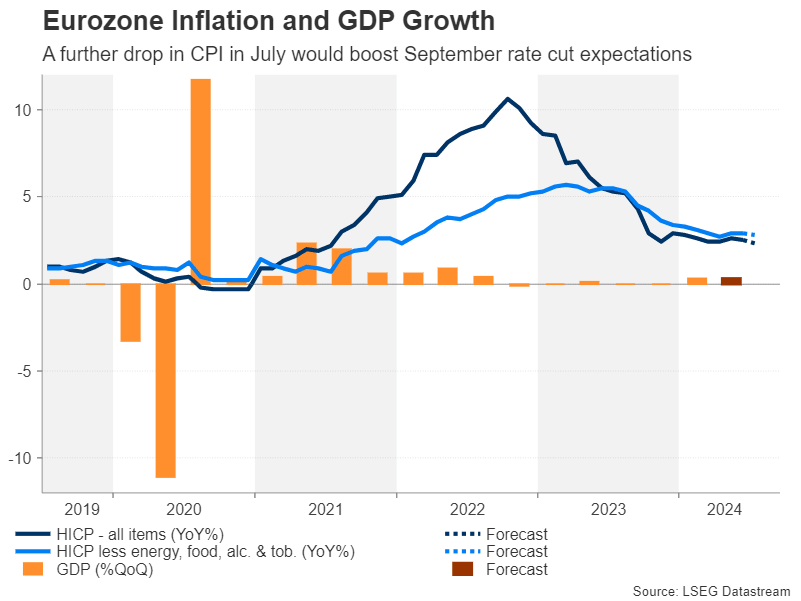

Eurozone CPI eyed as economic rebound falters

Over in the continent, the Eurozone’s economic recovery appears to have hit a roadblock. But figures out on Tuesday are expected to show that for the three-month period to June, GDP expanded by a respectable 0.3% q/q, pushing the annual growth rate up to 0.6%.

For the European Central Bank, the more up-to-date PMI surveys, which deteriorated further in July, will likely take precedence, especially for the doves who favour another rate cut in September. Wednesday’s flash CPI estimates will therefore be more significant for investors.

There was relief in the June report when headline inflation fell back to 2.5% y/y and there could be more good news for July. The harmonized index of consumer prices is projected to ease further to 2.3% y/y in July, coming within short distance of the ECB’s 2% goal.

The impact of such a drop will be lessened if there isn’t a similar decline in the underlying measures of inflation. Thus, for the euro to come under significant pressure against the dollar, there will have to be progress in core inflation too.

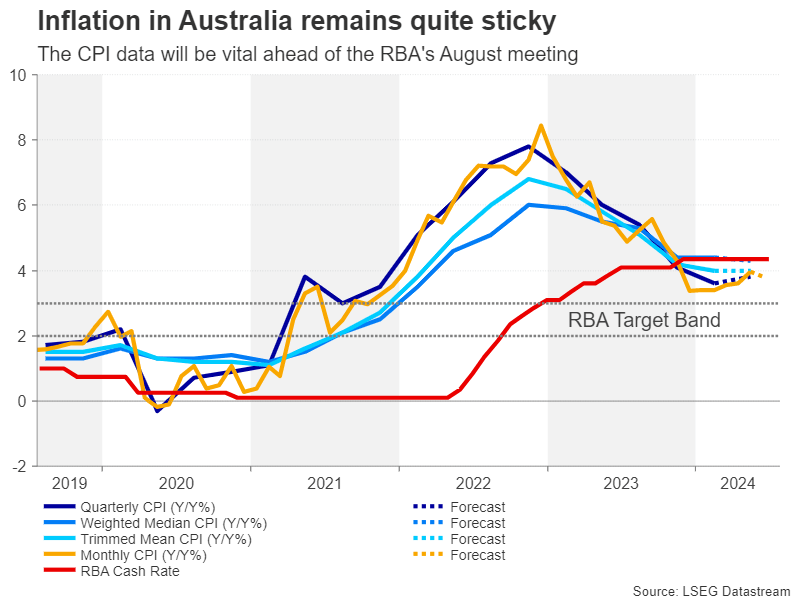

Australian CPI might pave way for RBA hike

It will be an unusually busy period for Australian data next week, with releases ranging from retail sales to trade. The highlight, though, will be Wednesday’s quarterly CPI readings.

Inflation in Australia has bucked the global trend and has been edging higher all year, reaching 4.0% y/y in May in the monthly measure. The Reserve Bank of Australia has been hesitant about raising interest rates again, but the more reliable and complete quarterly numbers may just convince policymakers that further tightening is needed. And with the next meeting coming up on August 6, the timing couldn’t be better.

The latest risk-off episode in the markets has been devastating for the Australian dollar so a hotter-than-expected set of CPI figures could provide the currency with a much-needed boost. Also on aussie traders’ radar will be Chinese manufacturing PMIs out on Wednesday and Thursday, amid the ongoing pessimism about China’s economy.

Author

Mr Boyadjian graduated from the London School of Economics in 1999 with a BSc in Business Mathematics and Statistics. Following graduation, he joined PricewaterhouseCoopers in the Business Recoveries team, where he was responsibl