Week ahead: With recession seemingly being ad portas

With recession seemingly being ad portas

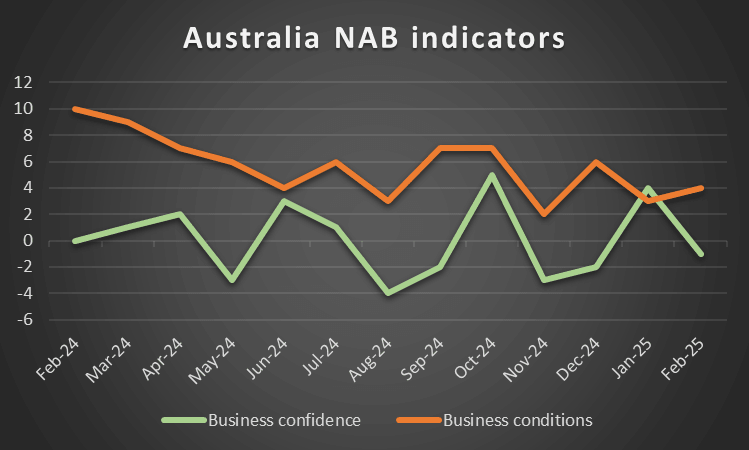

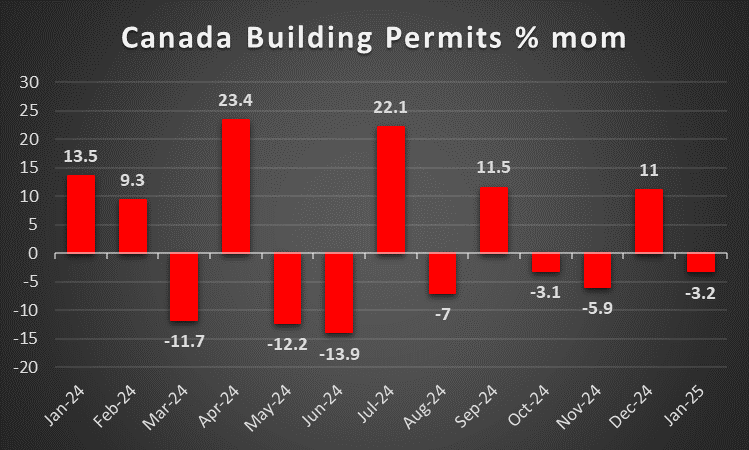

The week is coming to an end and we open a window at what next week has in store for the markets. On Monday, we get Germany’s Industrial output for February, UK’s Halifax House Prices for March and Euro Zone’s Sentix index for April. On Tuesday, we get Japan’s current account balance for February and Australia’s NAB indicators for March, while on Wednesday we note the release from New Zealand, RBNZ’s interest rate decision and in Japan BoJ’s Governor Ueda speaks and late in the American session, the Fed is to release the minutes of the March meeting. On Thursday, we get UK’s House price Rightmove for April, Japan’s Corporate Goods Prices for March, China’s inflation metrics for the same month, Sweden’s GDP rate for February, Norway’s CPI rates for March, from the Czech Republic the final CPI rates for the same month and the highlight is to be the US CPI rates for March, the weekly initial jobless claims figure and Canada’s building permits for February. On Friday we get UK’s GDP and manufacturing Output rates for February, Sweden’s CPI rates for March, the US PPI rates for March and the US preliminary University of Michigan consumer sentiment for April.

USD – March’s US CPI rates to move the markets

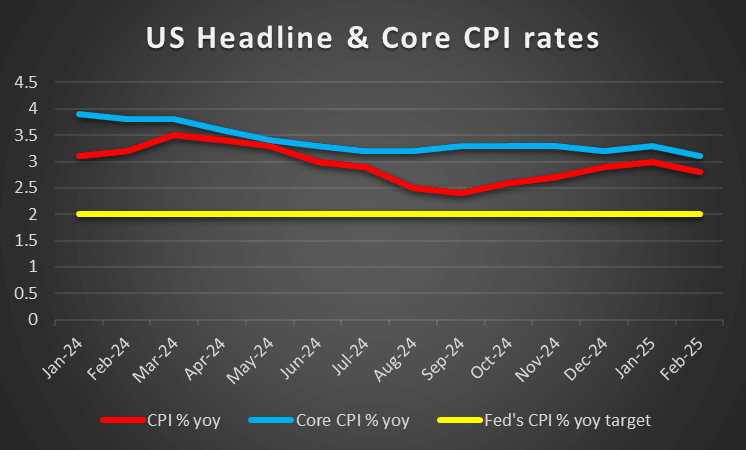

We make a start by noting that the US employment report for March is still to be released ad could possibly alter the bearish picture the USD is presenting since yesterday either way depending on the rates and figures to be released. In the coming week and with March’s employment data out we highlight the release of US CPI rates for the same month next Thursday, as the next big test for the greenback. Should the rates show persistence of inflationary pressures in the US economy could be supportive of the USD as it could enhance the Fed’s doubts for further rate cuts. Hence we highlight the release of the Fed’s March meeting minutes next Wednesday and the document is expected to be scrutinised by traders and analyst in search of more clues regarding the Feds’ intentions. It should be noted that the market’s expectations for the Fed to cut rates have been enhanced since the announcement of US President Trump’s tariffs and Fed Funds Futures imply that four rate cuts are expected by the bank until the end of the year. Yet on the other hand, a possible inflationary effect by Trump’s tariffs, should it emerge, could alter these market expectations. On a fundamental level, we highlight that US President Trump’s new tariffs came into effect and were harsher than the market may have initially expecting. The announcement intensified market worries for the US economic outlook and weighed considerably on the USD. It should be noted that the Atlanta Fed GDP Now rate for Q1 25, remained deep in the negatives, darkening the US economic outlook even further. We see the case for further escalation of the trade war to have a possibly bearish effect on the USD.

Analyst’s opinion (USD).

“Overall we see the case for the bearish tendencies of the market for the USD to remain with market attention increasingly being placed on the economic outlook of the US. Further worries for the US economy to slow down or even contract could drive the USD lower, while a possible enhancement of the Fed’s doubts to cut rates could allow for some respite for USD bears.”

GBP – February’s growth data in focus

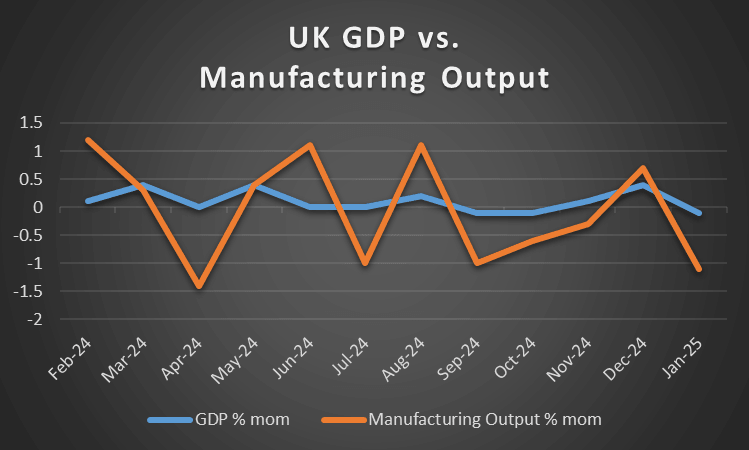

On a macroeconomic level, we note the easing of Uks’ house prices for the past month as well as the slower than initially estimated expansion of economic activity in the UK services sector for the past month. At the end of the coming week, we note the release of February’s GDP rate as well as other growth data for the same month related to the UK economy. Should the data imply a continuation of the contraction of the UK economy the release could weigh on the pound. On a monetary level, BoE seems to maintain some worries for a persistence of inflationary pressures in the UK economy as expressed on Tuesday by BoE policymaker

Greene. It should be noted though that the imposition of tariffs by the US could alter the bank’s stance. The market currently seems to expect the bank to cut rates by 25 basis points in tis May meeting and another cut in the August meeting and marginally prices in another rate cut in the December meeting. Hence should BoE policymakers which are scheduled to speak in the coming week, express further doubts for cutting rates, we may see the pound getting some support. On a fundamental level, it’s a positive that the US has imposed only the general blanket tariffs on UK products of 10%, which was the lowest imposed. Yet as UK PM noted US tariffs will clearly have economic impact on the UK.

Analyst’s opinion (GBP).

“Overall we see the interest of pound traders climaxing until Friday when the UK GDP rates are to be released. On a monetary level, any intentions of BoE policymakers to maintain the bank’s monetary level, at restrictive levels, could support the pound.”

JPY – BoJ’s intentions in the epicenter

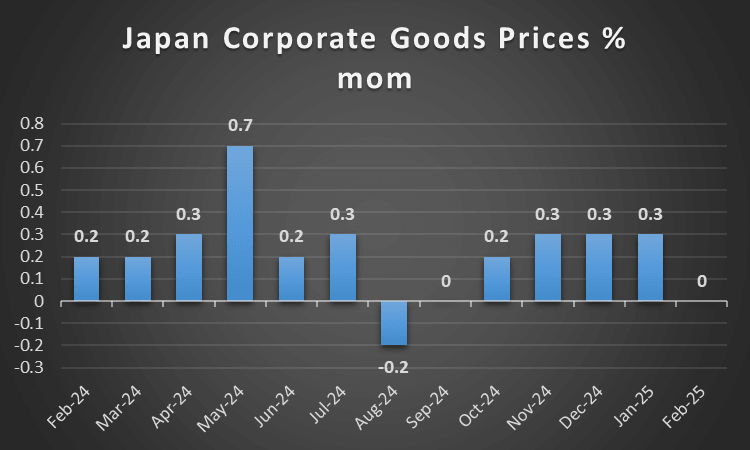

Japanese economic data released past week tended to be mixed. In the demand side of the Japanese economy, the wider than expected slowdown of the retail sales growth rate for February, was a negative. On the production side, we note the acceleration of the industrial output rate for February, while the Tankan indexes for Q1 sent mixed signals, a positive for the services sector and a negative for the manufacturing sector, with the latter possibly weighing more. In the coming week, we note the corporate goods prices rate for March, for the inflationary front while the current account balance for March may also stir some interest. On a monetary level, we note the market’s expectations for the BoJ to proceed with a rate hike possibly in July or September. Yet BoJ Governor Ueda warned of the possible hit to global trade from the US tariffs. Yet we still tend to maintain the view that the Bank is to maintain its hawkish intentions and highlight BoJ Governor UEDA’s speech next Wednesday, in search of further clues regarding the bank’s intentions. Any hawkish comments could provide support for the JPY. On a fundamental level, the imposition of relatively high US tariffs on Japanese products could weigh on the JPY, if considered at aa compounded way and in relevance to other economies such as the EU. Also the safe haven qualities of the JPY should not be underestimated on a fundamental level, in these times of turbulence.

Analyst’s opinion (JPY).

“There are some financial data due out next week and Trump’s tariffs on Japanese products tend to weigh, yet the main factor for JPY’s direction next week, may be BoJ’s stance. Should we see some hawkish intentions be expressed by BoJ policymakers in the coming week, we may see the JPY getting some support.”

EUR – The EU in a deep vision quest

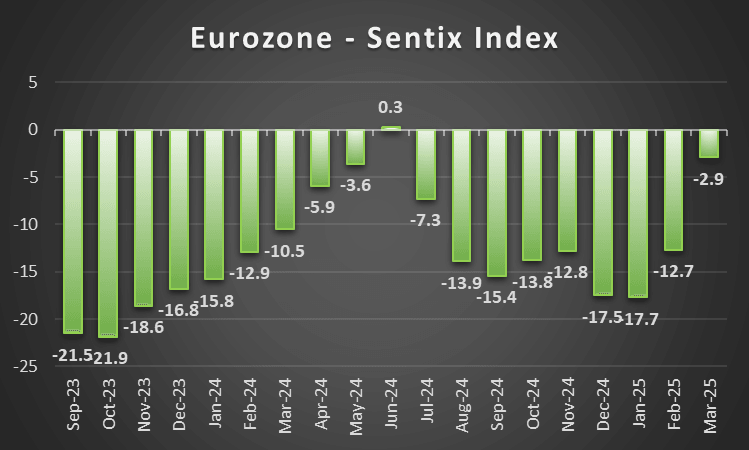

Focus of EUR traders tends to revolve around the fundamentals surrounding the common currency. It’s characteristic that the need for political stability within the EU, the “betrayal” of the US in the Ukraine war, the need for increased fiscal spending on defence and infrastructure but also a search for the role of the EU on the global scene, highlights the uncertainty surrounding the single currency. On the one hand, Germany’s decisiveness to reach deep into the fiscal pocket tends to be supportive for the EUR, while on the other the recent US tariffs on European products tend to intensify the pressure on the EU economic outlook. Any further indications of increased fiscal spending on an EU level, could support the common currency. On a monetary level, we note ECB President Lagarde’s warning for the possible adverse effects of the US tariffs. It’s characteristic that Germany’s Bundesbank President Nagel stated that the situation will have to be reassessed. The release of the ECB’s account of monetary policy meeting tends to verify that the bank is be more cautious in rate setting and communication in light of the uncertainty in the international economy. For the time being and after the announcement of the US tariffs, the market seems to expect another two, maybe three rate cuts by the bank until the end of the year, thus a dovish orientation seems to be dominant in market expectations for ECB’s actions. Should bank officials express more hawkish intentions we may see the EUR getting some support. As for financial releases, we note the further easing of inflationary pressures in the Euro Zone for March yet in the coming week, with the exception Germany’s industrial output for February and Euro Zone’s Sentix index for April, we have a rather light calendar for EUR traders, hence we see the case for fundamentals to lead the way for the single currency.

Analyst’s opinion (EUR).

“Conflicting fundamentals tend to tantalize EUR traders yet a more decisive approach in fiscal spending could provide some support for the common currency. On a monetary level, should ECB officials maintain a dovish tone in the coming week, we may see them weighing on the EUR. As for financial releases, we note a rather light calendar for EUR traders in the coming week, which could allow fundamentals to play a key role in EUR’s direction”

AUD – Renewed cautious sentiment could weigh on AUD

Making a start for the Aussie with RBA’s interest rate decision last Tuesday, the bank remained on hold as expected. The bank’s accompanying statement noted, “Many central banks have eased monetary policy since the start of the year, but they have become increasingly attentive to the evolving risks from recent global policy developments.” Implying that the RBA as well is concerned over the global economy. In turn this may be perceived as slightly hawkish in nature, with the bank potentially aiming to acquire further information before resuming on its rate cutting path. We expect RBA Governor Bullock’s speech next Thursday to shed some light in regards to the bank’s intentions. A possibly hawkish tone could provide some support for the Aussie. On a fundamental level, Trump’s tariffs were the key issue for Aussie traders and given the market’s

perception of AUD being a riskier asset in the FX market, given its commodity nature, a possible resurgence of a cautious market sentiment could weigh on AUD. Please note that the issue may have dovish implications for RBA’s monetary policy and should such intentions be expressed by RBA policymakers in the coming week we may see them weighing on AUD. Also an issue that may have passed under the radar was the rise of the manufacturing PMI figures of China for March, which were promising in regards to the possibility of more exports of Australian raw material. On a macro level, though we note the considerable narrowing of Australia’s trade surplus for February, which is not good news and intend to focus on consumer and business health data in the coming week.

Analyst’s opinion (AUD).

“Given the light calendar for Aussie traders in the coming week we expect fundamentals to dominate Aussie traders’ considerations. Major issues which are expected to play a key role in AUD’s directions are RBA’s intentions and the ongoing trade wars”

CAD – Intensifying trade war to weigh on the Loonie

We start our comment for the Loonie by noting that Canada’s employment data for March are still to be released as these lines are written and could potentially affect the CAD’s direction in a material way. On a macro level though we note the wider contraction of economic activity for Canada’s manufacturing sector as well as the trade surplus noted for February both being negative signals for the outlook of the Canadian economy. In the coming week may be with the exception of the release of Canada’s building permits growth rate for February next Thursday, the calendar seems to be lacking the release of any high impact financial releases for Loonie traders, thus fundamentals could be the main determinant for CAD’s direction. Despite Canada being exempted by Trump’s 10% blanket tariff, the tensions are another minus sign for the Canadian economic outlook and a possible escalation of the allready existing bitter US-Canadian trade war, may we remind our readers for the auto tariffs imposed on Canada, could weigh on the Canadian Dollar. On the other hand we also note the wide drop of oil prices on Thursday, as oil demand is expected to drop given trump’s tarifs and should the bearish direction of the black gold be maintained in the coming week, we may see the CAD retreating, given Canada’s status as a major oil producing economy. On a monetary level, the market’s dovish expectations for the Bank of Canada are still present as a rate cut is anticipated by the market in the cbank’s next meeting. The market also expects the bank to deliver four more rate cuts in total within the year. Any indications towards a possibly tighter than what is expected monetary policy by BoC, could provide support for the Loonie and vice versa.

Analyst’s opinion (CAD).

“Overall given the lack of high impact financial releases from Canada in the coming week, we expect fundamentals to lead the way. Issues such as BoC’s intentions, the path of oil prices and the US-Canadian trade war are expected to provide direction for the Loonie.”

General Comment

As a closing comment we would like to discuss a bit further the possibility of a trade war which was enhanced by the US tariffs. The US tariffs are in two layers, the first is a general blanket tariff of 10% across countries, while a number of countries get an additional tariff percentage for various reasons which could include currency manipulation, a US trade deficit or others. As we are ending the report, we see headlines that China has announced retaliatory tariffs of 34% on all US products, while there are intentions for retaliations from Canada, the EU and other countries. Our worries now tend to be placed on the scenario that the US may weaponize also the finance markets and possibly monetary policy, a scenario that could take the tensions in another level. It’s no secret that the US President had laid on the table the idea of a devaluation of the USD, through an appreciation of other currencies, in order for US exports to become more attractive. On the other hand the EU may retaliate not in kind but by raising barriers of entry for US tech companies, which would be signalling the expansion of the trade wars also in the services sector. I any case the existing tensions are threatening growth in major economies with the US not being exempted from such a scenario and a recession with all the possible negative consequences for the markets, seems to be ad portas.ew all time highs. in the coming week as well.

Author

Peter Iosif, ACA, MBA

IronFX

Mr. Iosif joined IronFX in 2017 as part of the sales force. His high level of competence and expertise enabled him to climb up the company ladder quickly and move to the IronFX Strategy team as a Research Analyst. Mr.