The week that was:

Earnings season kicked off on a high note, with most results exceeding estimates and lifting US equity indices to fresh record highs. This, coupled with China’s fresh round of stimulus measures failing to inspire investors, tier-1 data from G10 economies, and the European Central Bank (ECB) announcing another 25 basis point (bp) rate cut, made for a rather eventful week.

UK CPI inflation below target

UK CPI inflation (Consumer Price Index) dipped below the Bank of England’s (BoE) 2.0% inflation target to 1.7% (YoY), touching a three-year low and was comfortably lower than the 2.2% reading in August. This saw the British pound (GBP) fall sharply and loosened the trapdoor so the BoE could become ‘more aggressive’ with easing policy. Investors are nearly fully pricing in a 25bp rate reduction for next month’s meeting, with another potential cut in December. However, as the FP Markets Research Team highlighted last week, ‘while a rate cut is possible in November, strengthened by comments from BoE Governor Andrew Bailey in September – communicating the central bank could become a ‘bit more activist’ in easing policy should inflation continue to subside – the measures announced at the UK Annual Budget at the end of the month will likely be the final obstacle.

ECB cuts by 25bps

The ECB reduced all three benchmark rates by 25bps, directing the euro (EUR) lower versus G10 peers. The rate cut marked the first time in over a decade that the ECB opted for a back-to-back rate cut. The move was largely priced in based on easing inflation, weaker PMI metrics (Purchasing Managers’ Index), and dovish commentary from ECB officials. Forward guidance was rationed at the meeting – no surprises there; the central bank echoed their data-dependent stance and that they’re not ‘pre-committing to a particular rate path’. The FP Markets Research Team added: ‘Because of the trajectory of inflation and faltering economic growth (particularly in Germany), it should not be surprising that investors are pricing further policy cuts down the road’. Markets are now pricing in 35bps of cuts for December’s meeting, demonstrating a bulkier 50bp reduction may be seen, particularly if inflation cools further and growth metrics signal softness. That said, a 25bp reduction remains possible; core inflation is north of 2.0% (2.7%) on a YoY basis, and services inflation and wage growth remain elevated.

Strong US retail sales

Finally, data from the US was thin; the focus was largely on retail sales numbers, which came in stronger than economists had anticipated. Between August and September, retail sales jumped by 0.4%, up from 0.1% in previous data (market consensus: 0.3%), sending US Treasury yields and the US dollar (USD) higher. In addition, between August and September, excluding autos, retail sales rose by 0.5% from 0.1% prior; the retail control group sales also increased by 0.7% from 0.3% prior. The latter is used as part of the calculation of the country’s Gross Domestic Product (GDP). In part, increased consumer spending was underpinned by lower gasoline prices and robust income growth. This resilience is unlikely to discourage the US Federal Reserve (Fed) from cutting rates; the Fed is expected to reduce the funds rate by another 25bps next month (24bps of easing priced in), with another cut possible in December. This follows announcing a 50bp reduction at September’s meeting, taking the funds rate down to 4.75–5.00%.

The week that is:

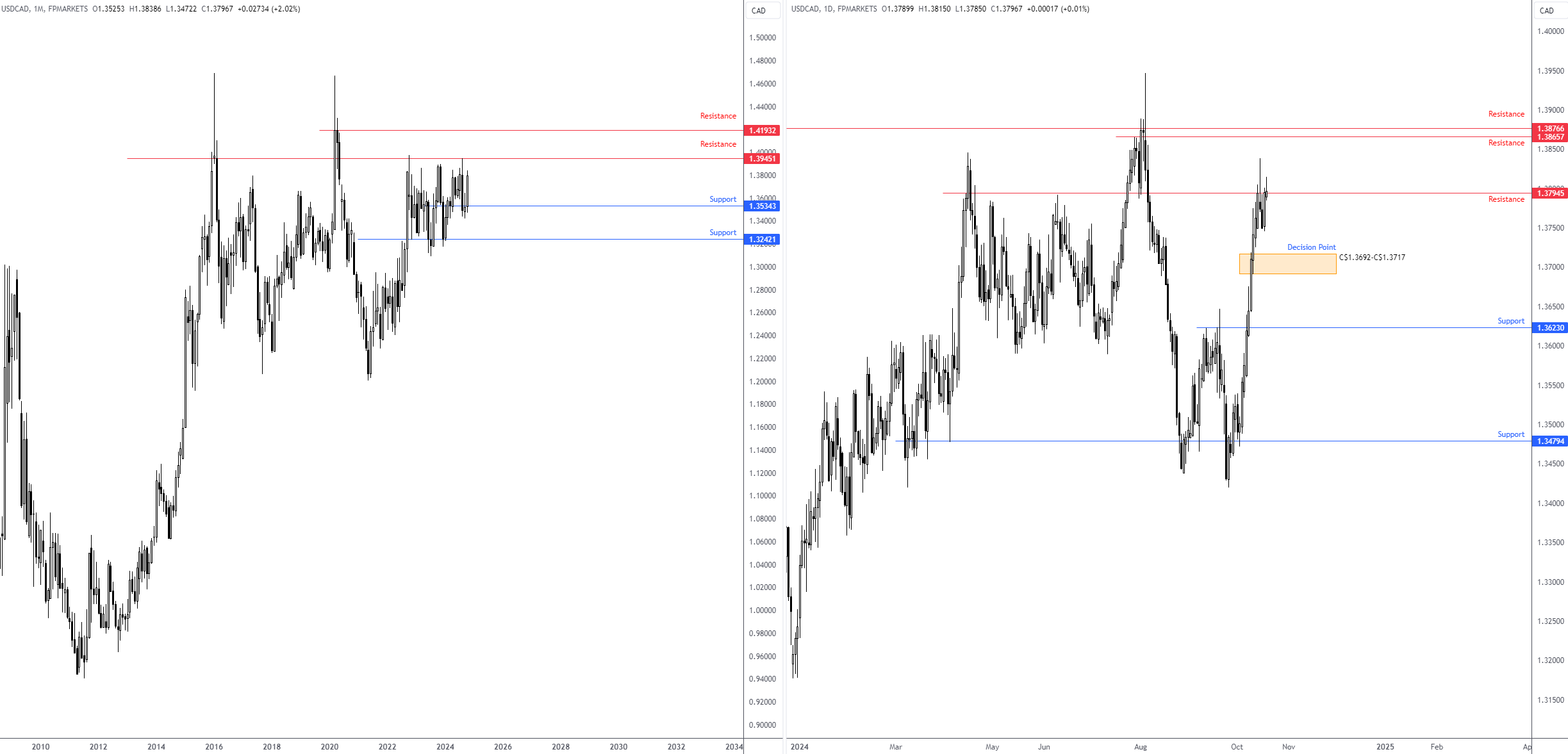

BoC: 25 or 50?

The Bank of Canada’s (BoC) update will be a key risk event for market participants on Wednesday at 1:45 pm GMT. Investors have assigned a 97% probability that the central bank will run with a 50bp reduction following September’s broadly softer-than-expected inflation data. A 50bp rate cut this week will mark its fourth consecutive reduction and take the overnight rate to 3.75% after the central bank kicked off its easing cycle in June this year. Interestingly, should the BoC push with a 50bp decrease, this would increase the rate differential between the BoC and the Fed by 125bps, potentially weighing on the Canadian dollar (CAD).

Last week, Statistics Canada revealed that CPI inflation cooled to 1.6% (YoY) in September, its lowest rate since early 2021 and down from August’s reading of 2.0%. According to the release, the primary driver was a drop in gasoline prices, tumbling 10.7% in September (YoY) from a decline of 5.1% in August. CPI Median and Trim measures remained unchanged in September, averaging 2.35%.

On the jobs front, employment numbers came in better than expected, adding more than double the number of jobs in September (46,700), up from 22,100 in August. Also relevant, full-time employment change rose by 112,000, its largest gain since mid-2022. Additionally, unemployment ticked lower to 6.5%. However, it is worth pointing out that the unemployment rate remains a full percentage point above what it was this time last year, though this is largely due to increased immigration rather than job losses.

GDP growth for Canada expanded by 0.2% in July, with August estimated to have stalled. Consequently, economists forecast Q3 24 growth to come in below the BoC’s Q3 24 estimate (2.8%).

As noted, a 50bp cut is priced in for this week’s decision. This is largely due to inflation numbers and the BoC’s Business Outlook Survey (Q3 24) showing that sentiment remains subdued (the report also noted that future expectations are more optimistic). However, a handful of desks call for a smaller 25bp reduction based partly on a loosening labour market and rising GDP growth (albeit less than the central bank forecasted, as noted above).

In September, BoC Governor Tiff Macklem expressed the need for an acceleration in economic growth to ‘keep inflation close to the centre of the 1.0% to 3.0% inflation-control band’. Therefore, this could push the bank to opt for a bulkier 50bp cut, given lower-than-forecast growth.

While the rate decision is expected to take centre stage, investors will closely monitor the accompanying rate statement, the central bank’s economic forecasts (the Monetary Policy Report will deliver updated projections, which economists expect to be lower than prior projections), and the press conference.

What could this mean for the Canadian dollar this week? Should the BoC defy market consensus and opt for a 25bp reduction, this will likely see an unwind in CAD shorts. According to the technical picture, the USD/CAD is up 2.0% month to date and demonstrates scope to run higher until monthly resistance at C$1.3945. However, daily price is seen testing resistance at C$1.3795, which could continue to deliver a ceiling (particularly if the BoC runs with a 25bp cut); alternatively, punching north opens the door to daily resistance at C$1.3866.

Additional data to watch this week

Tuesday:

Eurozone, UK and US (Flash) Manufacturing and Services PMIs for October at 8:00 am, 8:30 am and 1:45 pm GMT, respectively.

Thursday:

US Weekly Unemployment Claims for the Week Ending 19 October at 12:30 pm GMT. Following the unexpected decline to 241,000 (week ending 12 October) from the previous week’s rise of 260,000 (due to disruptions from hurricanes), traders will be watching this print closely this week (expected: 247,000).

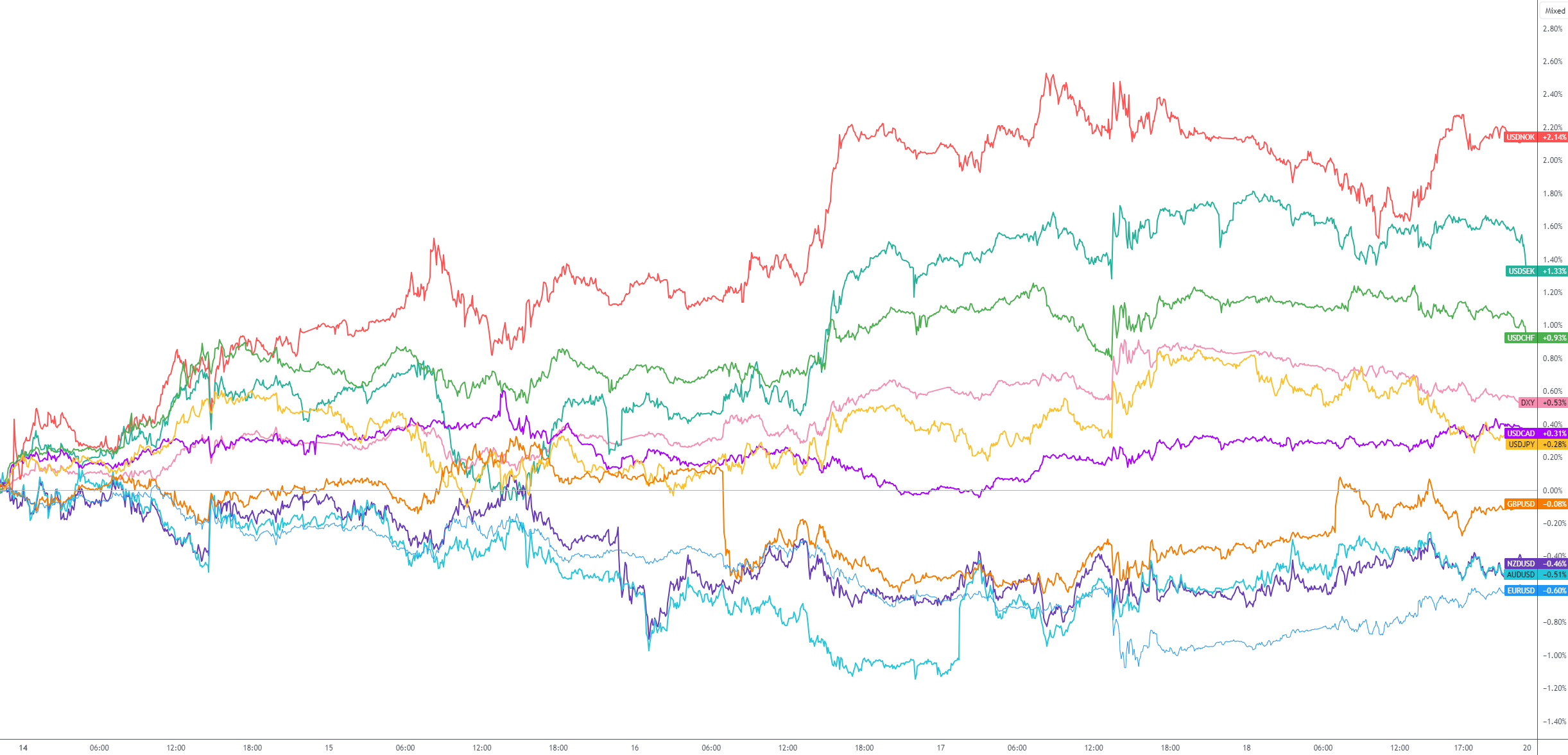

G10 FX (five-day change):

This material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP Markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for Difference (CFDs) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading CFDs you do not own or have any rights to the CFDs underlying assets.

FP Markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. A Product Disclosure Statement for each of the financial products is available from FP Markets can be obtained either from this website or on request from our offices and should be considered before entering into transactions with us. First Prudential Markets Pty Ltd (ABN 16 112 600 281, AFS Licence No. 286354).

Recommended Content

Editors’ Picks

EUR/USD bounces off lows, retests 1.1370

Following an early drop to the vicinity of 1.1310, EUR/USD now manages to regain pace and retargets the 1.1370-1.1380 band on the back of a tepid knee-jerk in the US Dollar, always amid growing optimism over a potential de-escalation in the US-China trade war.

GBP/USD trades slightly on the defensive in the low-1.3300s

GBP/USD remains under a mild selling pressure just above 1.3300 on Friday, despite firmer-than-expected UK Retail Sales. The pair is weighed down by a renewed buying interest in the Greenback, bolstered by fresh headlines suggesting a softening in the rhetoric surrounding the US-China trade conflict.

Gold remains offered below $3,300

Gold reversed Thursday’s rebound and slipped toward the $3,260 area per troy ounce at the end of the week in response to further improvement in the market sentiment, which was in turn underpinned by hopes of positive developments around the US-China trade crisis.

Ethereum: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.