Week ahead – All eyes on the Jackson Hole symposium

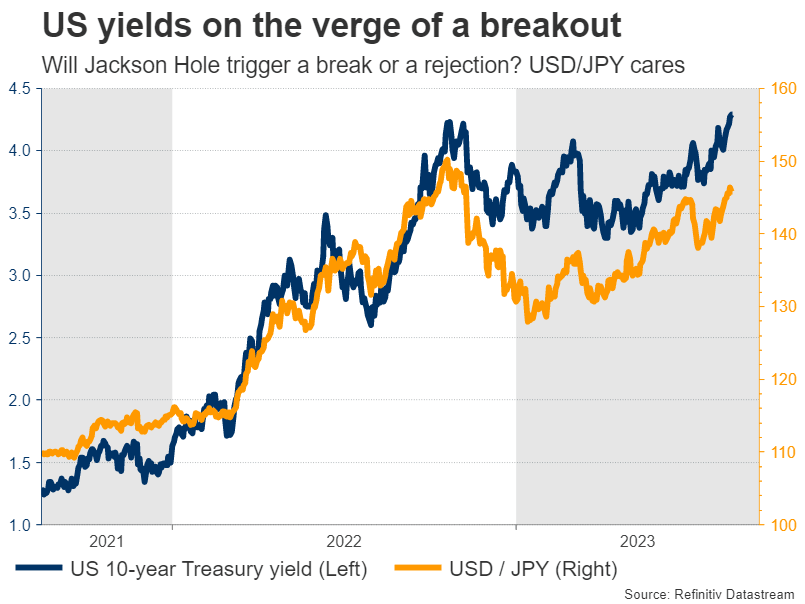

It’s a light week in terms of economic data, with the most important releases being the business surveys from the major economies. But the true highlight will be the Fed’s annual economic symposium. With US yields on the verge of a breakout, Chairman Powell’s signals about the path of interest rates will be absolutely crucial for the dollar.

Will Powell tread lightly?

Once per year, FOMC officials gather at their summer retreat in Jackson Hole, Wyoming for a symposium to exchange views on monetary policy and economic trends. Although this is mostly an academic event, it has been used by Fed leaders over the years to signal major strategy shifts.

Last year, Chairman Powell used this venue to declare that his Fed will continue raising interest rates with urgency to fight rampant inflation. He was trying to send the message that the tightening cycle was just beginning. What followed was a powerful rally in US yields, which turbocharged the dollar and slammed stocks.

The landscape is very different today. Inflation has moderated, although much of this improvement is because of declines in energy prices. Core inflation is still burning hot and since the labor market remains extremely tight, there are concerns inflation might not return to its 2% target anytime soon.

Adding fuel to such concerns is the recent streak of economic data. The Atlanta Fed GDP tracker currently estimates growth for this quarter at an annualized 5.8%, thanks to a resilient consumer and a booming housing market. With home prices hitting new record highs in much of the country, the cooldown in rents that the Fed has long anticipated might prove elusive.

All this goes to say that while there has been serious progress on the inflation front, it is probably too early for the Fed chief to take a victory lap and declare ‘mission accomplished’. Most likely, his message will be flexible, keeping the door open for maintaining rates at current levels and for raising them again if inflation proves persistent.

That’s essentially what he said at the Fed’s July meeting three weeks ago. However, considering that the data flow has been stronger than expected since then, the risk is that he strikes a slightly more hawkish tone this time, putting greater emphasis on the prospect of keeping rates elevated for a longer period or another rate hike.

The event will begin on Thursday, although the Fed chief usually speaks on Friday. As for economic data, the latest S&P Global business surveys will be released on Wednesday ahead of durable goods orders on Thursday.

Now in the markets, Powell’s comments could have a disproportionate impact given that US yields are trading near their highest levels for this cycle. Jackson Hole can be the catalyst for a break higher or a rejection, driving the US dollar accordingly.

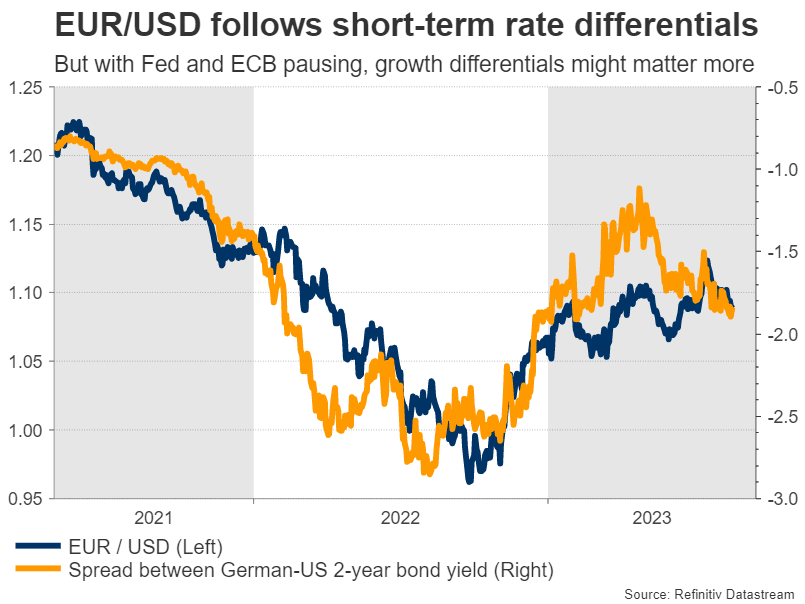

Overall, the fundamental outlook for the dollar seems bright amid a US economy that is superior to Europe and China from a growth perspective. The technicals are lining up too after euro/dollar sliced below the crucial 1.0940 zone this week, violating an uptrend line drawn from the September lows and some key moving averages.

Flash PMIs from Europe

In the Eurozone, the spotlight will fall on the preliminary PMI business surveys for August, out on Wednesday. Forecasts suggest the slump in manufacturing continues to deepen and has started to infect the much larger services sector, putting the brakes on the economy.

The euro has shrugged off dire economic news for some months now, and has instead focused on the ECB’s rate increases that have narrowed rate differentials in its favor. That said, the ECB can only ignore the weaker growth profile for so long. If the data pulse continues to slow, the central bank might ‘pause’ its tightening cycle in September, giving the euro a rude awakening.

It’s a slightly brighter picture in the United Kingdom, which will also receive its business surveys on Wednesday. The latest services PMI pointed to an economy that was “set to flatline at best in the coming months”. But since the UK has a bigger inflation problem than other countries, markets still expect another 75bps worth of rate increases from the Bank of England.

This is a double-edged sword. These rate bets have helped boost the pound this year, but the higher rates go, the greater the risk of a recession that comes back to bite the currency. Stock market performance will also be critical, as Cable is strongly correlated with global risk sentiment, thanks to the nation’s twin deficits that require funding from abroad.

Finally, there are some key releases from Japan and Canada. The latest Tokyo inflation data on Friday could influence the Bank of Japan’s decision-making process. In Canada, retail sales for June will be released Wednesday, but might be seen as outdated by investors.

Author

Marios graduated from the University of Reading in 2015 with a BSc in Economics and Econometrics. Prior to joining XM as an Investment Analyst in December 2017, he was providing financial analysis, reporting and consulting service